🏦🔜 The Fed Gives Us the Guidance We Need

Welcome to the Sunday Primer,

Hope you are having a good weekend. The market has been a rollercoaster as of late following Fed Chairman Jerome Powell’s comments about moderating the pace of rate increases. We just made a video explaining the Fed’s new stance going into 2023 on the YouTube channel. Give it a watch and be sure to leave a comment with your thoughts!

- Humphrey, Rickie & Tim

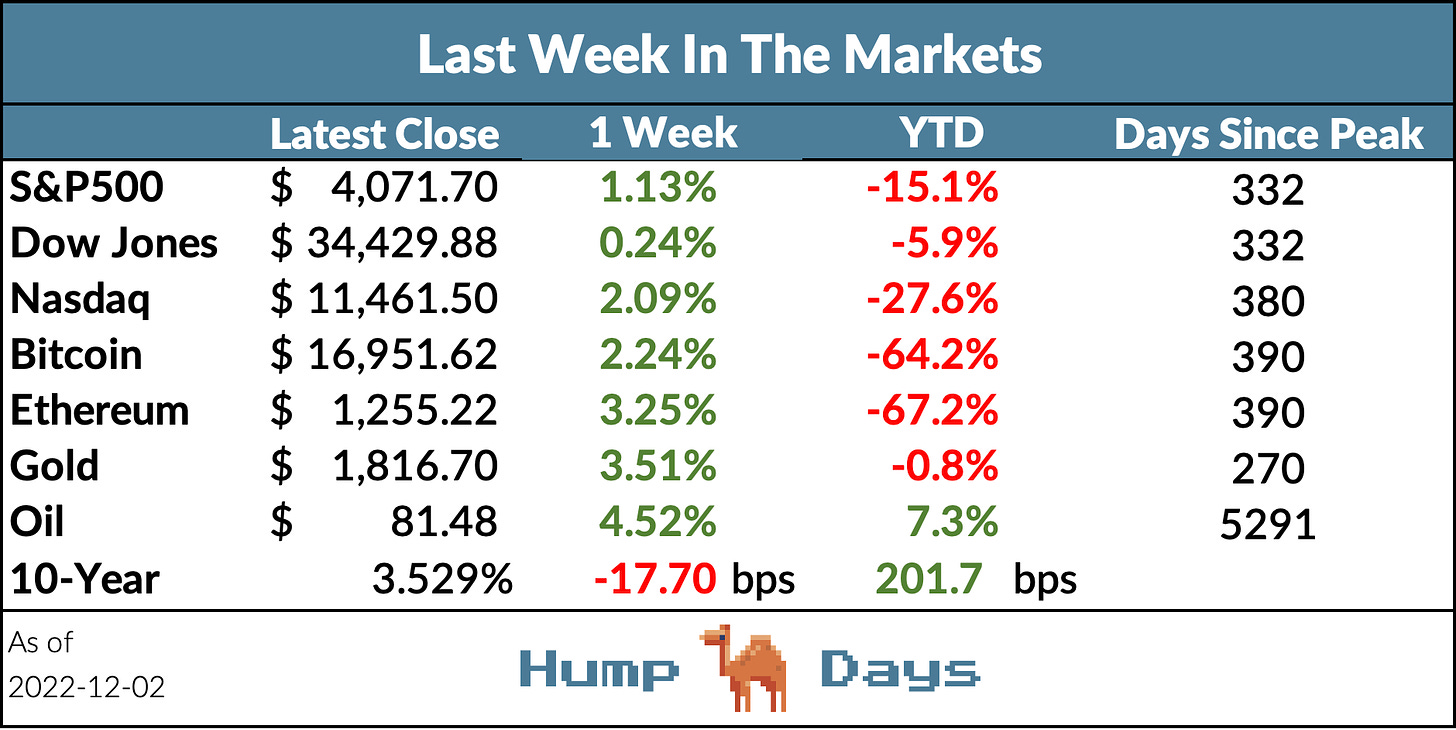

Market Report

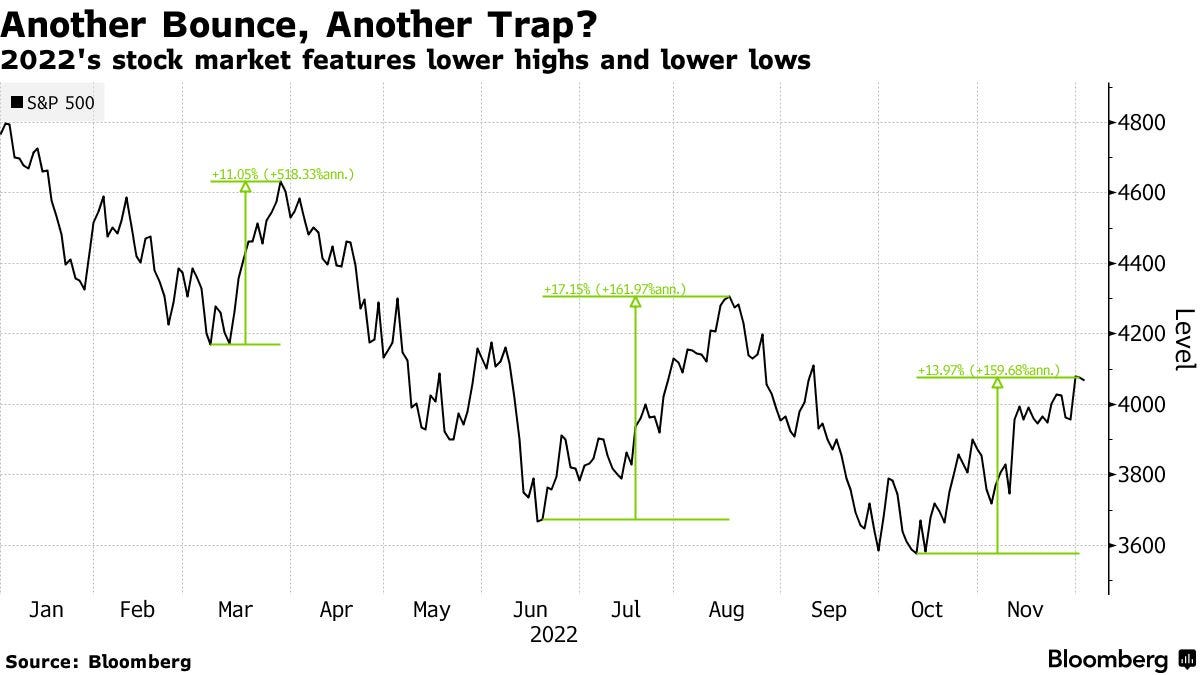

Jerome Powell spoke on Wednesday about possibly downshifting the pace of tightening at next month’s meeting. As a result, the market rallied. Here are some of his comments that caught our eye.

“The time for moderating the pace of rate increases may come as soon as the December meeting.”

“Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

“It will take substantially more evidence to give comfort that inflation is actually declining. The truth is that the path ahead for inflation remains highly uncertain. Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.”

In other news, two of the most prominent players in the real estate industry, Blackstone and Wells Fargo, took action this week to contend with weak housing demand. Blackstone announced that its $69 billion Real Estate trust would be limiting withdrawals and Wells Fargo (the biggest home loan originator) announced that it would be firing hundreds of mortgage employees.

