🇺🇸🇨🇳 Trump Changing His Tune on China?

Happy Wednesday all,

Tesla just posted its worst quarter in years - a 71% drop in profit, missed estimates across the board, and new signs of pressure from Trump’s trade tariffs. Elon says he’s stepping back from his government advisory work to focus on the company. Meanwhile, the White House is weighing a major tariff rollback on Chinese imports, the EU just slapped Apple and Meta with historic fines under its new Digital Markets Act, and consulting giants are offering to slash $20 billion in federal contracts.

This week’s Brief unpacks the tension: how tariffs are reshaping global supply chains, why Big Tech’s facing a new kind of regulation war, and what these shifts signal about the next phase of economic power plays.

Let’s get into it.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Tesla reports 20% drop in auto revenue as first-quarter results miss Wall Street estimates (CNBC)

Trump says he has 'no intention' of firing Fed Chair Powell (CNBC)

The ‘magic number’ to retire comfortably fell to $1.26 million — but people are less confident they can reach it (CNBC)

Consulting Firms Offer to Cut Up to $20 Billion From Federal Contracts (WSJ)

RFK Jr. Unveils Plan to Phase Out Artificial Food Dyes (WSJ)

Intel to Announce Plans This Week to Cut Over 20% of Staff (BBG)

The Weekly Brief

White House Considers Cutting Chinese Tariffs in Bid to De-Escalate

According to the WSJ this morning, the Trump administration is contemplating a significant reduction in the steep tariffs currently imposed on Chinese imports, potentially cutting them by more than half from the existing 145% level.

While President Trump confirmed his willingness to lower the tariffs, stating they wouldn't remain at 145% but also wouldn't drop to zero, no final decision has been made, and discussions are ongoing.

Options reportedly include lowering tariffs to a range of 50%-65% or implementing a tiered system, possibly setting rates at 35% for non-strategic goods and 100% or more for strategic items, phased in over time.

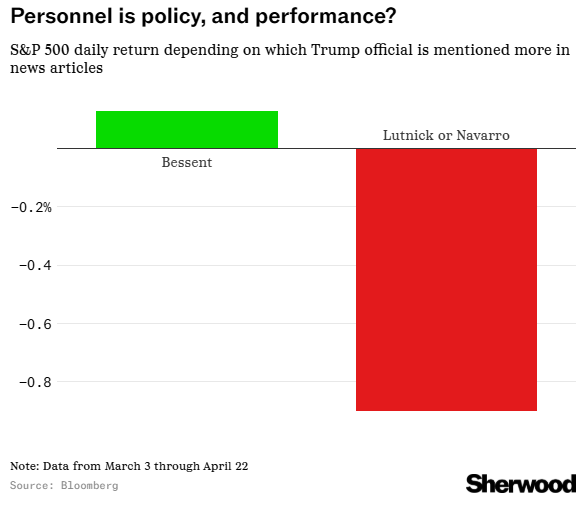

Just yesterday, US Treasury Secretary Scott Bessent echoed the sentiment for de-escalation, stating at a private event that the US goal is not to decouple from China but to achieve a rebalancing of trade that favors increased US manufacturing.

Elon Musk To Pull Back from DOGE As Tesla Sees Worst Quarter in Years

Elon Musk announced he will significantly reduce his time spent on government work with the Department of Government Efficiency (DOGE) starting next month to focus more on Tesla.

This shift came after Tesla reported its worst quarter in years, with first-quarter net income dropping 71% and missing analyst estimates for both revenue and EPS.

The company faced challenges, including declining sales in key markets like the US, China, and Germany, competitive pressures, production pauses for the Model Y refresh, and the impact of President Trump's trade tariffs.

Trade tariffs under the Trump administration have worsened supply chain issues and added costs for Tesla, particularly impacting components sourced from Mexico and Canada, as well as battery cells for the energy business, which often come from China.

Despite the current headwinds, Tesla emphasized the importance of autonomy and AI, with plans to launch a small "Cybercab" robotaxi service in Austin in June and develop the Optimus humanoid robot.

The company also announced that new, more affordable vehicle models are on track for production in the first half of the year.

Apple and Meta Hit by EU Tech Fines After Trump Threats

Apple and Meta have become the first companies fined under the European Union’s Digital Markets Act (DMA), with Apple facing a €500 million ($570 million) penalty and Meta €200 million ($228 million).

The DMA, enacted to curb the dominance of major tech companies, aims to ensure fairer competition in the EU’s digital marketplace by imposing strict rules on how these companies operate.

Apple was penalized for restricting app developers from directing users to alternative purchasing options outside its App Store, thereby limiting competition and consumer choice.

On the other hand, Meta’s fine resulted from its “consent or pay” model, which required users to either allow their personal data to be used for targeted ads or pay for ad-free access to Facebook and Instagram.

The fines, while significant, are relatively modest compared to the maximum possible under the DMA, which allows for penalties up to 10% of a company’s global annual revenue.