💰🇪🇺 US Firms Chase Cheap Euro Cash

Happy Wednesday all,

Markets are shifting, inflation is heating up, and big moves are happening in AI, defense, and trade. This week, we break down why inflation is sticking around, how Trump’s new tariffs could shake up industries, and why US companies are flocking to Europe’s bond market.

Plus, some eye-catching headlines you won’t want to miss.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Chinese tech giant Baidu to release next-generation AI model this year as DeepSeek shakes up market (CNBC)

Anduril to take over Microsoft’s $22 billion US Army headset program (CNBC)

Elon Musk-Led Group Makes $97.4 Billion Bid for Control of OpenAI (WSJ)

China’s Xi Is Building Economic Fortress Against US Pressure (WSJ)

Nvidia Shares No Longer Bulletproof as DeepSeek Fears Linger (BBG)

Traders See Just One 2025 Fed Rate Cut After Hot Inflation Data (BBG)

The Weekly Brief

Hot Inflation in January Driven By Eggs and Shelter Costs

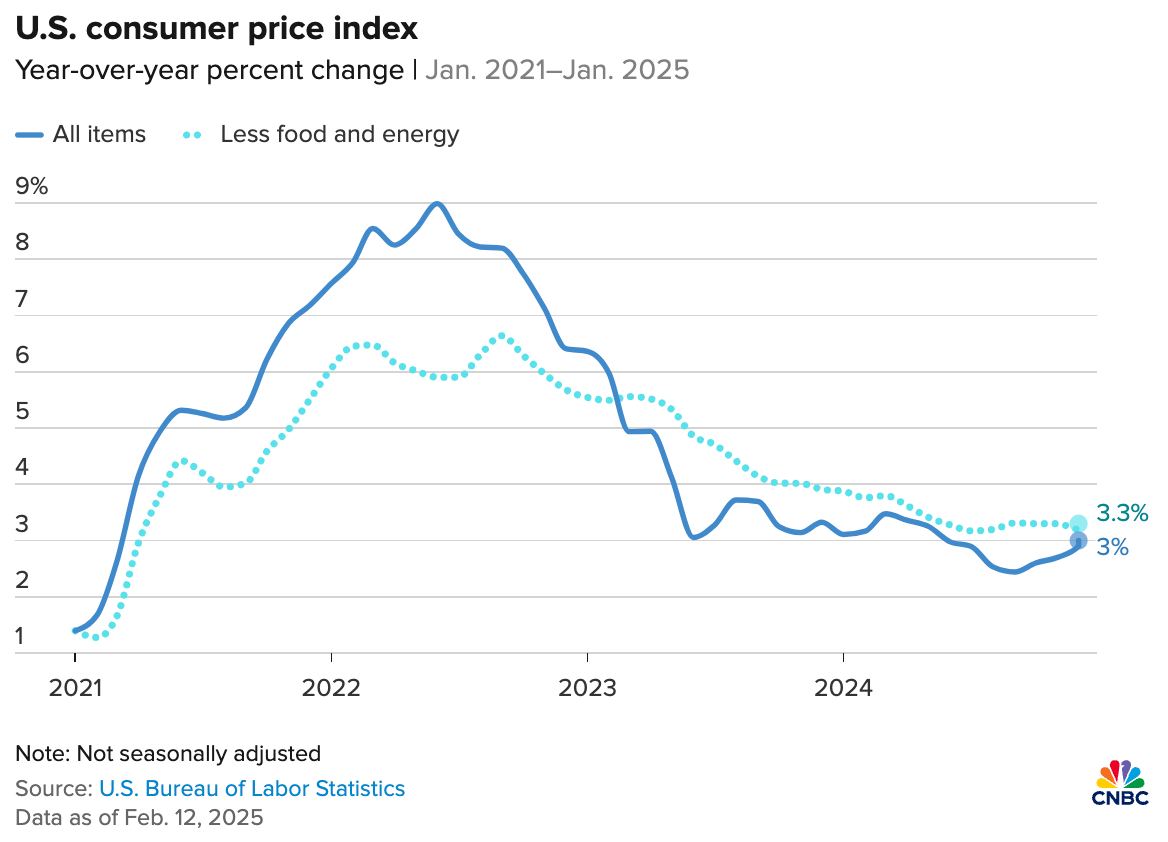

The US saw its highest increase in core inflation since March, with core CPI rising 0.4% in January 2024, following a 0.2% increase in December.

The increase was widespread, affecting various sectors including prescription drugs, car insurance, and airfares.

Overall CPI, which includes food and energy costs, rose 0.5% - the largest increase since August 2023.

Nearly 30% of this advance was attributed to shelter costs, while grocery prices, particularly eggs, also contributed significantly to the overall increase.

