🇺🇸🇨🇳 USA/China Going Band 4 Band

Happy Wednesday all,

The trade war is back — and this time, it’s messier than ever. In just a few days, Trump announced 125% tariffs on China, China retaliated with an 84% hit to US goods, and the EU jumped in with €21 billion in new tariffs. Meanwhile, markets soared, the yuan tanked, and everyone from airline CEOs to mortgage lenders started recalculating.

This week’s edition breaks down the chaos: what’s driving the headlines, how China is using currency as a weapon, and why the Fed may be forced to respond sooner than expected.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Walmart scraps quarterly operating income forecast, citing Trump’s tariffs (CNBC)

Delta CEO says Trump tariffs are hurting bookings as airline pulls 2025 forecast (CNBC)

Weekly mortgage demand jumped 20% last week, as tariff volatility briefly tanked rates (CNBC)

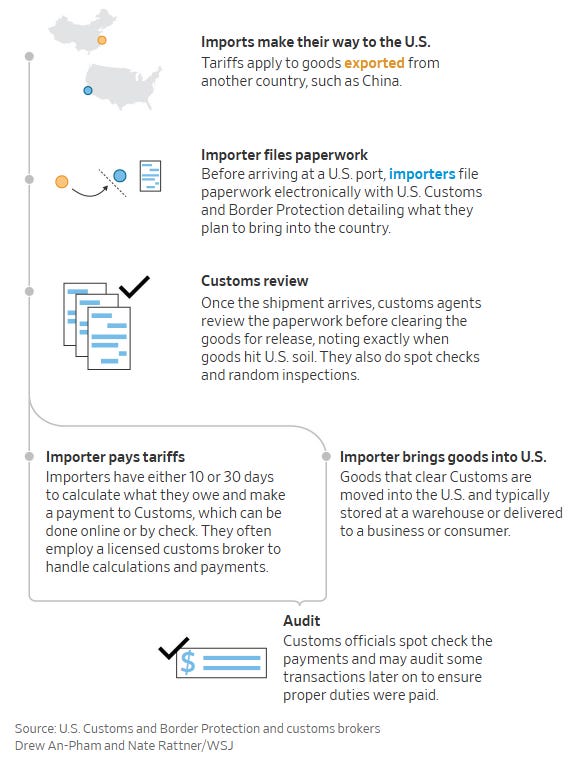

A Step-by-Step Look at How Trump’s New Tariffs Will Be Implemented (WSJ)

China Has Readied a Trade-War Arsenal That Takes Aim at US Companies (WSJ)

Trump Administration Revises Port-Fee Plan to Soften Blow to US Exports (WSJ)

The Weekly Brief

China Raises Tariffs on US Goods to 84% as Trade War Worsens

At midnight last night, President Trump’s record 104% tariffs on China took effect. Trump said that “[China wants'] to make a deal. They just don’t know how to because they’re proud people”.

This morning, China retaliated, announcing it would impose an 84% tariff on all imports from the US starting April 10th.

It also announced that it would sue the US at the World Trade Organization, added American companies to its ‘unreliable entity list’, and enacted export controls on a dozen American companies.

After all this, we thought it would be over… And boy, were we wrong.

Around 1:30pm EST, President Trump announced a 90-day pause on higher tariffs that hit dozens of trade partners after midnight, while raising tariffs on China to 125%.

Stocks proceeded to have their best one-day gain since October 2008. The S&P 500 Index soared 9.5%, rebounding from bear-market territory, while the tech-heavy Nasdaq 100 skyrocketed 12%.

China’s Yuan Weakens to Record Low After PBOC Eases Grip

China’s offshore currency fell to its weakest level since the creation of the offshore yuan market in 2010 as the US pushed ahead with massive tariffs on Chinese goods.

China has been easing its grip on the currency, leading to a steady drop in value. This may seem like a confusing move, but weakening its currency could be an option for Beijing to raise the comparative appeal of its exports, a key driver of growth now under greater pressure due to tariffs.

However, this could backfire as it could increase bearish bets on the economy and worsen capital outflows.

On the other hand, keeping the exchange rates artificially strong could weaken exports, increase volatility in markets and further hurt the already struggling economy.

According to Reuters, China’s central bank has asked major state-owned banks to reduce US dollar purchases. The banks were seen selling dollars and buying yuan aggressively to slow the pace of declines in the yuan.

EU Adopts Tariffs on €21 Billion of US Goods in Metals Dispute

This morning, the European Union approved tariffs to hit around €21 billion ($23.2 billion) of US goods in retaliation for the 25% tariffs President Trump imposed last month on the EU’s steel and aluminum exports.

The US already has a universal 20% tariff on nearly all European exports, as well as a separate 25% duty on cars and some auto parts. Trump also said he’ll announce additional tariffs on lumber, semiconductor chips and pharmaceutical products.

All of Trump’s new tariffs are hitting around €380 billion of EU goods.

Markets Are Pricing in Relief from the Federal Reserve…

Market-implied federal fund rates have bounced around in recent days (what hasn’t), with futures pointing to around three 25 basis point rate cuts by year-end. Meanwhile, Bloomberg sees policymakers taking a more cautious approach and only taking a quarter-point cut this year.

FOMC members have said in the past that they need more clarity before cutting rates again — and there likely won’t be clarity about Trump’s tariff policies anytime soon.