Happy Wednesday all,

It’s another action-packed week in the markets. The U.S. federal deficit hit a whopping $1.8 trillion this year, driven by rising interest payments—talk about spending sprees! And as the deficit grows, it’s becoming a hot topic in the lead-up to the presidential election. Meanwhile, active ETFs might sound like a good idea, but recent numbers show they’re underperforming their cheaper, passive counterparts.

Elsewhere, the trade deficit narrowed, but the real storm to watch is Hurricane Milton, which is set to hit Florida hard and could spell major losses for catastrophe bond investors. From potential market shocks to fiscal policy debates, there’s plenty to unpack this week—let’s dive in!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Federal Deficit Hit $1.8 Trillion for 2024, CBO Says (WSJ)

The Battle Over Robots at U.S. Ports Is On (WSJ)

Breaking Up Is Hard to Do: Antitrust Officials Weigh Splitting Google, Others (WSJ)

US, Allies Launch Spy Satellites, Alliances to Prevent a Space War (BBG)

Turbulent US Funding Market Forewarns of a Volatile End to 2024 (BBG)

Earnings Season Is Here. Why Decent Numbers Won’t Supercharge Stocks. (Barron’s)

Vanguard Wants to Shake Up Investing Again. Its New CEO Has Big Plans. (Barron’s)

The Weekly Brief

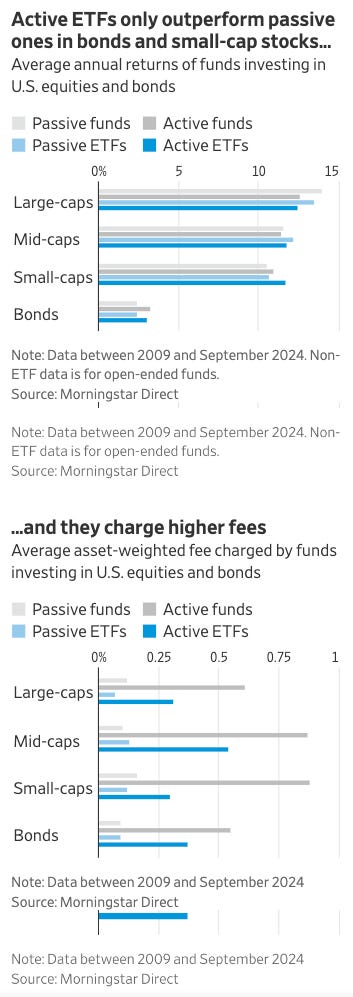

Active ETFs Underperform Passive Ones… And Cost More..

Over the past 10 years, assets managed by ETFs have jumped from $1.5 trillion to more than $10 trillion. More recently, actively-managed ETFs have been on the rise, as more and more active funds popped into the market.

But active doesn't mean better.

According to Morningstar, over the past 15 years, active ETFs have delivered an average annual return of 12.4% in U.S. blue-chip stocks, compared to 13.5% for passive ETFs and 12.6% for active mutual funds.

Active ETFs are also more expensive, costing 0.31% on average compared to 0.07% for passive ETFs.

US Federal Deficit Hit $1.8 Trillion for 2024 as Interest Payments Climb

According to estimates from the Congressional Budget Office, the US federal budget deficit reached $1.8 trillion for fiscal year 2024. This increase was driven by higher spending on interest payments, which rose 34% to $950 billion, and increased outlays for Social Security and Medicare.

Despite an 11% rise in tax revenue to $4.9 trillion, government spending of $6.8 trillion outpaced income.

The growing deficit poses challenges for the upcoming presidential election and future fiscal policy. Both major candidates, Donald Trump and Kamala Harris, have proposed tax and spending plans that are projected to add trillions more to the deficit over the next decade.