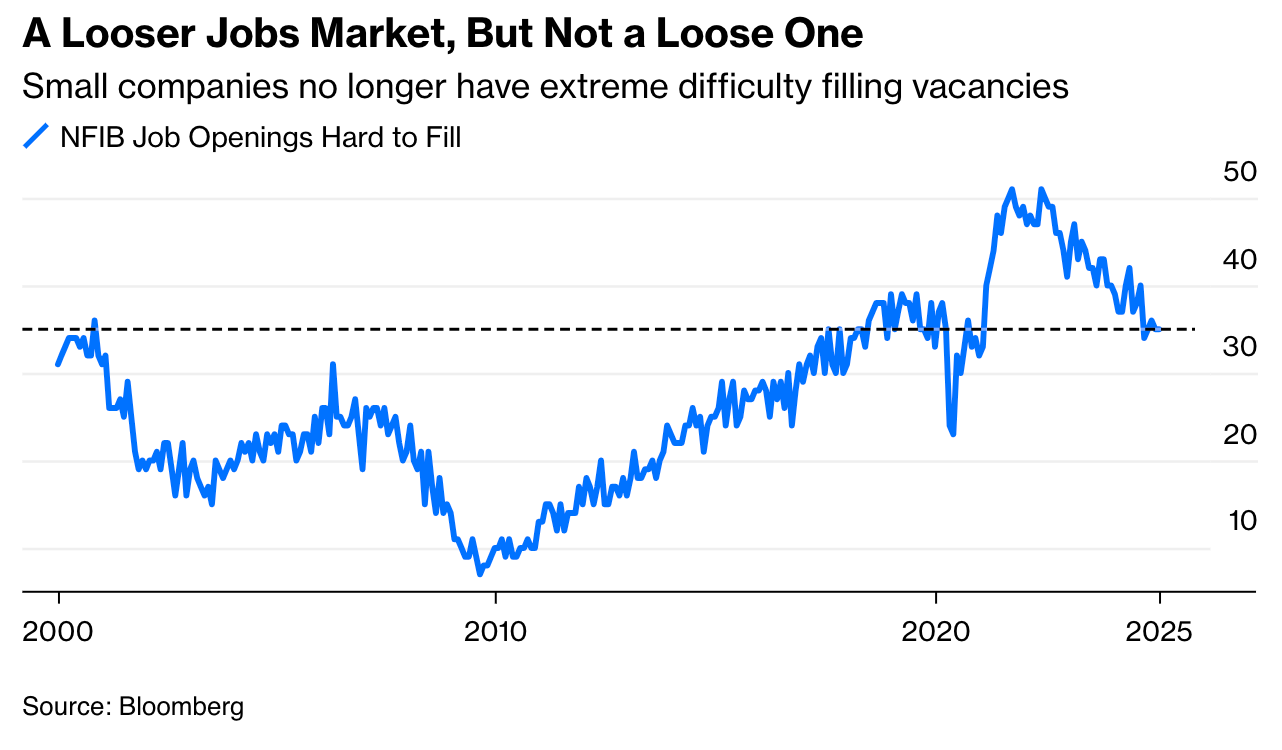

The unexpected inflation surge, combined with a robust labor market, suggests the Federal Reserve is likely to delay interest rate cuts. The news caused stock futures to drop while Treasury yields and the dollar increased, with traders now expecting only one quarter-point Fed rate cut this year instead of two.

