Happy Wednesday all,

Recently I bought a Chess Clock for productivity and I have been loving it. On both sides, I put a timer up for 4 hours. Then, I set it to count down.

Whenever I’m doing work, the timer associated with the white pieces will count down, and the timer associated with the black pieces stays frozen. When I go and take a break, I simply press the Chess Clock and activate black’s timer.

My goal is to get white’s timer down to zero before the black pieces! It’s kind of a fun, gamified way, of being productive. I learned it on Twitter somewhere.

I hope you’re having a great Wednesday… again, we have some more tariff news for you. Feels like every week there’s something new 🤷♂️

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Treasury scraps reporting rule for U.S. small business owners (CNBC)

GameStop to invest corporate cash in bitcoin, following in footsteps of MicroStrategy (CNBC)

Treasury Plans ‘Substantial’ Layoffs as Part of Musk’s DOGE Push (WSJ)

U.S. blacklists over 50 Chinese companies in bid to curb Beijing’s AI, chip capabilities (CNBC)

The Surprising Good News for Mall Owners: Forever 21’s Bankruptcy (WSJ)

Corporate America’s Euphoria Over Trump’s ‘Golden Age’ Is Giving Way to Distress (WSJ)

Wall Street Sees Stock Rout Ending, While European Rivals Are Not So Sure (BBG)

The Weekly Brief

Trump Weighs Imposing Copper Import Tariffs in Coming Weeks

US tariffs on copper could arrive much sooner than expected, with sources from Bloomberg indicating implementation may occur within weeks rather than waiting for the Commerce Department's 270-day review period.

President Trump directed the investigation in February, but the process is reportedly being treated as little more than a formality, with Trump having repeatedly stated his intention to impose these tariffs.

The potential tariffs, which could reach as high as 25%, stand to disrupt the global market for this essential metal used in pipes and electrical cables.

This accelerated timeline would be quite different from Trump's first-term approach to steel and aluminum tariffs, which took approximately 10 months of investigation before implementation.

Trade War Explodes Across World at Pace Not Seen in Decades

Trade protectionism is surging worldwide at an unprecedented pace, with barriers rising well beyond President Trump's recent tariff actions. Even before Trump's return to office, countries were implementing trade restrictions to shield domestic industries from Chinese competition in sectors like EVs and steel.

These protectionist measures are now accelerating as nations brace for goods diverted by Trump's tariff shield, with the EU recently announcing plans to strengthen protections for its steel and aluminum producers against imports redirected from the US.

According to Global Trade Alert, G20 economies now have 4,650 import restrictions in force - up 75% since 2016 and ten times the number from 2008.

