Happy Wednesday all,

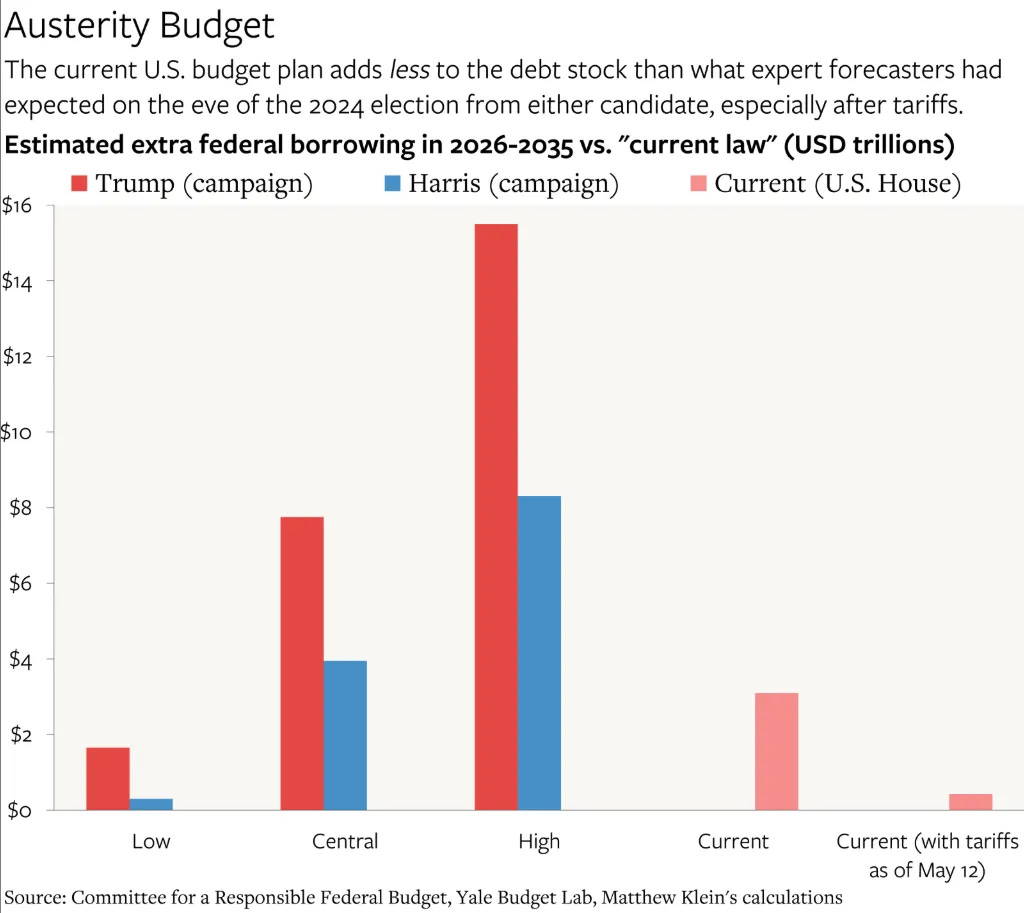

This week’s newsletter tracks the quiet power moves behind the headlines: Trump delays tariffs but sharpens his trade stance, Xi doubles down on industrial dominance, and American households are quietly buckling under the weight of resumed student loan payments. Meanwhile, the bond market is sending a warning to Washington, and even Elon Musk is chiming in on DOGE and government spending.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Elon Musk says Trump’s spending bill undermines the work DOGE has been doing (CNBC)

Abercrombie & Fitch soars 25% even as retailer slashes profit outlook due to tariffs (CNBC)

Macy’s CEO says retailer will hike some prices as tariffs cut into profits (CNBC)

North Korea Infiltrates U.S. Remote Jobs—With the Help of Everyday Americans (WSJ)

Bond Market to Washington: We’ll Make You Pay (WSJ)

Wall Street’s Rush to Launch Vanguard-Style Funds Draws Warnings (BBG)

Asia’s $7.5 Trillion Bet on US Assets Is Suddenly Unravelling (BBG)

The Weekly Brief

Trump Extends EU Tariff Pause to July Amidst Trade Negotiations

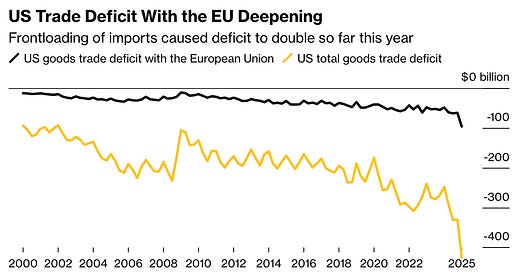

President Trump extended the deadline for potentially imposing 50% tariffs on European Union goods from June 1 to July 9. The decision was made after a phone call with the European Commission, during which both leaders agreed to "fast-track” trade negotiations.

The extension pushes back a threatened increase from a temporarily paused 10% tariff (originally 20% under Trump's "reciprocal tariffs" announced in April).

The threatened 50% tariffs could impact $321 billion in US-EU goods trade, potentially reducing US GDP by nearly 0.6% and increasing prices.

Despite the extension, challenges remain. The EU has expressed difficulty understanding the US's specific demands, particularly concerning non-tariff barriers, while the US has accused the EU of slow-walking talks and unfairly targeting American companies.

President Xi Planning to Impose “Made In China” Production Campaign

President Xi is reportedly developing a successor to his "Made in China 2025" initiative, signalling a continued focus on bolstering high-end domestic manufacturing despite US calls for China to rebalance its economy toward consumption.

This new decade-long plan is expected to prioritize critical technologies like chip-making equipment, aiming to reduce reliance on foreign technology and maintain manufacturing's stable share of China's GDP.

At the same time, as officials prepare the next Five-Year Plan starting in 2026, they are reportedly hesitant to set a target for consumption's share of GDP due to concerns over the lack of effective tools to stimulate household spending.

The US, under President Trump, has been pushing China to increase domestic consumption while simultaneously employing tariffs and export controls to encourage a "strategic decoupling" and bring manufacturing back to American shores, particularly in sensitive sectors like semiconductors and medicine.

Student Loan Payment Stress Beginning to Show in the Economy

The resumption of student loan payments after a pandemic-era pause is beginning to cause significant financial strain for millions of Americans and could pose challenges to the broader economy.

Around 5.6 million borrowers were newly marked as delinquent in the first quarter of this year, leading to damaged credit scores. The Trump administration has also begun putting millions of defaulted borrowers into collections, which could lead to wage garnishment and seizure of tax refunds.

Economists from Morgan Stanley estimate the renewed payments could collectively amount to $1-3 billion extra per month, potentially trimming 2025 GDP by about 0.1 percentage point.

The surge in delinquencies, with the rate jumping from 0.7% to 8% in the first quarter, has brought it back to pre-pandemic levels. This has led to substantial drops in credit scores for affected borrowers, which could restrict their access to future credit for significant purchases like cars or homes.