📉💸 US Profit Expectations Plummet (2Y Low)

Happy Sunday,

Markets are recalibrating as optimism runs into structural risk. A September rate cut, once seen as inevitable, now looks uncertain as core inflation ticks up and tariff impacts loom. Wall Street enters earnings season with low expectations but high valuation pressure, especially as AI giants mask broader weakness. Meanwhile, Robinhood’s push into tokenized private equities has triggered regulatory backlash across two continents, raising new questions about the line between innovation and compliance.

This week’s report connects the dots. Enjoy today’s Sunday Primer.

- Humphrey & Rickie

Market Report

Odds of Rate Cuts Decline as Tariff Effects Remain Uncertain

In a shift from earlier sentiment, bond investors are no longer certain that the Federal Reserve will cut interest rates by its September meeting. In the meantime, all eyes are on this week's upcoming inflation report, which is expected to heavily influence the Fed's next move.

After strong job figures in early July, the market-implied odds of a September rate cut have fallen to around 70%, down from what was previously seen as a guarantee.

The key tension for the Fed and investors is the potential for rising inflation, partly driven by President Trump's tariffs, which could complicate the case for monetary easing.

Economists are forecasting that the upcoming data will show core inflation accelerated to 2.9% in June, its highest level since February.

While Fed Chair Jerome Powell has indicated a need for more time to assess the tariff impacts, policymakers appear divided on the immediate path forward. The Fed's own projections suggest two rate cuts by the end of the year, but officials' individual forecasts vary.

