🇺🇸😱 Trump Assassination Attempt + Inflation Cooling Again

Happy Sunday,

Like many people, I was definitely glued to my Twitter timeline and other news sources in reading and watching the assassination attempt on Donald Trump yesterday. One of the rules on the channel is that we don’t get too political, as I like to stick to just the finance and educational content here - but I did want to express my condolences to the spectator who lost their life yesterday, as well as just say political violence is never OK. It was a crazy situation no matter what side you are on.

As a curious person, the last public assassination attempt was in 1981 on President Reagan who was shot after a speaking engagement. There have been some attempts on Presidential figures since then, but those have all been foiled. This will likely be talked about for the next few months, and we will see if it has any impact on the markets tomorrow.

In more personal news, I’ve been running a bit more, and actually enjoying it. It’s been about 6 months since I started running about 2-3 times a week. In Chess, I’m still garbage. But I’m learning and obsessed! In channel news, we have some fun new experimental formats on the channel coming out soon so be on the lookout for that in the next few weeks.

— Humphrey, Tim, & Rickie

Market Report

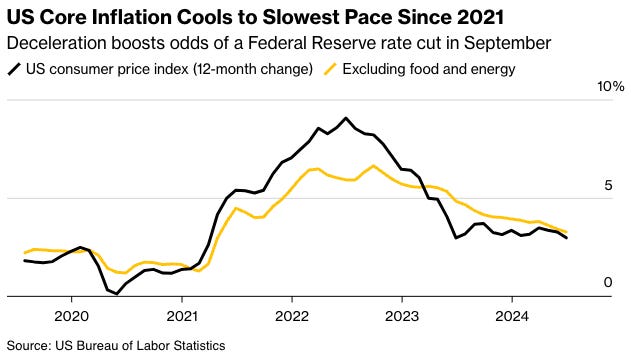

U.S. Inflation Broadly Cools to Slowest Pace In 3 Years

In June 2024, U.S. inflation cooled to its slowest pace since 2021, driven by a significant slowdown in housing costs.

The core consumer price index (CPI), which excludes food and energy prices, rose by only 0.1% from May, marking the smallest increase in three years.

Overall inflation fell by 0.1% month-over-month, largely due to cheaper gasoline. This deceleration in inflation boosts the likelihood of the Federal Reserve cutting interest rates, potentially starting in September.

Fed Chair Jerome Powell emphasized the need for more positive data before making any policy changes, although the latest figures have increased market expectations for rate cuts later this year.

