💵🤯 Warren Buffett Sitting on $157 Billion!!

Happy Sunday,

Today is when, in America, we turn the clocks back one hour. We’ll have to wait until March 10, 2024 to change our clocks back. That means there are 126 days until then, and for these next 126 days the sun will set a lot earlier :(

Daylight Savings Time was first implemented in the United States to conserve energy during World War I - and we’ve kept it ever since. In doing research on it - I found the following that busts a longtime myth I’ve heard:

“It’s a common myth in the United States that DST was first implemented for the benefit of farmers. In reality, farmers have been one of the strongest lobbying groups against DST since it was first implemented. The factors that influence farming schedules, such as morning dew and dairy cattle's readiness to be milked, are ultimately dictated by the sun, so the time change introduces unnecessary challenges”

The Sunshine Protection Act is a proposed bill that would make Daylight Savings Time permanent, which means that the time would no longer change twice per year. As of 2022, it had been passed in the Senate, but the House of Representatives is yet to pass / decide on it. So until that happens, we’re stuck with the time changes.

In more personal news, I am going to be at The Asia-Pacific Economic Cooperation (APEC) conference in San Francisco from the 14th-17th. There, I’ll be interviewing certain World Leaders on behalf of YouTube, and you can expect a video to follow in the coming months! A very cool opportunity indeed and I’ll be sure to share with you guys as much as I can in the coming weeks. I still have no agenda on who I will be interviewing. Biden is expected to meet China’s leader Xi Jin Ping at the summit - but alas, I do not think we’ll get privileges to that. Still cool, though!!

Enjoy this Sunday edition of Hump Days.

— Humphrey, Tim, & Rickie

Market Report

Warren Buffett’s Berkshire Hathaway Sits on Record $157 Billion Cash Pile

Berkshire Hathaway ., led by CEO Warren Buffett, reported a record cash reserve of $157.2 billion, exceeding the previous high from two years prior.

This accumulation of cash is attributed to the difficulty in finding substantial acquisition targets, despite recent purchases like Occidental Petroleum and the $11.6 billion deal to buy Alleghany Corp., as well as an increased reliance on stock repurchases to benefit shareholders.

Berkshire's cash, mainly invested in short-term Treasuries, has grown due to higher interest rates, contributing to a surge in operating earnings to $10.76 billion, aided by stronger performance in its insurance businesses.

The same high interest rates that have boosted Berkshire's cash yields have also placed a strain on some of its industrial businesses, with its building products businesses seeing a revenue dip of 11%.

Higher rates and inflation have had adverse effects, such as a 15% profit decrease at Berkshire’s railroad operations, BNSF, due to lower freight volumes and rising operating costs.

Overall, Berkshire Hathaway faced a third-quarter net loss of $12.8 billion, primarily due to a drop in the stock market affecting its equity portfolio, while still achieving an increase in operating earnings from the previous year.

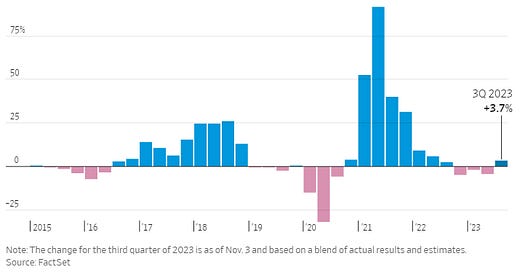

Breaking Down the Best Earnings Quarter in a Year

The S&P 500 companies are set to record a 3.7% increase in earnings for the third quarter, marking the first collective rise since the same quarter of the previous year, with revenues anticipated to grow by 2.3%.

This growth is largely attributed to robust consumer spending, as indicated by increased activities in dining out, traveling, and online shopping.

Communication services and consumer discretionary are the top-performing sectors, driven by strong earnings from giants such as Amazon, Alphabet, Starbucks, and McDonald's.

Approximately 60% of the companies reported higher earnings per share compared to last year, with significant contributions from major players like Apple and Microsoft.

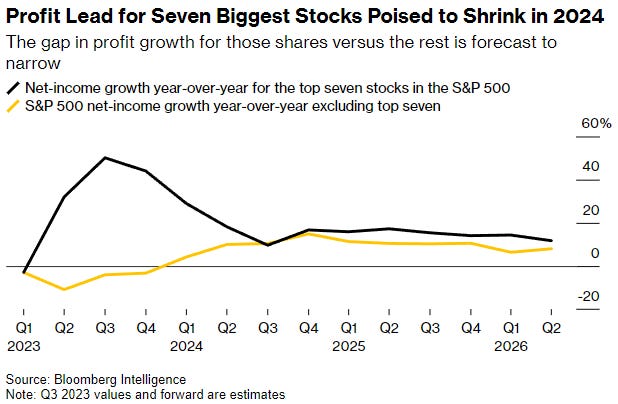

Big Tech’s Growth Status in Doubt With Weaker Sales Outlooks

Big Tech companies like Apple, Alphabet, Meta, and Tesla have recently reported higher profits than anticipated, but their forecasts for the fourth quarter are less optimistic, causing concern among investors.

With weaker growth outlooks and concerns over areas such as Apple's holiday sales and Alphabet's cloud segment, tech stocks have become more volatile, averaging a 9% drop from their 52-week highs.

The decline has led to more attractive valuations, yet they remain relatively high at 31 times projected earnings for the largest S&P 500 tech stocks.

Despite these issues, some analysts believe the market may see a rebound in tech stocks towards the year's end, driven by seasonality and optimism around AI, while others remain cautious about potential economic or geopolitical disruptions affecting the sector.

New hedge fund is hiring journalists to not do journalism

Hunterbrook is a new novel VC-backed hedge fund that aims to revolutionize investment research by employing former reporters to conduct and publish their findings, regardless of whether the research leads to actual investments.

Unlike traditional journalism that often leans on non-public insider information, Hunterbrook researchers will only utilize publicly available data, likely including open-source intelligence and insights from lesser-covered geographical regions.

They aim to combine media expertise with investment strategies, taking long and short positions on equities and venturing into commodities and derivatives.

With $10 million in seed funding from significant names in the industry and a goal to raise up to $100 million, Hunterbrook is positioned to put a fresh spin on combining journalism with hedge fund operations.

The initiative Hunterbrook is taking is both intriguing and contentious. The firm's model allows for cultivating a variety of sources outside of non-public company information, abiding by SEC regulations.

If successful, the firm's strategy will create a self-sustaining cycle where investigative reporting fuels investment decisions, potentially setting a new precedent for the journalism and finance industries.

Forecast Ahead

Big Number: 150,000 jobs

In October, U.S. job growth slowed, with nonfarm payrolls adding 150,000 jobs compared to the 170,000 expected, partly due to the impact of the United Auto Workers strikes on manufacturing jobs.

The unemployment rate increased to 3.9%, and the labor force participation rate slightly declined.

Wages grew by 0.2% for the month, less than expected, but still marked a 4.1% year-over-year increase.

This cooling in the labor market and modest wage growth may ease pressure on the Federal Reserve, which has paused interest rate hikes in its last two meetings despite inflation above its target.

Overcome the Sunday Scaries

Memes of the Week

In Case You Missed It

This is a 27 minute video on the 4 levels of making money online + my journey with my first eCommerce store. Make sure to watch it if you can spare half an hour!