Market Optimism Tested as Wall Street Braces for Weak Earnings

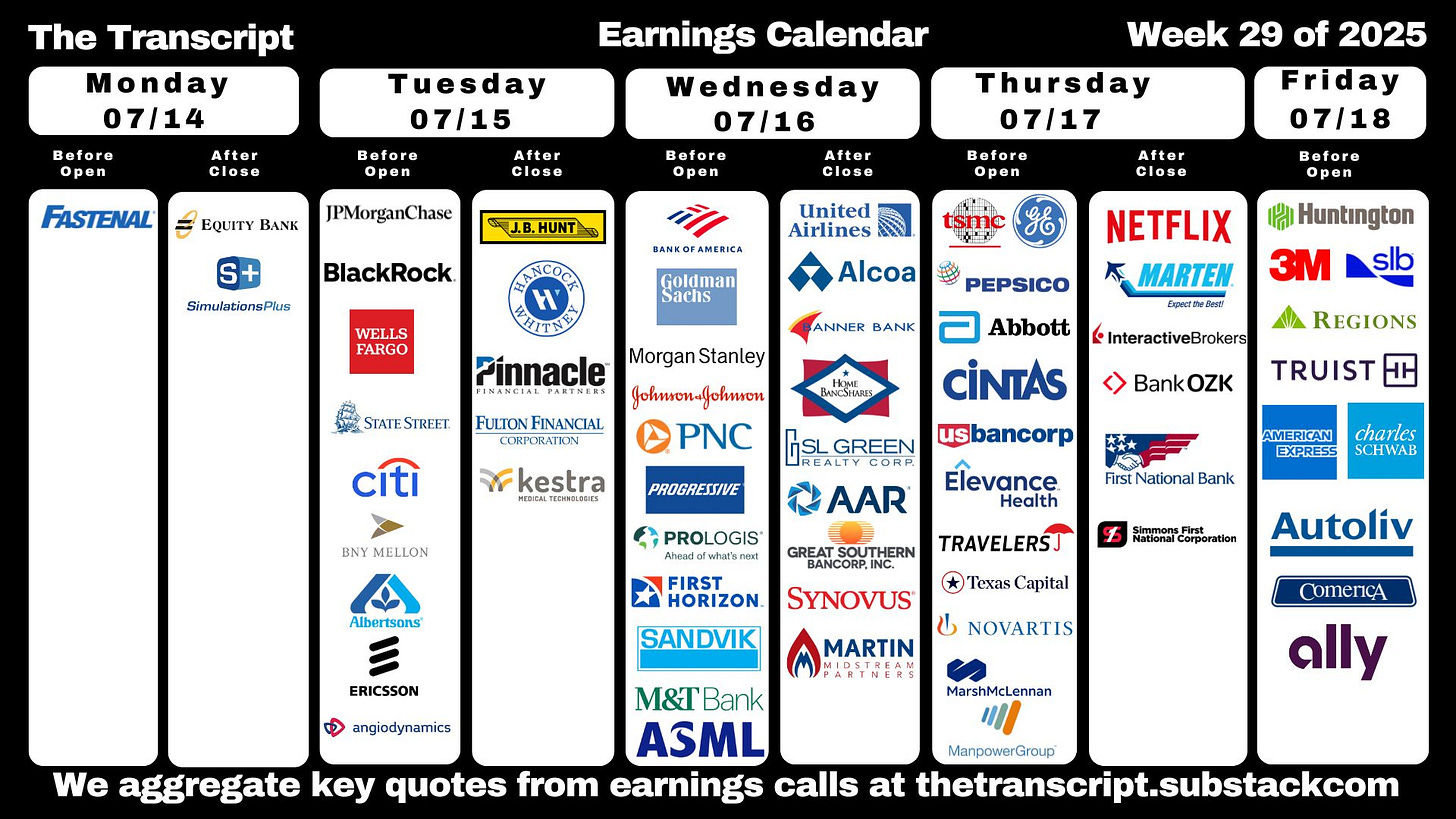

As the second-quarter earnings season kicks off, investors are closely watching to see if corporate profits can justify the stock market's recent surge to new heights.

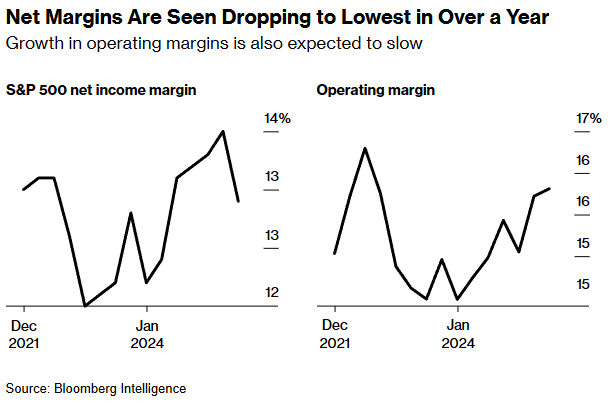

Expectations are notably low, with analysts forecasting a modest 2.5% year-over-year profit increase for S&P 500 companies, the weakest outlook since mid-2023.

This low bar may make it easier for companies to report positive surprises, but the real focus will be on forward-looking guidance and the health of profit margins.

While the full impact of tariffs may not be evident in second-quarter results yet, any commentary on supply chains and rising costs will be scrutinized. A major driver of the market's performance continues to be the massive spending on artificial intelligence by tech giants.

The "Magnificent Seven" are expected to post a 14% profit increase, propping up the entire index; without them, S&P 500 earnings would likely show a slight decline.

Furthermore, a weaker US dollar is providing a significant, though perhaps underappreciated, tailwind for large American companies with substantial international sales.

Robinhood’s Private Stock Tokens Draw Regulatory Scrutiny

Robinhood has ignited a firestorm with its recent European launch of "tokenized" equities, a new offering that allows for 24/7 trading of assets designed to mimic stocks on the blockchain.

The debut on June 30, which included a promotional giveaway of tokens representing private companies like OpenAI and SpaceX, was met with swift criticism.

OpenAI publicly warned investors about the securities, and Robinhood's primary EU regulator, the Bank of Lithuania, quickly began asking questions.

In the US, SEC Commissioner Hester Peirce cautioned that such products must adhere to existing securities laws, emphasizing that the "magical abilities" of blockchain don't change the fundamental nature of the asset.

The controversy centers on the structure of these tokens. As Robinhood's fine print reveals, they are not actual shares in the underlying company, but rather derivative contracts pegged to the company's own estimated price of the underlying private stock, with no guarantee of a 1:1 backing.

Despite the backlash, Robinhood CEO Vlad Tenev remains committed to the initiative, stating the tokens provide valuable exposure and that the company plans to expand the offering to thousands of companies and eventually bring it to the US market.