🤷♂️🧐 Wall St. Confused By Rate Cut

Welcome to the Sunday Primer,

Rickie and I are back at home after spending a week in Switzerland on a shoot. Here’s a picture from one of the restaurants we ate at!

We filmed some pretty cool shorts while we were there so keep an eye out on TikTok/Instagram/YT Shorts for them!

In the meantime, I’m preparing for another trip to Japan and then it’ll be back to regularly scheduled programming after having been on the road so much for the last couple months.

Enjoy the Sunday Primer!

- Humphrey

Market Report

Rate Cuts Lead to Higher Treasury Yields??

The Federal Reserve's recent 50 bps rate cut, the first in four years, hasn’t led to an immediate decrease in long-term borrowing costs as some might have expected.

Despite the Fed's move to lower short-term rates, yields on longer-term U.S. Treasurys have actually increased slightly since the announcement.

This highlights the complex relationship between Fed policy decisions and market interest rates, as Treasury yields are influenced more by investors' expectations of future Fed actions and economic conditions rather than current short-term rates.

Wall Street Taking a New Approach to Playing Rate Cuts

Wall Street traders are facing an unprecedented situation as the Federal Reserve begins cutting interest rates amid a strong economy and record-high stock markets.

Traditionally, rate cuts signal economic weakness, prompting investors to favor defensive sectors like consumer staples and utilities.

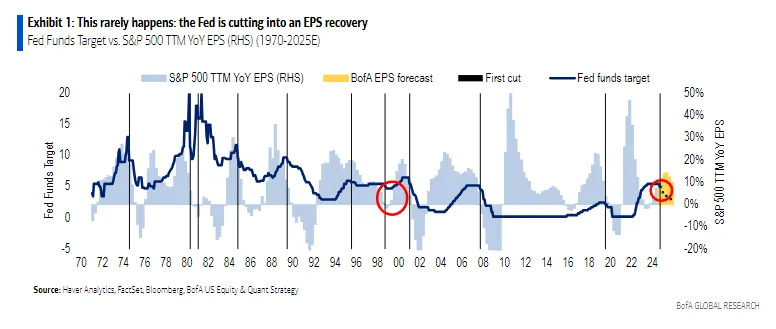

Since 1970, the S&P 500 Index has risen 21% on average in the year after the first cut in an easing cycle — as long as the economy averted recession.

What else is interesting is that eight of the last nine easing cycles occurred when profits were decelerating. But profits are expanding now, which favors cyclicals and large-cap value shares.

At the moment, it appears investors are moving back into big-tech stocks and other growth corners of the market. According to Goldman Sachs, hedge funds were buyers of US technology stocks at the fastest pace in four months last week.

Chip Giants TSMC and Samsung Discuss Building Middle Eastern Megafactories

Taiwan Semiconductor Manufacturing and Samsung Electronics are in early discussions with the United Arab Emirates about potentially building massive chip manufacturing complexes in the country.

These projects, which could cost over $100 billion in total, would be funded by the UAE, with Abu Dhabi's sovereign development vehicle Mubadala playing a central role.

The aim is to increase global chip production, particularly for AI applications, and help reduce chip prices.

These projects could represent a major expansion of the global semiconductor industry beyond recent government-subsidized growth in the U.S., Europe, and East Asia, while also advancing the UAE's ambitions to diversify its economy and become a player in advanced technologies.

Chipmaker Qualcomm to Explore Takeover of Intel

Qualcomm recently approached Intel to discuss a potential acquisition. This move comes as Intel faces challenges, with its stock price down 37% over the past year and the company in the midst of a turnaround effort under CEO Pat Gelsinger.

The proposed friendly takeover, if realized, could be one of the largest M&A deals ever, given Intel's market value of about $93 billion and Qualcomm's $188 billion.

While the initial approach may not necessarily lead to an agreement, Qualcomm believes an all-American combination could alleviate potential antitrust concerns.

Intel's recent announcements, including a deal with Amazon Web Services and plans to separate its foundry operations, have provided some optimism for its turnaround strategy.