🏦 📈 Warren Buffett Builds Up $182B War Chest

Happy Sunday,

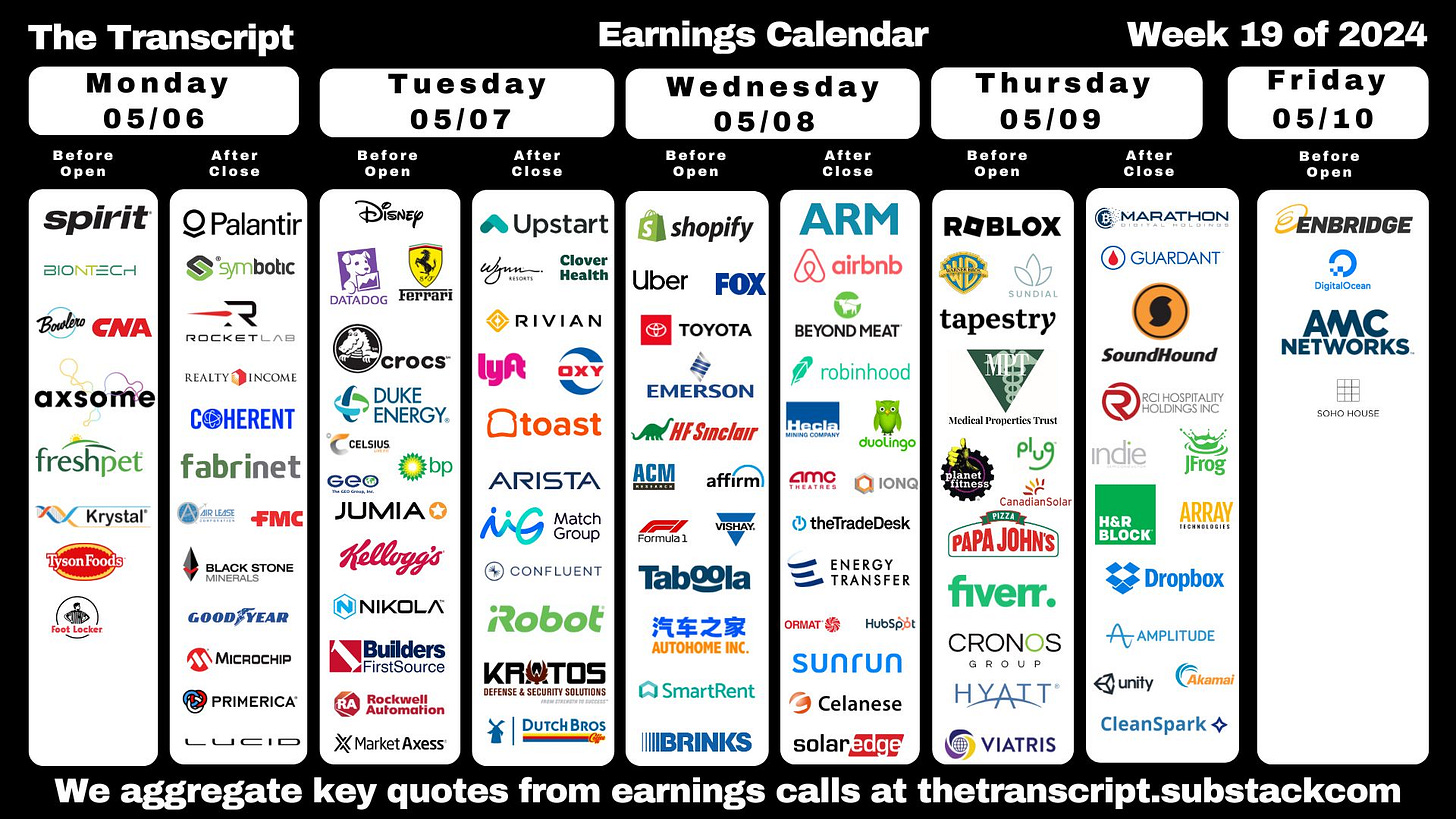

It’s a really interesting time in the markets right now, nearing the end of earnings season, and the added consideration of Berkshire Hathaway sitting on a growing pile of cash. Macro often lags behind micro if you know what you’re looking for, and from the guidance we got from company earnings, it looks like they’re bracing for a deceleration at the very least. Read more below!

