✂️🇺🇸 Trump's Job Cuts Starting to Show Signs of Impact

Happy Wednesday all,

Hope you had a good holiday weekend. We are preparing to start posting 2x videos a week on YouTube again so we hope you enjoy that. And in personal news, I am really just trying to make sure I’m in good running shape before I begin official “training” for the marathon. I still haven’t decided on a race, but I was thinking of trying to get into the New York Marathon or just do the one here in California in Sacramento, in December. So I have some time!

Apple unveiled a new iPhone today! It’ll be the first link in our eye-catching headlines.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Apple unveils cheaper iPhone 16e powerful enough to run AI (CNBC)

Microsoft reveals its first quantum computing chip, the Majorana 1 (CNBC)

Walmart is getting a bump from a surprising cohort: Wealthier shoppers (CNBC)

Trump Backs $4.5 Trillion Tax Cut in House GOP Budget Plan (BBG)

EU Ready to Discuss Lower Auto Tariffs With US, Trade Chief Says (BBG)

How AI Can Protect Vital Pipelines and Cables Deep in the Ocean (WSJ)

How Dirty Money From Fentanyl Sales Is Flowing Through China (WSJ)

The Weekly Brief

US Housing Starts Sees Broad Pullback After Surge in December

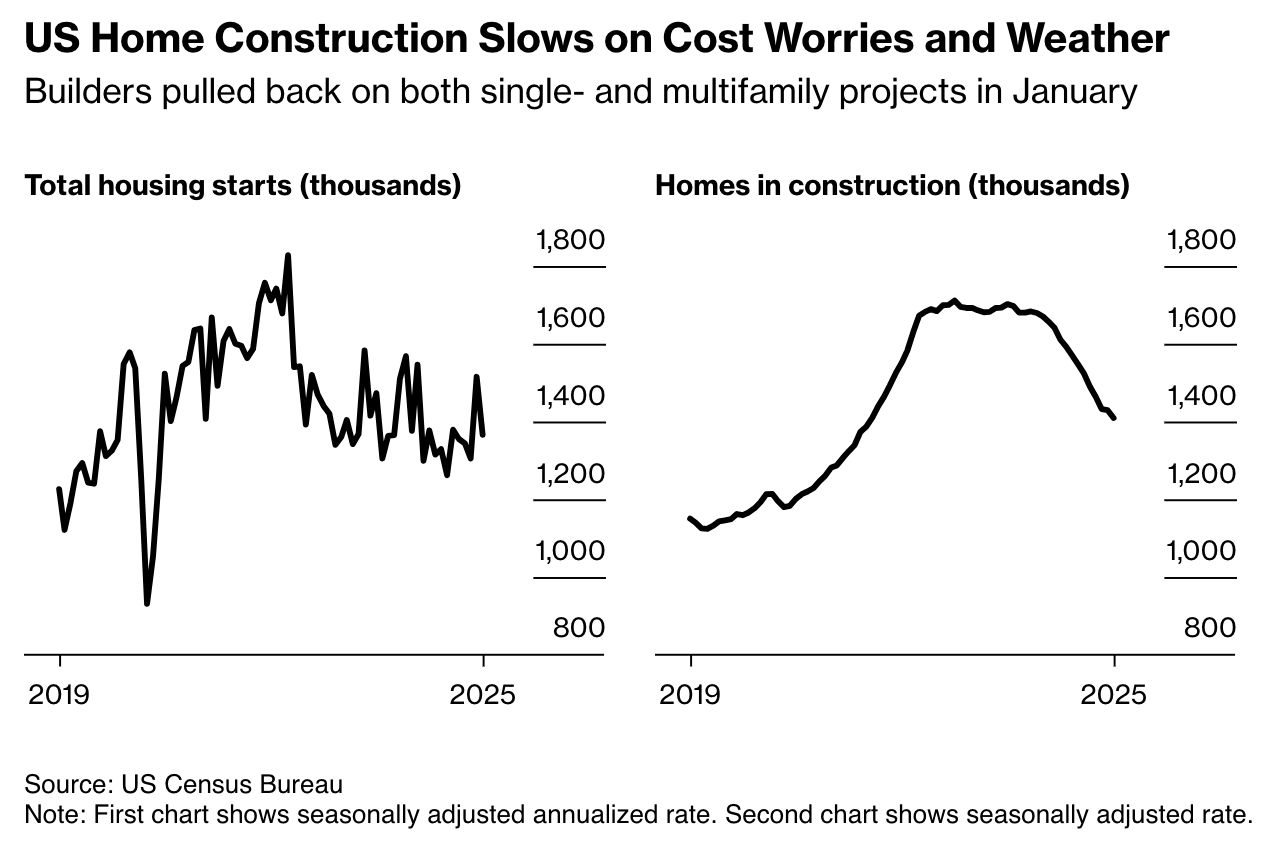

US housing construction declined in January, dropping 9.8% to an annualized rate of 1.37 million units after December's 16% surge. The slowdown affected both single-family homes (down 8.4%) and multifamily projects (down 13.5%), with cold weather contributing to the decline.