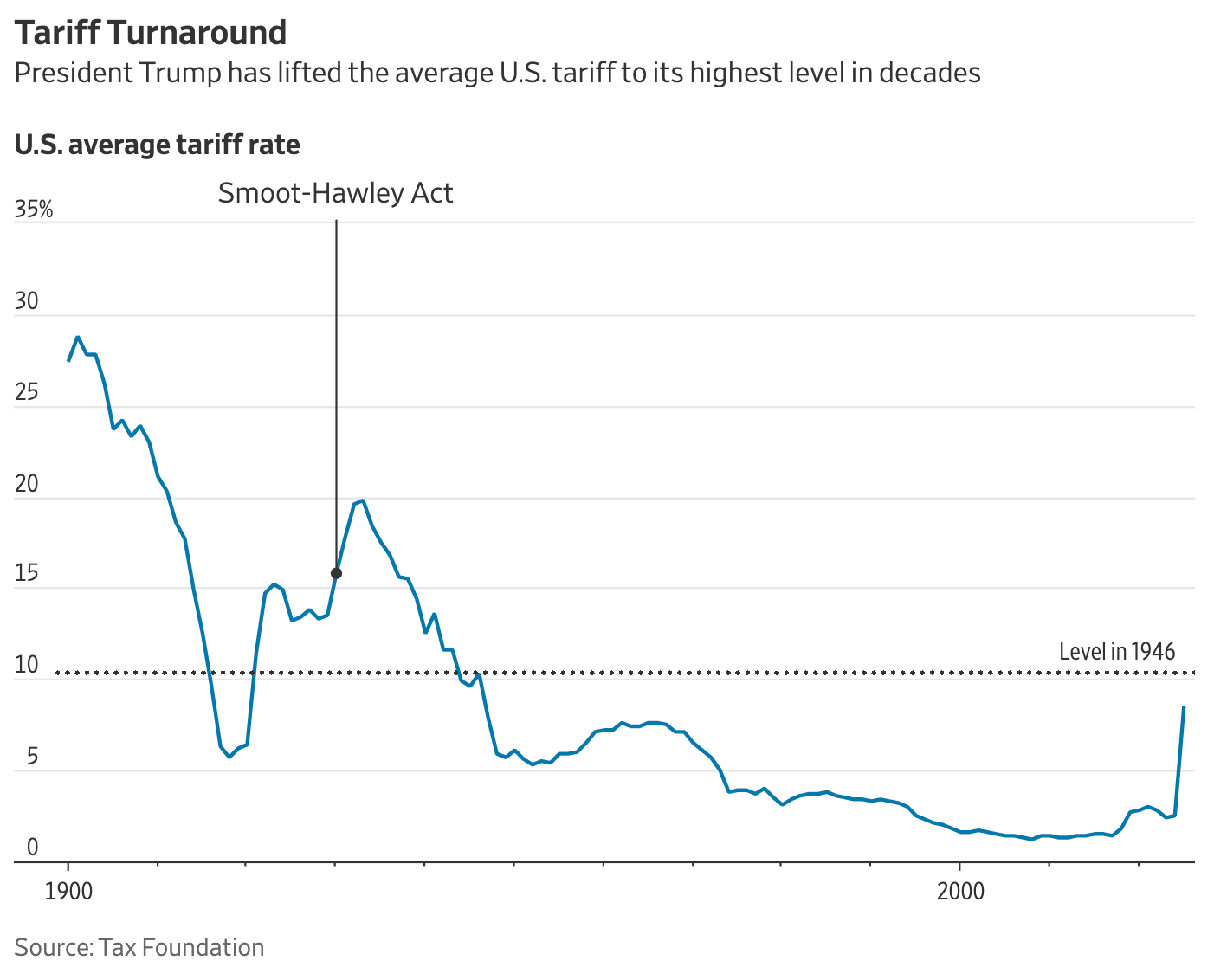

The US average tariff rate has returned to 1946 levels at 8.4% (from 1.5% in 2016), with Fitch estimating it could reach 18% if Trump implements all proposed tariffs.

US Stock Market Liquidity Drying Up as Trade War Concerns Mount

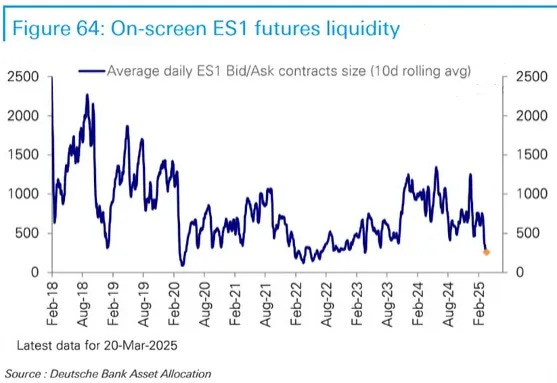

Global trade tensions are now impacting US stock market liquidity, creating significant challenges for institutional investors.

Liquidity in S&P 500 futures has fallen to a two-year low according to Deutsche Bank data, while Citigroup's liquidity index is also hovering near its lowest level in two years.

The problem stems from tariff concerns causing heightened volatility in individual stocks, making large-block trading increasingly difficult.

This deteriorating liquidity environment can increase hedging costs, widen bid-ask spreads, and potentially enhance market downturns if investors can't exit positions at desired prices - a concern already flagged by the Federal Reserve in November.