🇺🇸🪖 US Support in Ukraine Coming Down to Minerals??

Happy Sunday,

Markets are moving, deals are being negotiated, and Warren Buffett is making history—again. This week, the US and Ukraine are in talks over a critical minerals pact that could reshape global supply chains and counter China’s dominance. Meanwhile, jobless claims remain steady, signaling resilience in the labor market despite federal workforce cuts. And in classic Buffett fashion, Berkshire Hathaway has set yet another record—this time, with an eye-watering tax bill that underscores its dominance in corporate America.

Let’s dive into the biggest stories shaping the financial landscape.

- Humphrey & Rickie

Market Report

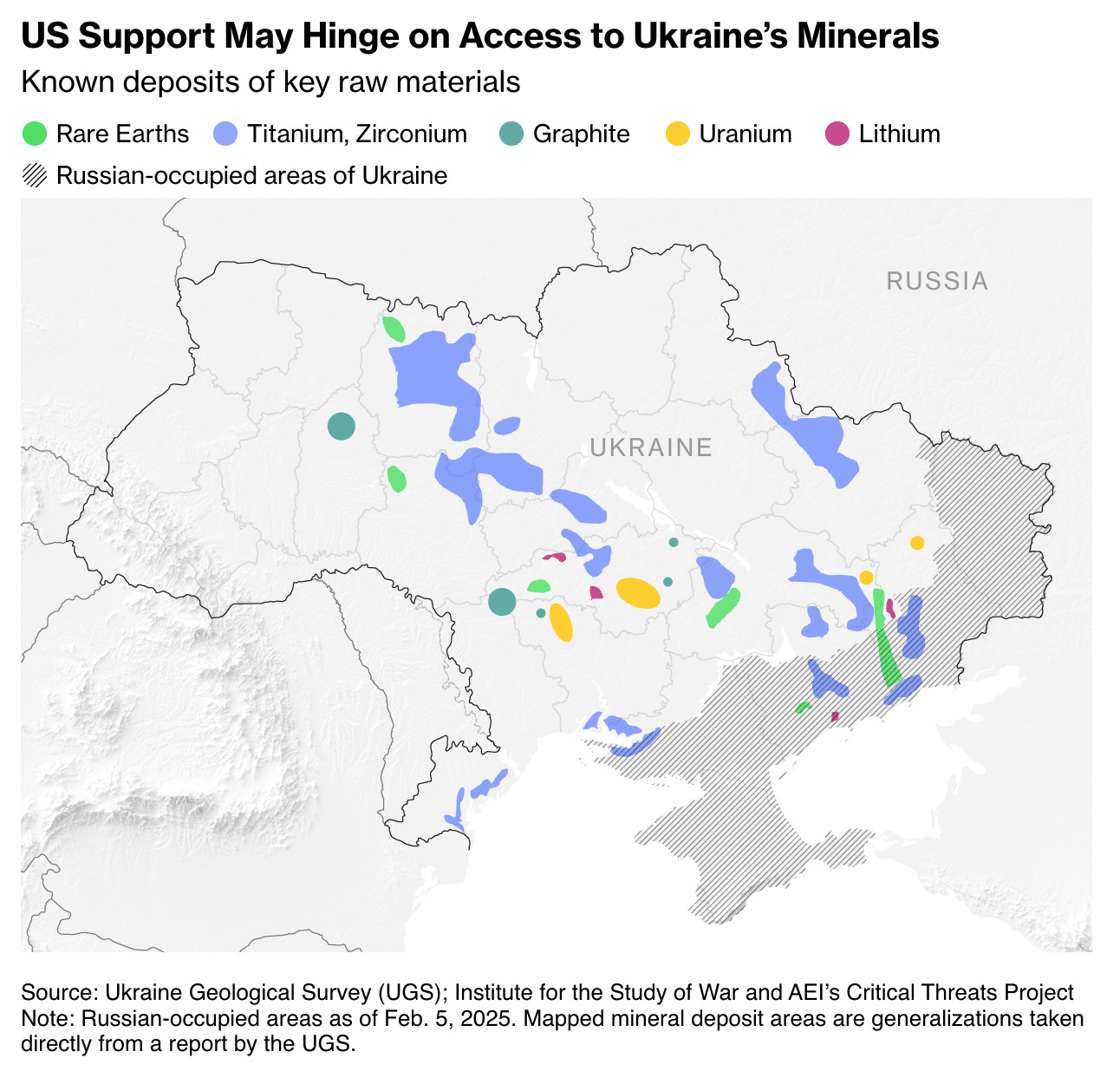

Ukraine and US Negotiating Minerals Pact

A US-Ukraine mineral deal is in negotiation as Washington seeks a share of Ukraine’s critical resources in exchange for continued support.

The Trump administration's initial proposal included securing 50% of license sales and other proceeds, which Kyiv rejected, citing violations of Ukrainian law and concerns over sovereignty.

Treasury Secretary Scott Bessent emphasized that the agreement would not involve direct US ownership of assets but would allocate revenue to a reconstruction fund in which the US would have governance rights.

Trump’s interest in Ukraine’s resources aligns with his broader policy to secure critical minerals and counter China’s dominance, as Beijing controls about 60% of global rare earth mining and 90% of refining capacity.

Ukraine reportedly has mineral deposits valued at over $10 trillion, including lithium, graphite, titanium, and rare earth elements. The US imported approximately $1.5 billion worth of rare earths, titanium, zirconium, graphite, and lithium in 2024.

While Ukraine ranks among the top ten producers of ilmenite and rutile, essential for titanium production, it lacks the capacity to produce titanium sponge—critical for US defense applications.