The decrease also follows builders' growing concerns about high mortgage rates (near 7%), elevated home prices (30% higher than pre-pandemic levels), and potential tariffs on building materials from Mexico, Canada, and China.

The construction industry faces challenging market conditions, with builders worried about the rising inventory of unsold new homes—currently at its highest level since December 2007.

While builders have been using incentives like mortgage rate buydowns to attract buyers, many are now slowing construction and adjusting prices to reduce their home inventory.

Trump’s Cuts to Federal Workforce Starting to Have Economic Impact

The Trump administration's ongoing federal workforce layoffs are beginning to show economic impacts, with unemployment claims already rising in the Washington DC metro area (including Maryland and Virginia) to their highest level in three years.

More significant effects are expected to come in Thursday's jobless claims report, as over 10,000 government workers have already been fired and approximately 200,000 workers have been targeted.

Economists predict these cuts could lead the DC region into a mild recession by summer as the elimination of well-paid positions affects consumer spending and housing markets.

Moody's Analytics projects nearly 100,000 federal positions could be eliminated or relocated from the capital, potentially causing double-digit employment declines by late 2026.

The March jobs report (due April 4) might show the first drop in job creation since 2020 if all targeted probationary workers are terminated, though this could be partially offset by Trump's push to bring federal workers back to offices, which might boost downtown DC consumption.

