Happy Sunday,

Hi all. Unfortunately I don’t come to you with the best news: My dad has been in the hospital for the past 4 days with a heart arrhythmia and has to stay due to his condition fluctuating from it quite a bit... Needless to say, I have been distracted and taking the time to be with him. If you have any positive thoughts please send it our way - we appreciate them, it’s always tough to see a parent go through anything medically related :(

I’ll send another update in Wednesdays edition and the videos you may see on the channel will be from the prior weeks of filming. Also, I did meet a Hump Days subscriber in the wild: Campbell. If you’re out there, thanks for saying hello and the kind words.

Enjoy this week’s Hump Days.

- Humphrey

Market Report

Trump’s Budget Proposal to Cut $160bn to Discretionary Spending

President Trump's fiscal 2026 budget proposal, released on Frida,y outlined significant cuts totaling over $160 billion to nondefense discretionary spending, targeting programs related to renewable energy, education, foreign aid, and environmental initiatives.

This preliminary "skinny budget" aims to reduce what the administration deems "wasteful" programs, curtail clean-energy funding, eliminate diversity, equity, and inclusion initiatives, and encourage more state control.

The plan calls for boosting military spending to $1.01 trillion and Homeland Security funding by nearly 65% to $107 billion, while making deep cuts elsewhere.

Specific targets include defunding EPA environmental justice programs, cutting funds for the National Institutes of Health (NIH) and National Science Foundation (NSF), reducing IRS funding, eliminating the Corporation for Public Broadcasting, and ending a low-income heating assistance program.

This proposal could face significant hurdles in Congress. Democrats argue the cuts would harm American families and undermine research and innovation.

In addition, key Republicans like Mitch McConnell and Roger Wicker have criticized the defense spending figures, arguing they rely on budget reconciliation maneuvers and amount to a cut when factoring in inflation.

Since appropriations bills require bipartisan support to pass the Senate, Trump's budget will likely need significant modifications to become law and avoid a government shutdown when the fiscal year ends on September 30.

Buffett to Step Down Following Six-Decade Run At Berkshire Hathaway

Warren Buffett, the legendary investor who led Berkshire Hathaway for six decades and transformed it into a conglomerate valued at over $1.16 trillion, announced he will step down as CEO at the end of the year.

The 94-year-old made the surprise announcement at the company's annual shareholder meeting, stating that Greg Abel, the 62-year-old vice chairman for non-insurance operations, will succeed him upon board approval.