Hope you have a great week ahead!

— Humphrey, Tim, & Rickie

Market Report

Souring Profit Outlooks Could Threaten the S&P 500’s Rally

With more than 400 firms in the S&P 500 Index having reported earnings this season so far, 79% of them have beaten profit expectations. However, only 18% of companies provided guidance that exceeded estimates.

The median stock outperformed the index by less than 0.1% on earnings day, the smallest margin since late 2020.

Chipmakers, despite strong expected growth, faced stock declines after warnings about future profits. Meanwhile, consumer bellwethers like McDonald’s, Darden Restaurants, and Starbucks reported increasing pressures on lower-end consumers.

Why It Pays to Start Companies in Recessions

A recent study found that launching a tech startup during a recession could lead to longer-lasting and more innovative companies.

Researchers found that startups founded during recessions were 12% more likely to still be in business by their seventh year compared to those founded outside of recession periods.

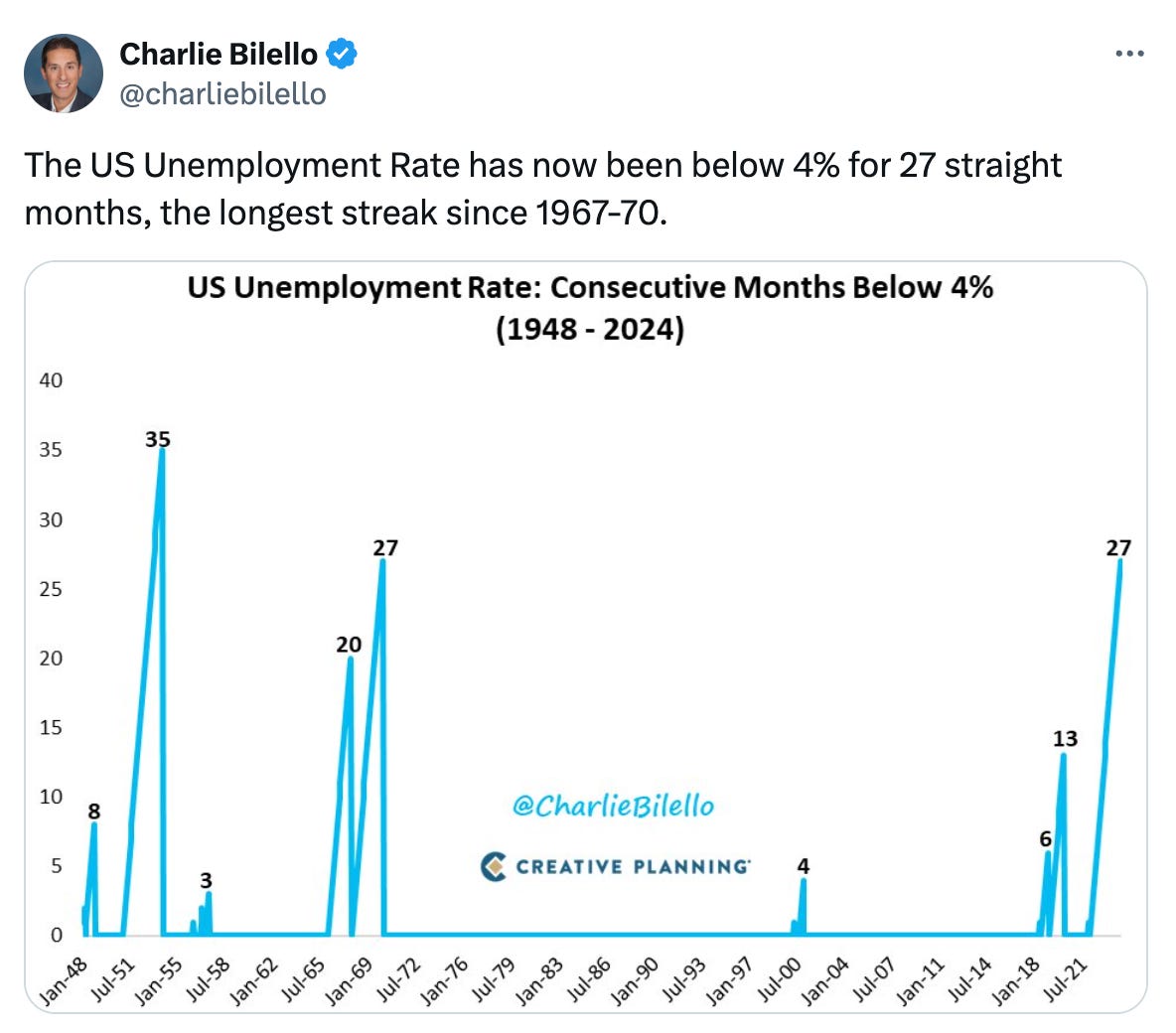

The success of recession-era startups was attributed to their ability to attract and retain highly productive and innovative employees amidst a tight labor market, resulting in higher rates of employee retention among founding inventors and subsequent innovation.

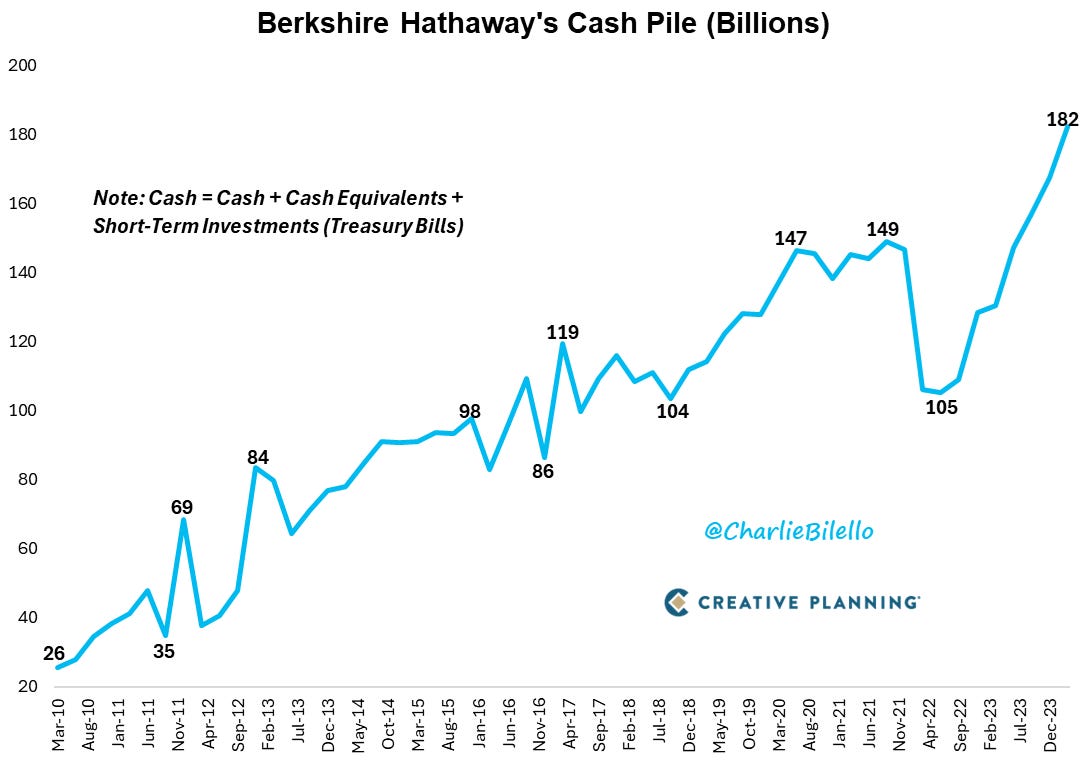

Buffett Builds Massive War Chest, Sells Down Some Apple

Berkshire Hathaway led by Warren Buffett reported a record-high cash pile of $182 billion amidst a lack of acquisition opportunities.

Despite reporting a 39% increase in operating earnings, fueled by improved results in its insurance businesses, Buffett expressed difficulty in finding needle-moving deals to invest in.

The conglomerate sold some of its Apple shares, praising the company but indicating concerns about broader market conditions.

Buffett hinted at the possibility of Berkshire's cash pile reaching $200 billion by the end of the quarter and emphasized the importance of being prepared to capitalize on opportunities when they arise.