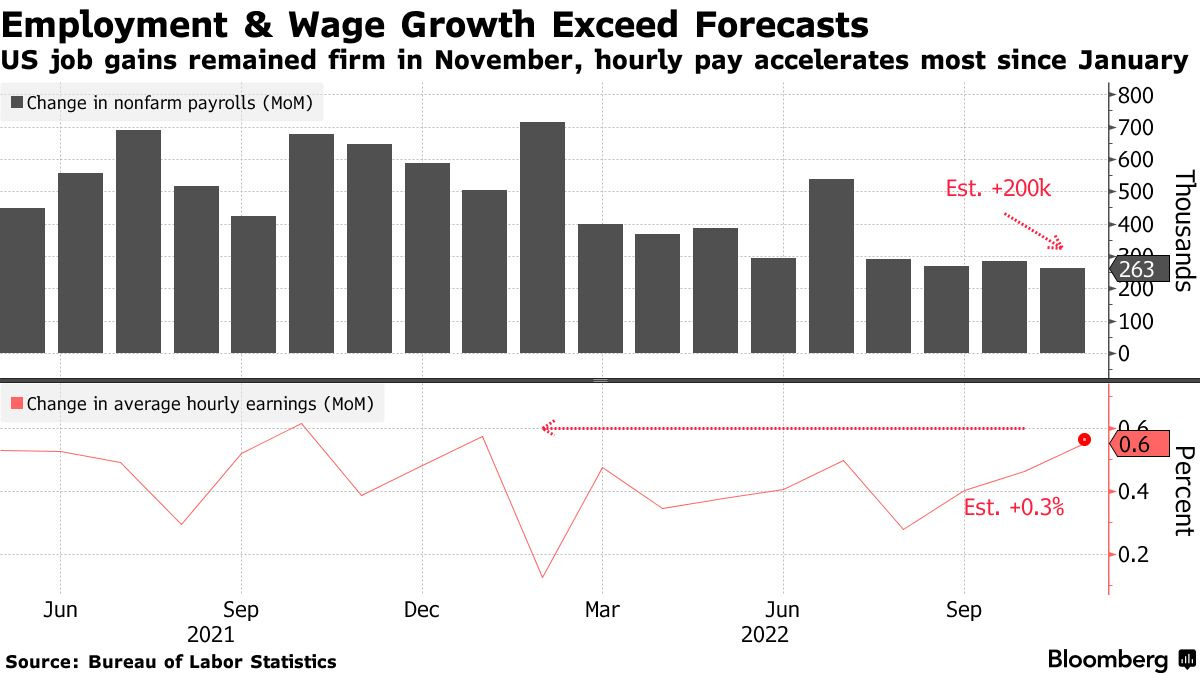

U.S. employers added more jobs in November than expected and wages surged by the most in nearly a year, which boosted the chances of higher interest rates from the Federal Reserve. Job gains were mainly in leisure and hospitality, healthcare, and government. Meanwhile, employers in retail, transportation, and warehousing cut staff. According to Bloomberg’s economists, “Given the slow adjustment in the labor market, Fed officials will likely have to raise their terminal-rate forecast”.

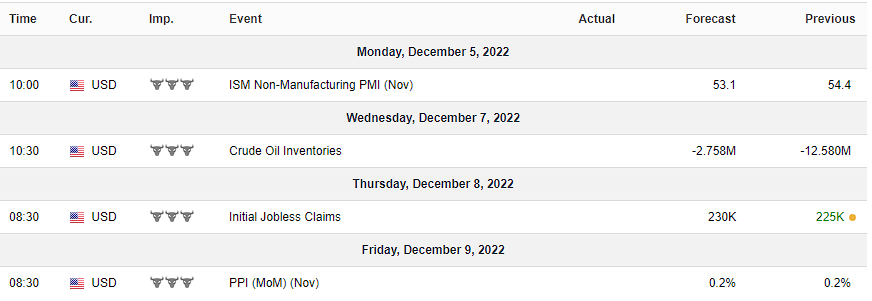

Forecast Ahead

Corporate Earnings (Throughout Week)

Tuesday, December 6th - AutoZone (AZO), Toll Brothers (TOL)

Wednesday, December 7th - Campbell Soup Company (CPB), Gamestop (GME)

Thursday, December 8th - Costco (COST), Oracle (ORCL), Broadcom (AVGO), Lululemon (LULU), Chewy (CHW), DocuSign (DOCU)

Runoff Election in Georgia’s Senate Race

Nearly a month after the midterm elections, Georgia voters will decide between Democrat Raphael Warnock and Republican Herschel Walker in Georgia’s Senate runoff on Tuesday. The results will either bolster the narrow Democratic majority in the Senate or keep it at a 50-50 tie.

What We Read Last Week

11 Hours With Sam Bankman-Fried: Inside the Bahamian Penthouse After FTX’s Fall (Bloomberg)

The Great Purpling (Business Insider)

Twitter's clumsy handling of the Hunter Biden laptop story spurred enough bipartisan criticism to risk the existence of the internet as we know it (Business Insider)

The Passion of Cathie Wood: Why the ‘Wackiest Portfolio Manager on Earth’ Isn’t Losing Faith (The Information)