📈🎇 The S&P 500 Isn't Diversified + Happy 4th of July

Happy Wednesday all,

It’s the 4th of July Eve! If you’re in the U.S., I hope you are getting some time off and ready to BBQ and enjoy the hot weather tomorrow (it’s hot all across the U.S.). I’ll personally be going to a barbecue + swimming party down in my hometown tomorrow, and then I’ll probably play Chess online, lose a bunch of games, and tank my rating some more. Lol.

I’m trying to be a lot more active on Instagram - so I started posting Q&A stories on there and I’ll keep these going andAt the end of this newsletter, you’ll find our latest video on the average 401(k) balance in the United States as of the most recent Vanguard report, I do hope you check that video out and leave a like on it.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

🤝🏻 Beijing and Moscow Go From ‘No Limits’ Friendship to Frenemies in Russia’s Backyard (WSJ)

💾 The Underground Network Sneaking Nvidia Chips Into China (WSJ)

📉 Social Security cost-of-living adjustment may be lower in 2025. These charts help show why (CNBC)

✈️ Southwest Airlines adopts ‘poison pill’ to fend off activist Elliott Management (CNBC)

🗳️ Pressure on Biden Builds as Democrats Fear Big November Losses (WSJ)

🇨🇳 China’s Investment Bankers Join the Communist Party as Morale Shrink (BBG)

The Weekly Brief

The S&P 500 Isn’t as Diverse as It Used to Be.

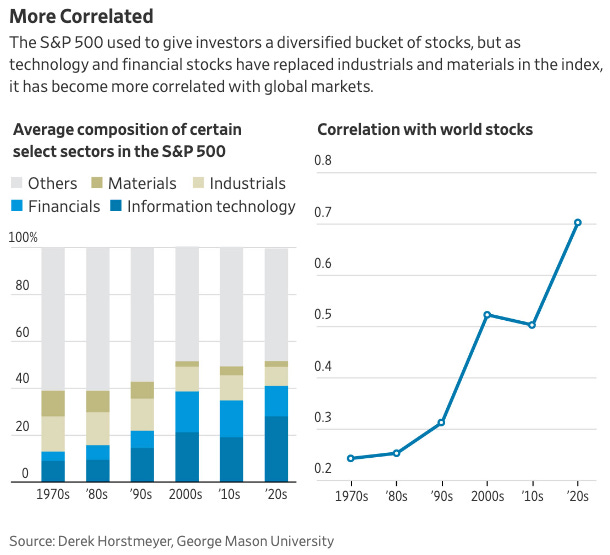

The S&P 500 index has undergone significant changes over the past 50 years, becoming more concentrated in technology and financial stocks, which now comprise 42% of the index by weight.

This shift has made the index more sensitive to interest rates and more correlated with global markets, with the average correlation between the S&P 500 and other global indexes increasing from 0.24 in the 1970s to 0.70 in the early 2020s.

Additionally, the index's valuation levels have increased, with the average Shiller price-to-earnings ratio rising from 13.5 in the 1970s to over 30 in the early 2020s, while its dividend yield has decreased from 4.11% to 1.45% over the same period.

US Job Market Shows More Signs of Slowing

Recent labor market data suggests a gradual slowdown in the U.S. job market. ADP's private payroll report showed moderate hiring in June, with 150,000 jobs added, primarily in leisure and hospitality.

Wage growth for both job stayers and job changers has cooled, reaching a near three-year low for job stayers.

Additionally, continuing unemployment claims have risen for nine consecutive weeks, indicating difficulties in finding new employment.

Fed says it’s not ready to cut rates until ‘greater confidence’ inflation is moving to 2% goal

The Federal Reserve's June meeting minutes reveal that officials believe inflation is moving in the right direction but not quickly enough to warrant interest rate cuts.

The committee maintained its current interest rate policy, with the majority of members indicating only one potential quarter-point rate cut by the end of 2024, down from the three cuts projected in March.

While some officials expressed concerns about the need to tighten policy if inflation persists or increases, others emphasized the importance of being prepared to respond to economic weakness.

Chair Jerome Powell noted that the risks of cutting rates too soon versus too late have become more balanced, signaling a cautious approach to future policy decisions.