💵 The Most Important Money Management Skill

Hi all,

In today’s Paid Edition of Hump days we’re going over how to categorize the money you receive every single paycheck. Too often, we get our paychecks and we spend whatever we have in our checking account.

I’ve personally been manually moving money whenever I get paid to different “buckets” or “categories” that I like to save and budget for. Imagine getting paid $1000 and having it moved automatically for you - 10% into savings, 40% for bills, 30% for “fun”, and 20% for a car-fund for example - that would be the dream!

For now that’s a manual process that I like to do on my own, and I encourage you to set up your own buckets and move money into them whenever you get paid. Let’s get straight into today’s article. Enjoy!

— Humphrey

Budgeting to Balance Your Month

Picture this: You get paid a couple of times per month; bills are paid, nights out are had, and money is thrown around every which way. At the end of the month, you’re in the same spot you were in when it started. Where’d it all go? If this sounds like you and you feel stuck in this never-ending cycle, read on. Budgeting can be tricky; figuring out where to begin can be challenging. We’re going to give you a comprehensive guide to the top budgeting methods so you can learn to manage your money and build financial stability effectively.

Where to Start

Budgeting involves planning goals, tracking your month, and assessing/re-adjusting as needed. To set the stage, you must first know how much you bring in each month (your take-home pay after taxes). If your income varies, it could help to take a look at your past few months and take a conservative average.

It’s also essential to get a realistic idea of how much you’re spending and what you’re spending it on. There are tons of budgeting apps to help you get started in tracking, but even creating a spreadsheet or using traditional pen and paper can work just fine. It doesn’t matter what you use as long as you get an accurate picture of your typical monthly spending habits.

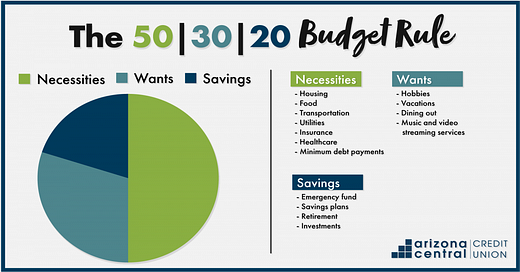

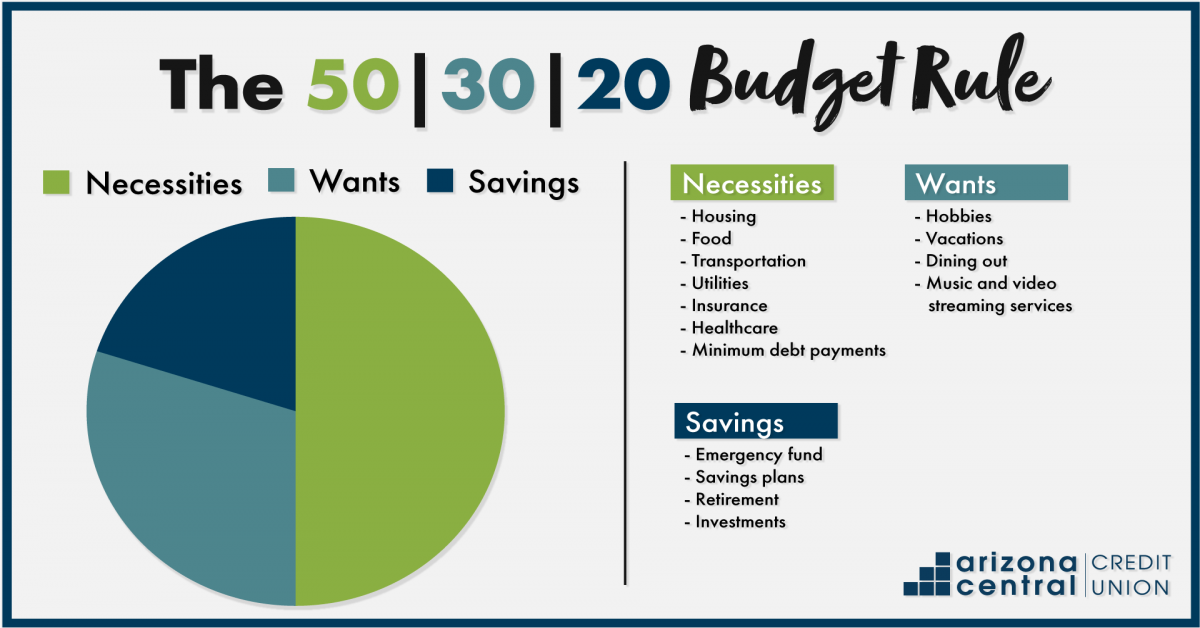

The 50/30/20 Rule

This simple yet effective budget incorporates your needs to live, wants, and savings. It outlines:

50% of your take-home pay should go to needs.

