⬇️🇺🇸 US Credit Rating Downgraded?!

Happy Sunday,

Markets may have rallied recently, but this week we dig into a sobering development: Moody’s has officially stripped the US of its last perfect credit rating. That’s not just symbolic - it could ripple through borrowing costs, markets, and future policy decisions.

In this edition, we break down:

Why Moody’s downgraded the US for the first time in over a century

The surprise drop in producer prices and what it signals about tariffs

How both American houses and homebuyers are aging rapidly

Plus: our chart of the week and a quick look at what’s ahead

As always, we’ve trimmed the noise and delivered the essentials. Let’s get into it.

- Humphrey & Rickie

Market Report

Moody’s downgrades US credit rating, citing growth in debt

Last Friday, Moody's Ratings downgraded the United States government's long-term issuer and senior unsecured ratings by one notch, from Aaa to Aa1.

This marked the first time Moody's has lowered the US from its top-tier status, which it had held since 1917.

With this action, the US has now lost its perfect credit rating from all three major rating agencies, following S&P Global Ratings' downgrade in 2011 and Fitch Ratings' downgrade in 2023.

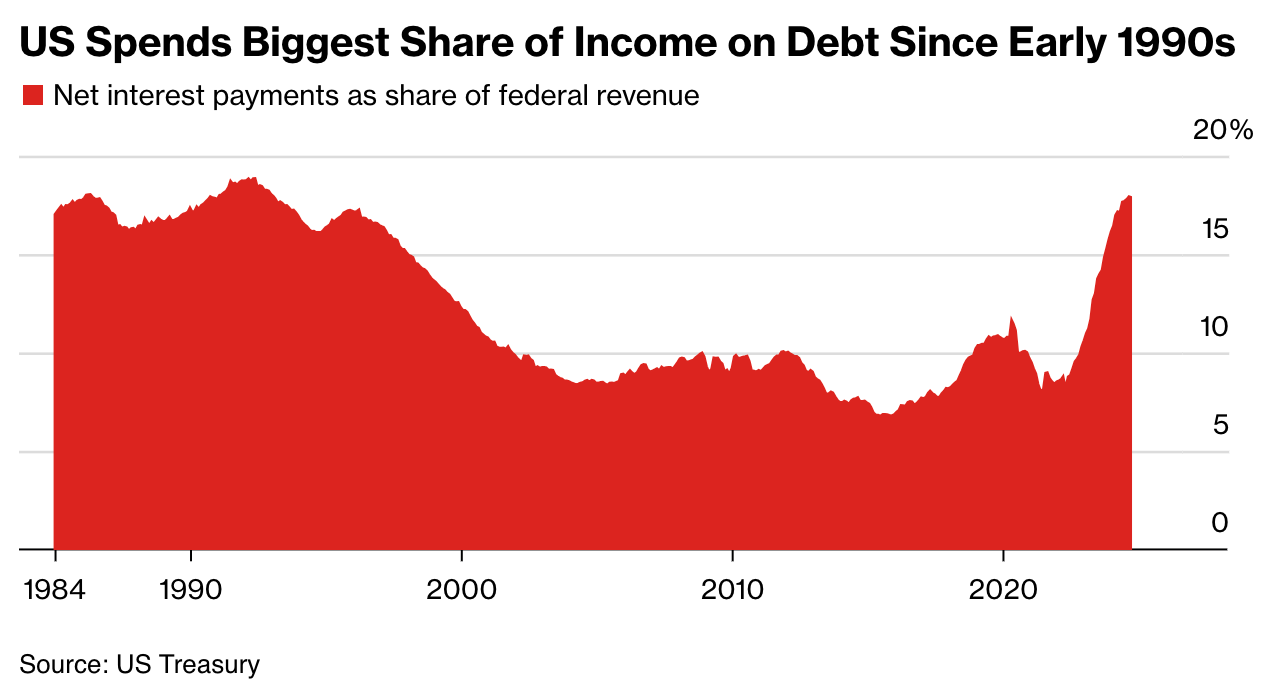

The primary driver for Moody's decision was the sustained increase in government debt and interest payment ratios over more than a decade, reaching levels significantly higher than similarly rated sovereigns.

Moody's cited concerns over persistent large fiscal deficits, which are projected to widen further, expecting federal debt to rise to approximately 134% of GDP by 2035 from 98% in 2024.

The agency also pointed to the failure of successive US administrations and Congress to agree on and implement measures to reverse the trend of these large deficits and growing interest costs.

Despite the downgrade, Moody's acknowledged the United States' "exceptional credit strengths." These include the size, resilience, and dynamism of its economy, as well as the continued role of the US dollar as the world's primary reserve currency.

The downgrade itself could lead to higher borrowing costs for the US government, which could potentially trickle down to consumers and businesses.

US Producer Prices Fell Unexpectedly in April as Margins Shrank

In April, US producer prices saw an unexpected and significant decline, with the Producer Price Index falling by 0.5%, the largest drop in five years.

This followed a flat reading in March and defied economists' expectations of a 0.2% gain. Core PPI, excluding food and energy, saw an even steeper decrease of 0.4%, its most substantial fall since 2015.

The downturn in prices was largely attributed to a slump in margins, particularly in machinery and vehicle wholesaling, indicating that companies are, for now, absorbing some of the financial impact from higher tariffs rather than immediately passing these costs on to their customers.

While some manufacturers and service providers are refraining from passing on increased import duties, others, like Walmart, have indicated potential price increases.

The automotive sector has seen companies like Stellantis offer discounts and Hyundai hold prices steady to mitigate tariff concerns. The report also showed a drop in food prices, driven by a significant fall in egg costs, and a continued decrease in energy costs.

America’s Houses and the People Who Buy Them Are Getting Older

Wealthier individuals are increasingly becoming homebuyers, while younger, first-time buyers are struggling. Persistently high mortgage rates and resilient house prices have pushed the median age of first-time homebuyers to a record 38 years in 2024, the highest since 1981.

The average age of all American homebuyers reached an all-time high of 56 last year. This demographic change is significant, as first-time homebuyers, who constituted half of all purchases in 2010, accounted for only 24% last year.

Accompanying this trend of aging homebuyers is an increase in the age of the homes being purchased. The median age of US homes sold in 2024 climbed to a record 36 years, a notable increase from 27 years in 2012.

This is largely because of the significant slowdown in new construction following the 2008 financial crisis, with the 2010s seeing the lowest share of new homes built since the 1940s.

Although older homes have traditionally been more affordable, this price advantage is diminishing; the discount for homes over 30 years old shrank from 19% below the median price in 2012 to 15% by 2024, as demand for older houses has risen and new construction increasingly occurs in historically less expensive areas.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.