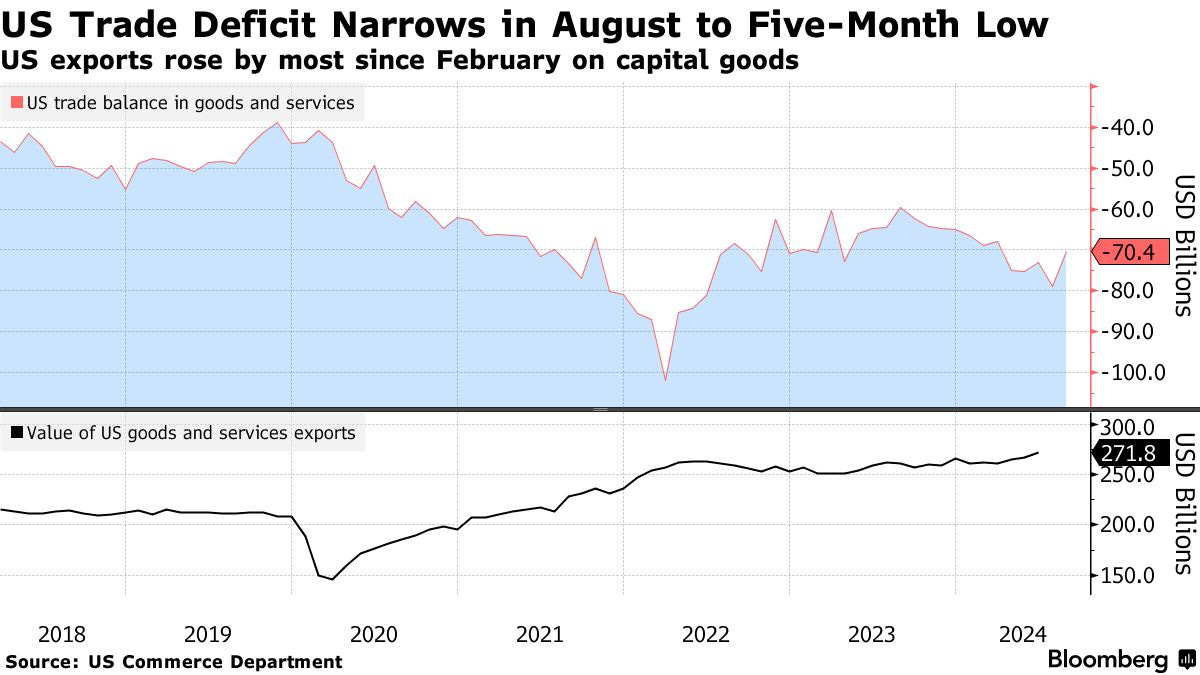

US Trade Deficit Narrows to Smallest in Five Months

The US trade deficit narrowed in August, shrinking by 10.8% compared to the prior month.

Imports declined on a pullback in the value of industrial supplies due to falling crude oil prices. Meanwhile, shipments of consumer goods moved higher as retailers ordered ahead of the dockworker strike at US ports.

Exports jumped on increased shipments of capital goods and motor vehicles.

Catastrophe Bond Investors Brace for Major Losses as Hurricane Milton Rages On

Investors in catastrophe bonds are bracing for potentially significant losses as Hurricane Milton, a Category 5 storm, approaches Florida's west coast.

This comes just two weeks after Hurricane Helene caused severe flooding across multiple states.

Experts predict that if Milton makes landfall near Tampa as a major hurricane, it could trigger catastrophe bond payment clauses on a scale not seen in years, potentially exceeding the impact of Hurricane Ian in 2022.

The combined effects of Hurricanes Helene and Milton could lead to one of the largest reinsurance loss events in history. Estimates suggest Milton alone may result in $60 billion to $75 billion in damages and losses, with some models projecting up to $150 billion.

The US is in a tough place - high deficits are unsustainable but the economy is so dependant on the firehouse of government spending that if they try to cut we’ll end up in a recession and tax receipts will drop so it will cancel out and the deficit won’t actually go down.

Title should have a "T" not an "M" for the $1.8 -- no?