Needs are anything you need to survive, like housing, utility bills, groceries, minimum loan payments, insurance, child care, etc. You need to pay these expenses each month, no matter what.

30% should go to discretionary spending, or wants.

It can be tough to differentiate wants and needs. Wants are those ‘extras’ that you don’t need to live, but they’re nice to have. This includes subscriptions (looking at you, Netflix), traveling, meals out, etc.

20% is for saving and paying off debt.

This is what you squirrel away for the future. This can be anything you put into a traditional savings account, investments, retirement, etc.

This is also where you’d pay down high-interest debts, like credit cards. The more you can pay down your debt, the more you can save or allocate to other categories like your wants or needs.

Here’s an example of how you’d use the 50/30/20 budget if your monthly take-home pay were $5,000.

Note: As a general rule following this method, your needs shouldn’t exceed 50% of your income in order for you to live comfortably. However, the 50/30/20 budget is just a guideline. So, for example, if your needs category falls short of 50%, it could be okay to allocate more to the other categories if desired. You could take that extra money and put it into savings or debt repayment, or maybe spend a little more on ‘wants.’ If your needs are more than 50%, your method could look more like 60/20/20, for example. The key is to be aware of your spending habits to stay within the parameters and not overspend. No two situations will be exactly the same, so adjust as needed. 50/30/20 is a great foundational concept that can be used in tandem with other budgeting methods.

The Envelope Method: Cash Is King!

Often, we swipe a debit or credit card to buy something we don’t need without thinking about it twice (it’s just a piece of plastic, right?). Also known as ‘cash stuffing,’ the envelope method is an excellent way to minimize extra spending. With the traditional envelope method, you give yourself a set amount of money to spend on categories (groceries, eating out, pet care, to name a few) and literally stuff envelopes with the cash you plan on spending for that category. That envelope is your fund for the month for that category. When it runs out, you either have to take from another category, or you’re done spending in that category for the month. This method can help you to stop overspending, but you don’t have to keep track of every single purchase. Having the cash-in-hand will help you think before buying something you may not really need, and having set cash in categories keeps you on track and within your monthly budget.

Here’s an example of using the envelope method on a $5,000/month budget:

If we incorporate the 50/30/20 rule, this is how we’d break down the envelopes by category:

$2,500 for ‘needs’ envelopes.

$1,500 for ‘wants’ envelopes.

$1,000 for ‘saving’ envelopes.

Let’s say you have a ‘wants’ envelope designated for coffee. You give yourself $40 per month in the envelope. When you get a $5 coffee, you take it out of that envelope and are left with $35 for the month. You’ll do this for every spending category for the month. The next time you get paid or at the beginning of the next month, you’ll fill your envelopes again: rinse and repeat.

Pros

You become very aware of how much you’re spending and how much you have left.

Cash is tangible, so you’ll feel more connected with the money. This can help you make better spending choices (as opposed to swiping a plastic card).

You won’t risk overdraft fees or going into more debt with cash in hand. This can help curb overspending and promote mindfulness.

Cons

You’ll make monthly (or more) trips to the ATM to take cash out, which can take time and effort.

Saving physical cash isn’t the best way to grow your wealth and risks being stolen; try putting your savings allotment into a high-yield savings account, retirement account, etc. to maximize saving.

If you try cash stuffing, it’s important to understand how much you take home per month, what your expenses are, and to stuff accordingly. This method can be great for someone who spends impulsively or a newbie to budgeting. The main idea of this method is to be more mindful of your money so that you’re less likely to make purchases that you can’t afford/don’t need.

Pay-Yourself-First

Also known as reverse budgeting, this concept is where you put saving and debt repayment at the forefront of your budget. Instead of first allocating your paycheck to your living expenses, you ‘pay yourself’ by putting money toward saving first. Of course, the idea isn’t to ‘pay yourself’ so much that you can’t afford your living expenses like housing, insurance, and utilities, but it’s a reverse way of budgeting in which you can make sure that you’re growing savings.

This is how the pay-yourself-first model works:

This budget, like any other, requires planning. Be conservative at first! You can always adjust the amount later. Set a low saving budget to start. This will make sure that you can afford your living expenses.

How much do you pay yourself? Well, you can look back at the trusty 50/30/20 rule for guidance. Aim to save 20% of your budget right from the start to ensure that you’re setting aside a reasonable amount for debt repayment and your long-term goals.

You also need to know your savings goals. Having an emergency fund should be a priority, as well as retirement (like a 401k, Roth IRA, etc.). If you already have these funds established, think about your other long-term goals, like saving for a house. Chip away at these goals little by little to make some great progress. Staying consistent month over month and year over year is key.

Keep reading with a 7-day free trial

Subscribe to Hump 🐪 Days to keep reading this post and get 7 days of free access to the full post archives.