An Investing Riddle: Stocks Are in Trouble but Stock Markets Aren’t

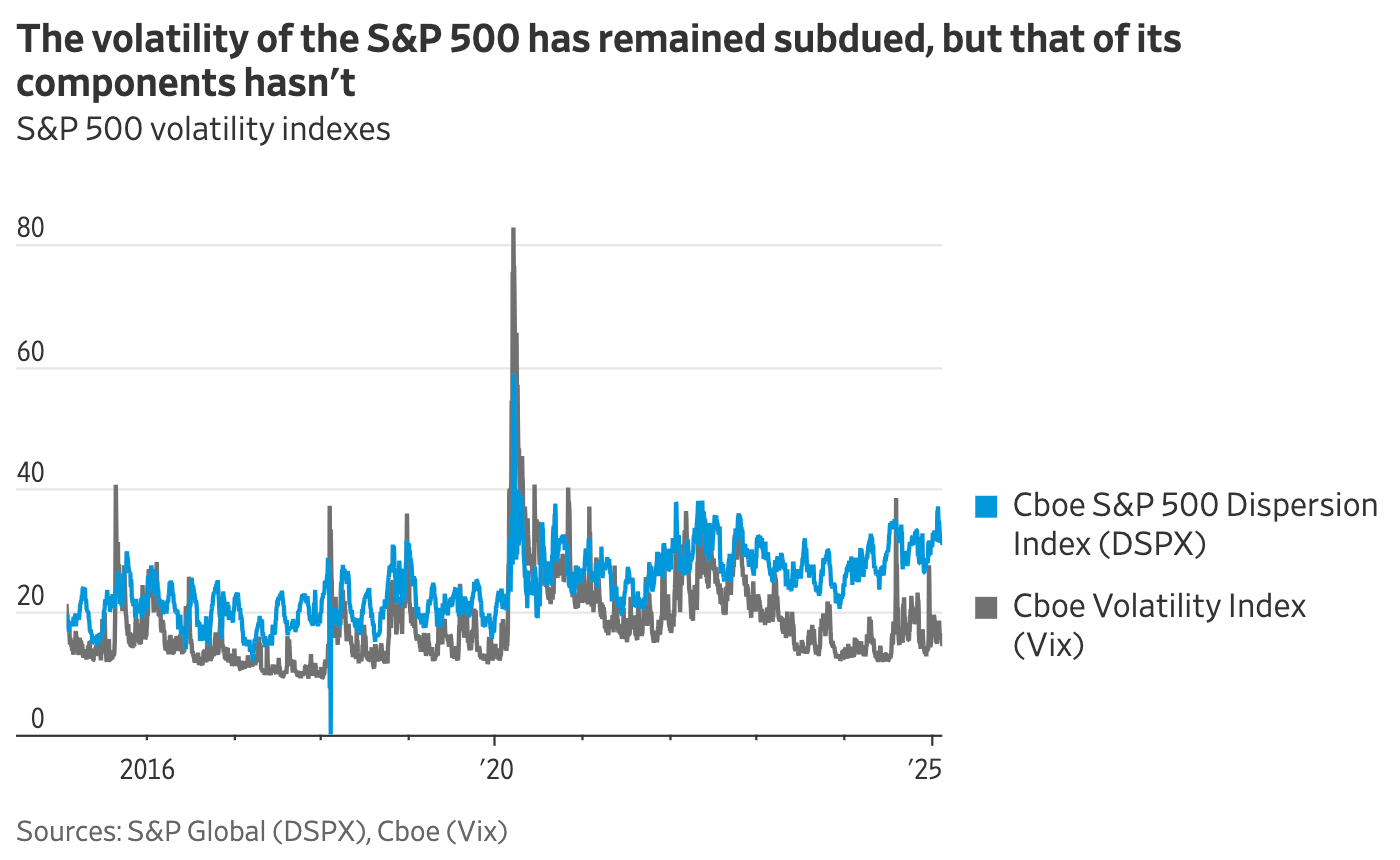

The S&P 500 is up 4.2% this year despite big challenges from Chinese AI and Trump's tariffs. While the stock market looks calm on the surface, there's a lot of chaos underneath.

While the overall market index is staying steady, individual stocks within it are swinging wildly in different directions.

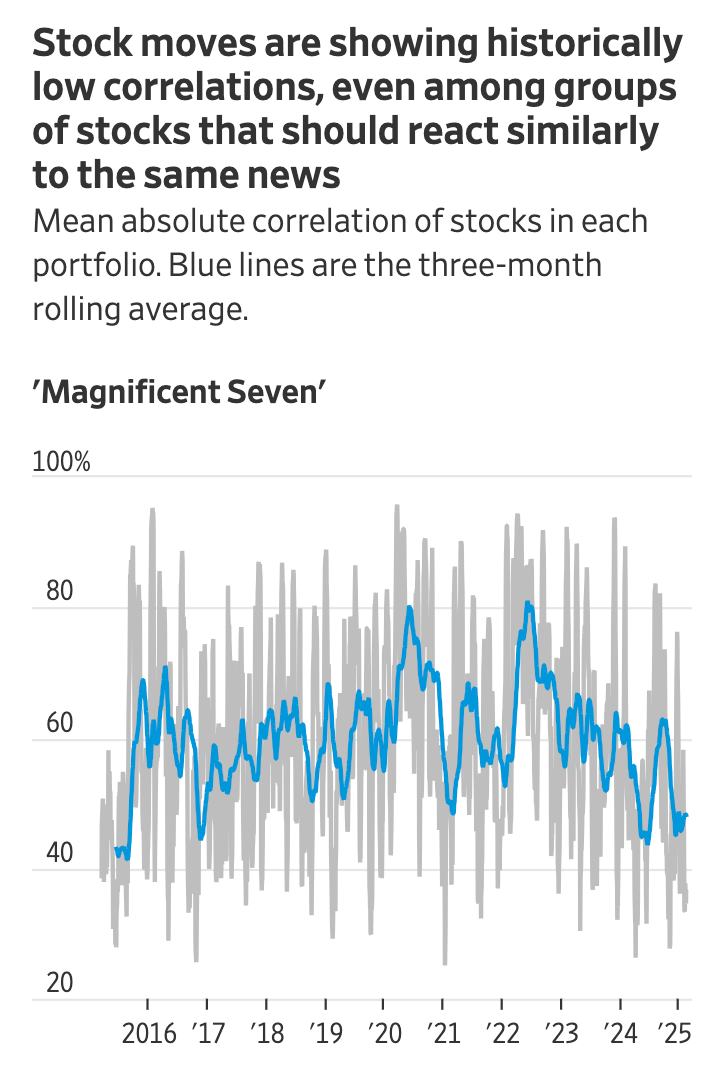

For example, among the big tech companies, Meta is up 10.6% while Alphabet is down 8.2% during the same period. These opposing movements are canceling each other out in the overall index.

This situation is dangerous because if these stocks suddenly start moving in the same direction (especially downward), the whole market could drop sharply. Some analysts think hedge funds are making this worse by placing bets that profit from this exact pattern.

The recent increase in dispersion, measured by the Cboe S&P 500 Dispersion Index reached its highest level since May 2022. History shows that when markets finally break, stocks tend to fall together.