🚀 The S&P 500 Is Up 14% in H1-2024

Happy Sunday,

Small talk first: July is upon us starting tomorrow, which means that half of the year is over. That’s pretty crazy broooo/broettes. Time flies!

Personal news: I ran 10 miles yesterday at a 10:04 pace. Very tired, not sure how people get to 26.2 miles… Psychos 🤣 People always ask me if I’m training for something. My answer is: No. But I did enjoy pushing myself to get to 10 yesterday.

YouTube news: Been working on getting ahead on the content schedule with some great videos for you this July before my vacation at the end of month, including an updated Average 401(k) balance video dropping tomorrow or Tuesday with the latest report from Vanguard.

I hope you all are having a good weekend. Enjoy this week’s Hump Days.

— Humphrey, Tim, Rickie

Market Report

The S&P 500 experienced an incredible first half of 2024, climbing 14% since January and recording 31 all-time closing highs.

This performance represents the second-best start to a year this century, surpassing the historical average first-half gain of 4.72% since 1953.

The rally has been primarily driven by the technology and communication services sectors, with companies like Nvidia, Microsoft, Meta Platforms, Alphabet, and Amazon leading the charge.

Nvidia has been a standout performer, contributing the most to the S&P 500's rally with a staggering 150% gain on a total return basis.

Other top performers include Constellation Energy (up 72%), General Electric, Eli Lilly, and Micron Technology.

However, the rally has been uneven, with the equal-weight version of the S&P 500 underperforming the market-cap weighted index by 10 percentage points since January, the widest underperformance in the first six months of a year ever.

Looking ahead, some strategists suggest that companies outside of tech may drive the next leg of market growth, given the current rich valuations in the tech sector.

Lumber Market Slump Signals Housing Sector Cooldown

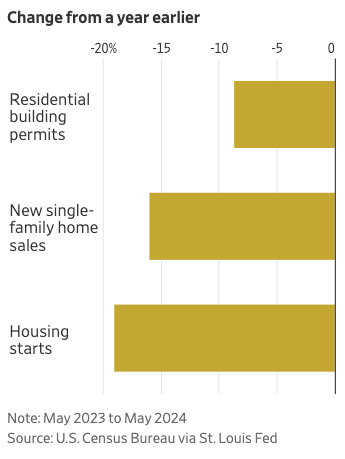

Lumber prices have fallen significantly as the U.S. housing market cools due to high interest rates. Futures prices dropped 27% since mid-March while cash prices hit their lowest levels since May 2020.

Many sawmills are now operating at a loss due to increased production costs and reduced demand, leading to mill closures and production curtailments across North America.

Housing starts and building permits have also declined, further confirming the market slowdown.

Record Summer Airline Travel is in Full Swing

Summer air travel in the United States is expected to reach record-breaking levels in 2024, with the TSA forecasting a 5.4% year-over-year increase for the July 4 holiday period.

Despite this surge in demand, airlines and airports face numerous challenges, including supply chain delays, regulatory pressures, the Boeing safety crisis, air traffic controller shortages, extreme weather, and rising costs.

Although airfares are currently lower than expected, industry experts warn that prices may increase in the future due to rising maintenance costs and reduced fleet capacity.

‘Inside Out 2’ tops $1 billion at the global box office, first film to do so since ‘Barbie’

Disney and Pixar's "Inside Out 2" has achieved a significant milestone by joining the billion-dollar club, grossing $1.014 billion worldwide as of Sunday.

This makes it the highest-grossing film of 2024 and the first to reach $1 billion globally since "Barbie" in 2023.

"Inside Out 2" has not only outperformed recent Disney animated features but also demonstrated the importance of family audiences to the box office, with over 70% of attendees being families during its domestic debut.

Additionally, the film attracted a significant teen audience, a demographic that has been largely absent from theaters in recent years.

Forecast Ahead

Earnings calendar is quite light this next week but Q2 earnings is starting up shortly!