Trump Sets 25% Steel, Aluminum Tariffs, Widening Trade War

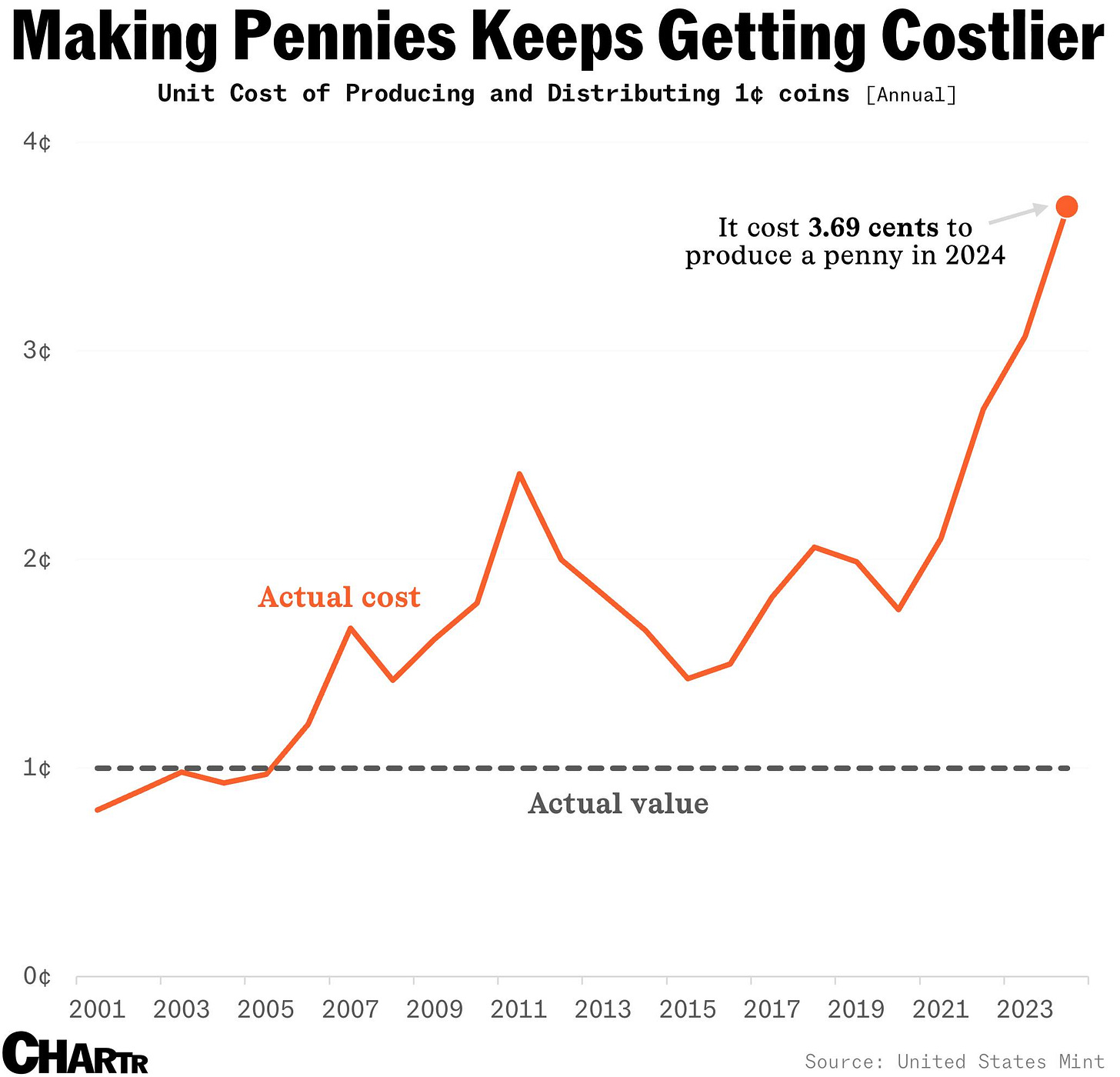

President Trump ordered new 25% tariffs on steel and aluminum imports, including finished metal products, which will take effect on March 12.

These tariffs will apply broadly to US imports from all countries, including close allies like Canada and Mexico, with administration officials saying the measures are meant to counter efforts by countries like Russia and China to circumvent existing duties.

While Trump indicated he might consider an exemption for Australia, the broader lack of exemptions has already prompted threats of retaliation, particularly from the European Union.

The new tariffs represent an expansion of similar measures Trump implemented during his first term in 2018, but now include downstream finished products, which could have broader price impacts across many sectors of the US economy.

Critics, including the National Association of Home Builders, warn that the tariffs will increase costs across industries and could hinder goals like reducing housing costs.

The US remains heavily dependent on aluminum imports to meet domestic demand, with net imports reaching over 80% in 2023, while certain sectors like aerospace and auto manufacturing rely on imported specialty steel grades.

The announcement comes about a week after Trump added a 10% duty on all Chinese imports.

US Firms Are Using Europe’s Cheaper Bond Market At Fastest Since 2007

US companies are tapping into the European bond market at the fastest pace since 2007, with "reverse Yankee" issuance reaching €23.4 billion ($24.3 billion) so far this year.

This surge is driven by a significant interest rate difference between Europe and the US, as the European Central Bank's deposit rate sits 175 basis points lower than the Federal Reserve's key rate.

Major companies like IBM and T-Mobile USA are leading this trend, with IBM's recent bond sale highlighting the stark difference in borrowing costs - their five-year euro bonds pay 2.9% interest compared to 4.8% for equivalent dollar debt.

This trend is expected to accelerate throughout 2025, particularly as monetary policies between the US and Europe continue to diverge.

The market anticipates at least three ECB rate cuts by year-end, while expectations for Fed rate cuts have diminished following higher-than-expected January inflation data.

For US companies, these euro-denominated bonds offer multiple advantages: they can either keep the debt in euros to hedge their European operations and benefit from lower rates, or they can swap the debt back to dollars while still potentially saving on costs and diversifying their investor base.