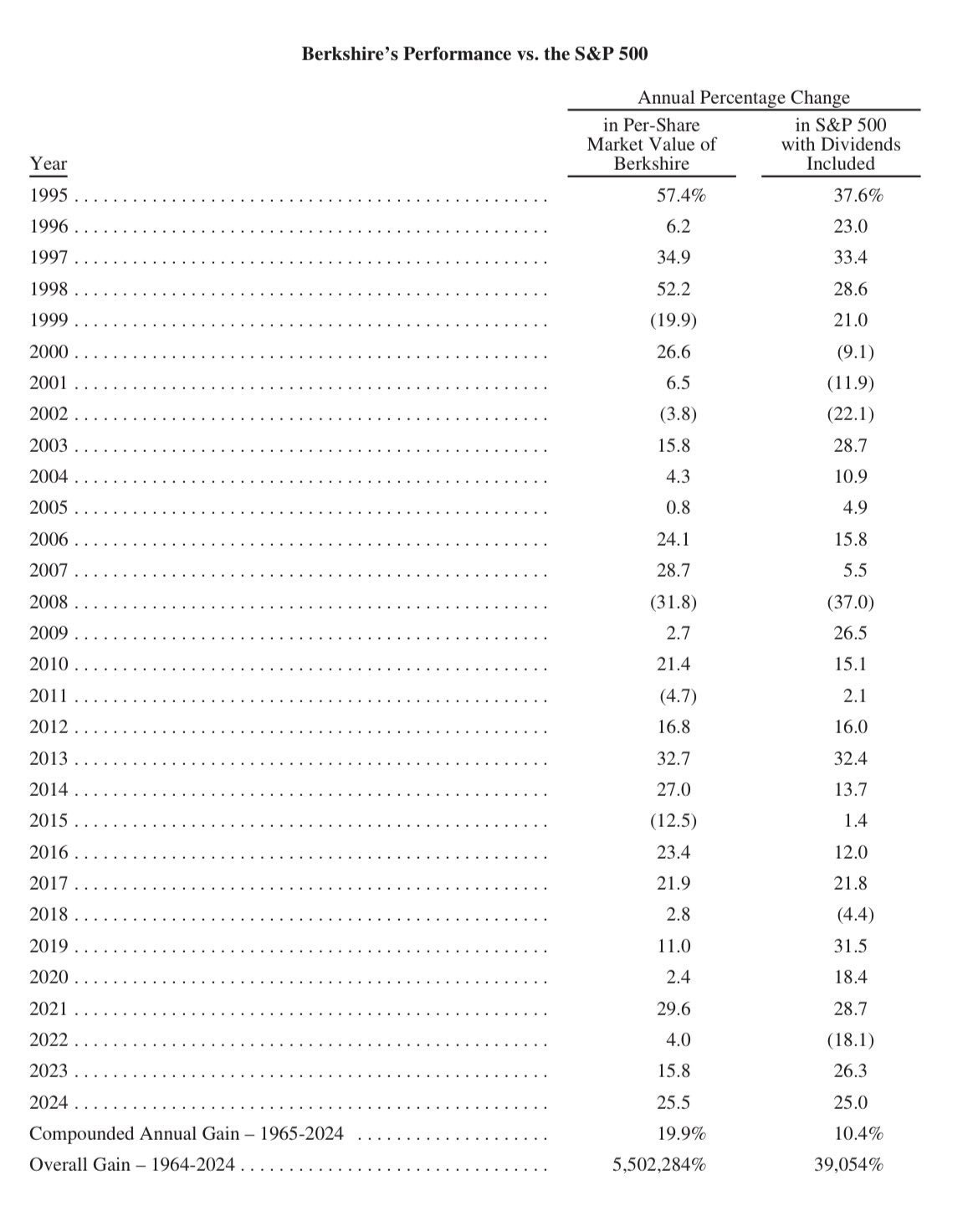

Buffett, known for his investment prowess that delivered a 20% compounded annual gain for Berkshire stock from 1965 to 2024, built the company through strategic acquisitions and stock picks alongside his late partner Charlie Munger, focusing on diverse businesses mirroring the US economy.

Greg Abel, long considered the heir apparent, will take the helm of the massive company. Abel joined Berkshire through the acquisition of MidAmerican Energy, where he eventually became CEO.

He gained Buffett's trust through successful deals and management, particularly in expanding Berkshire Hathaway Energy into an utility giant. In 2018, he was promoted to vice-chairman overseeing all non-insurance operations, including major holdings like BNSF railroad and Dairy Queen.

While Abel has a strong track record managing Berkshire's operating businesses, questions remain about his investment acumen compared to Buffett's legendary stock-picking skills.

Abel inherits a financially healthy Berkshire but faces substantially more difficult investing environment. Key among these is how he will manage the company's enormous cash pile, which reached nearly $350 billion as of March 31, 2025, after a period of scarce dealmaking opportunities.

US Employers Add 177,000 Jobs, Solid Pace in Face of Uncertainty

The US labor market showed resilience in April 2025, adding 177,000 nonfarm jobs while the unemployment rate held steady at 4.2%.

Despite downward revisions to the previous two months' figures, the report indicated a gradual cooling rather than a sharp downturn, even amidst uncertainty surrounding President Trump's trade policies and tariffs.

Wage growth moderated slightly, with average hourly earnings rising 0.2% from March and 3.8% year-over-year.

Job gains were broad-based, led by healthcare and transportation/warehousing, though manufacturing shed jobs and the federal government continued cutting positions, attributed partly to the Department of Government Efficiency (DOGE).

The labor participation rate ticked up slightly, particularly for prime-age workers. However, other indicators like falling job openings and slower private hiring suggest potential weakening ahead, and layoffs announced by companies like UPS point to growing caution among employers facing economic uncertainty.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.

Wish your dad a fast recovery!

Best wishes to your dad - I work as a cardiology fellow so happy to informally answer any questions you may have. Thanks for all your hard work.