High Expectations for Corporates as Earnings Season Kicks Off

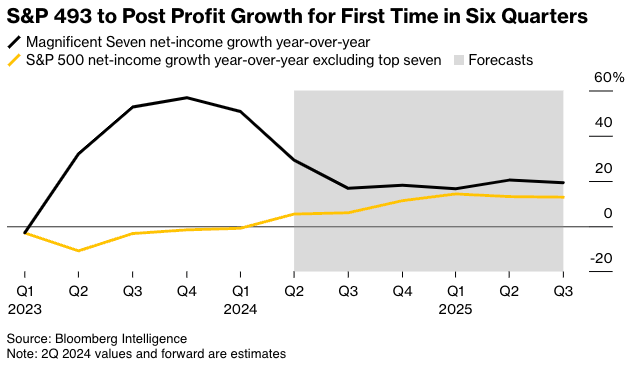

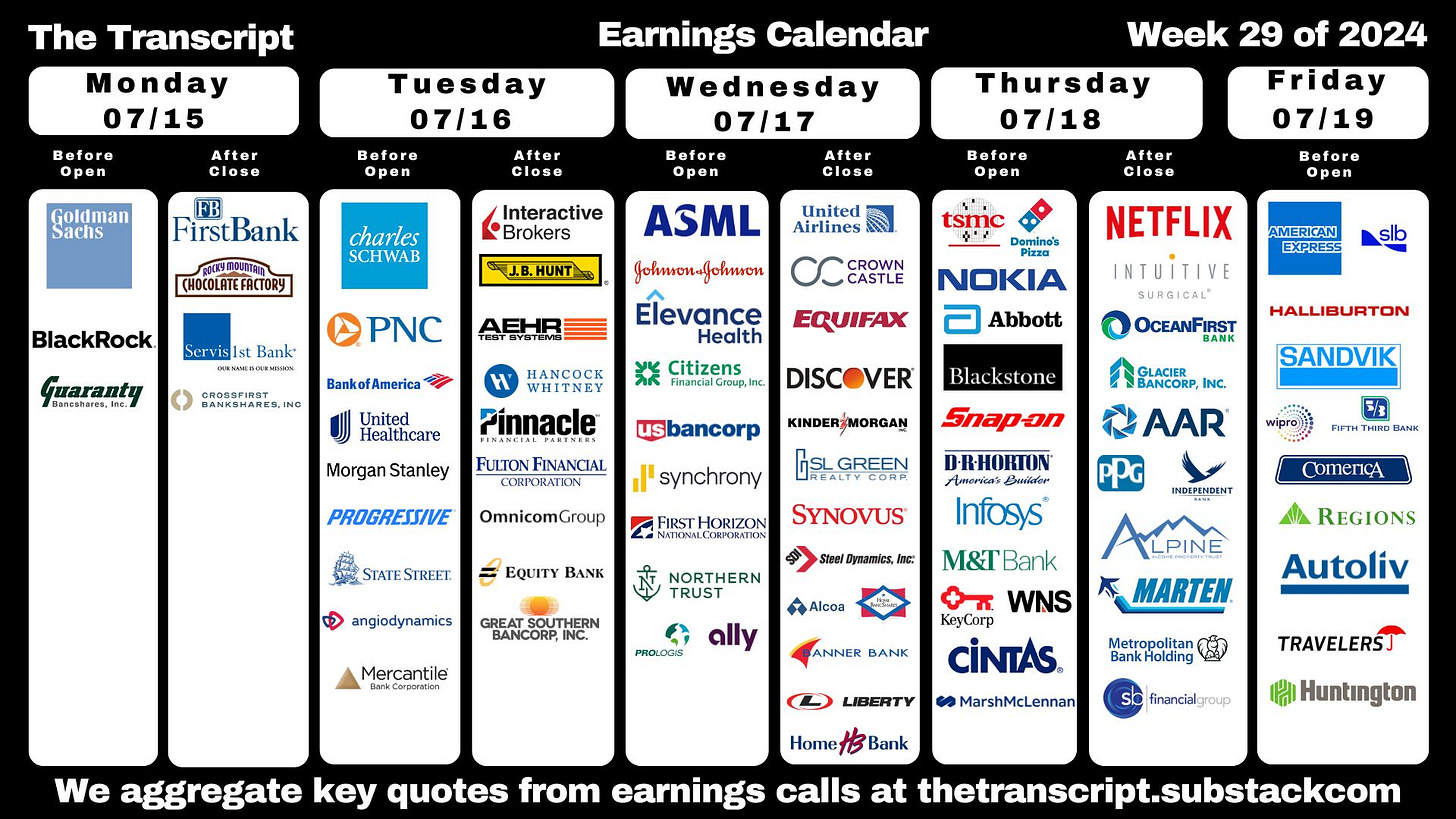

The upcoming earnings season in the U.S. stock market, starting this week, is poised to be a critical test for the ongoing market rally, with the S&P 500 Index having reached multiple record highs since April 2024.

Analysts project a 9.3% increase in second-quarter profits for S&P 500 companies compared to the previous year, marking the largest growth since late 2021.

While the "Magnificent 7" tech giants have been driving much of the market's gains, their earnings growth is expected to slow, and investors will be looking for broader market participation.

Big Banks Continue to Feel Pressure From Higher Rates

Q2 earnings reports from JPMorgan Chase, Citigroup, and Wells Fargo reveal a resurgence in Wall Street dealmaking, offsetting the impact of high interest rates on lending income.

Investment banking fees at these banks reached their highest levels since 2021, with JPMorgan and Citigroup experiencing significant increases of 50% and 63%, respectively.

This revival is attributed to increased merger activity, debt refinancing, and a slight uptick in initial public offerings.

However, the banks also faced challenges in their traditional lending businesses, with net interest income declining across all three firms compared to the first quarter.

WeBull is giving away a free Coca-Cola stock ($63 value) when you Deposit $500

If you deposit a minimum of $500 into WeBull you will get a guaranteed share of Coca Coal (valued right now at $63) deposited into your account. That’s probably one of the best promotions I’ve ever seen because that’s effectively like a 12-13% bonus on a $500 deposit. Use this link if you’re interested. Of course, if you don’t have $500 to move around - don't feel obligated to do it, but I thought I'd at least share this!