US Jobless Claims Tick Up Slightly, in Line With Pre-Covid Level

US unemployment benefits applications remained steady last week, with initial claims rising slightly to 219,000, aligning with pre-pandemic levels and indicating strong labor demand.

Despite some high-profile layoffs, overall claims remain consistent with 2019 levels, supporting the Federal Reserve’s current stance on interest rates.

In the Washington, DC, Maryland, and Virginia (DMV) area, jobless claims declined after a prior surge, though applications in the capital itself reached a nearly two-year high.

Economists are monitoring these trends for signs of impact from recent federal workforce cuts, though the data remains volatile. Unadjusted claims dropped nationwide, with California contributing nearly half of the decline.

Berkshire Hathaway Sets Another Record With Massive Tax Bill

“True, our country in its infancy sometimes borrowed abroad to supplement our own savings. But, concurrently, we needed many Americans to consistently save and then needed those savers or other Americans to wisely deploy the capital thus made available. If America had consumed all that it produced, the country would have been spinning its wheels.” - Warren Buffett

Warren Buffett's 2025 annual letter to Berkshire Hathaway shareholders highlighted the company's record-breaking tax contributions. In 2024, Berkshire paid $26.8 billion in federal taxes, about 5% of all corporate taxes collected in the United States.

This amount surpasses the company's tax payments for the previous five years combined. Since Buffett took control 60 years ago, Berkshire has paid over $101 billion in taxes to the US government, more than any other company in history.

Buffett's emphasis on Berkshire's tax payments comes at a time when President Donald Trump is proposing further corporate tax cuts, potentially reducing the rate from 21% to 15%.

Buffett expressed hope that Berkshire would make even larger tax payments in the future, urging the government to spend the money wisely and support those less fortunate.

Berkshire Hathaway's financial performance in 2024 was exceptional, with operating profits rising 27% to $47.44 billion for the year. The company's success over the year was attributed to gains in insurance underwriting and investment income.

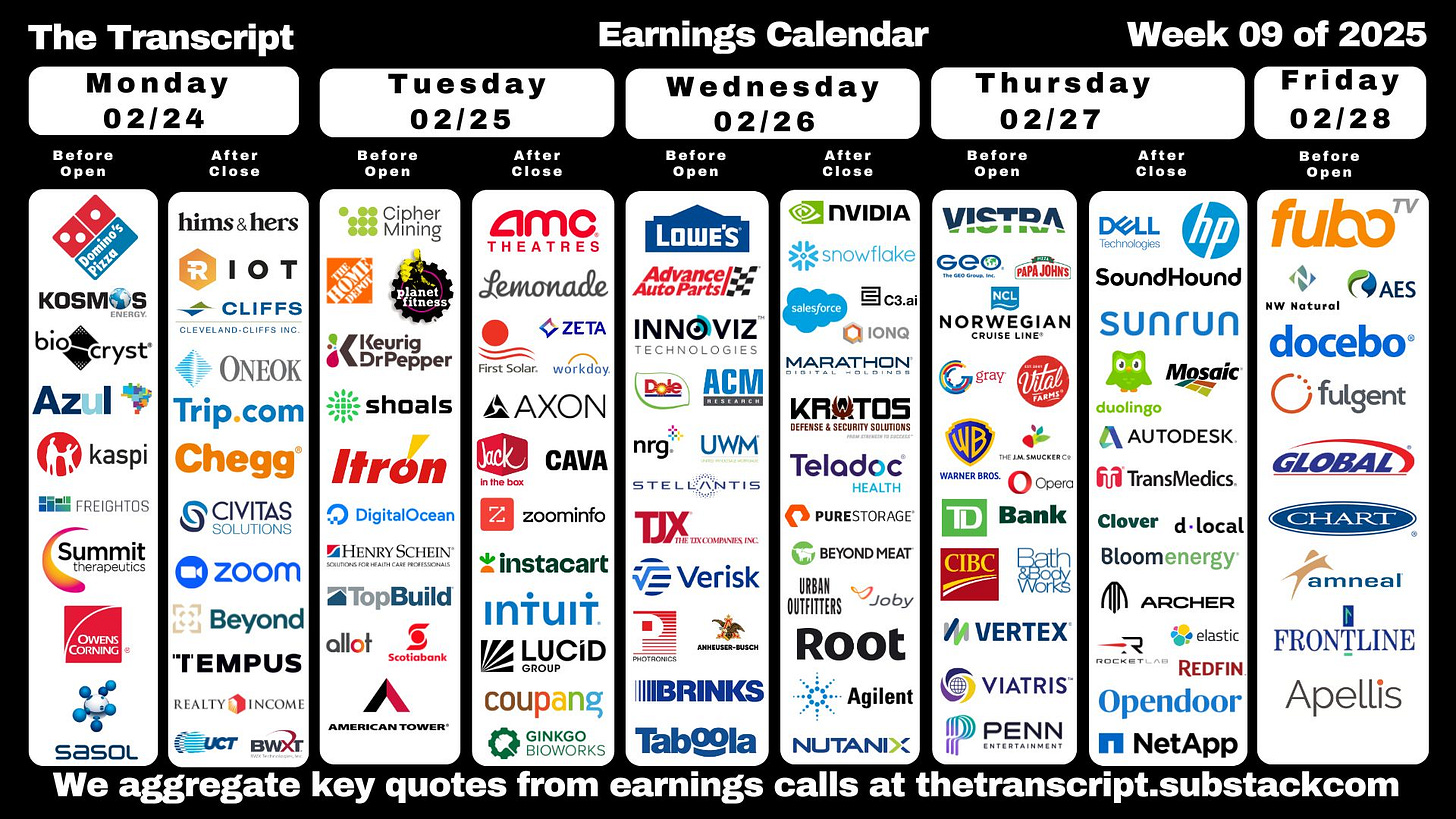

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.