Happy Sunday,

What’s up guys. Rickie checking in with you today. One story that caught my eye this edition was the story about the job market for gen-z. I graduated college a couple of years ago, and at the time, I didn’t realize how much of an advantage i

t was to be a student when the economy was booming. In general, you get better internships, there is less stress about finding a job after graduating, and companies that you interned at are more likely to bring you on full-time. This was quite the phenomenon even toward the end of my degree, where I’d hear about how people wanted to pursue more school just to not have to graduate in the current job market. Crazy stuff (to me at least).

It’s really interesting to see that kind of data visualized. For those currently in the job market, is this something you’re noticing? I’m quite a bit removed now from what corporate recruiting is like.

- Humphrey, Tim & Rickie

Market Report

The Elusive Recession That Has Yet to Come

Despite predictions of an impending recession, the U.S. economy continues to expand, driven by steady hiring and consumer spending. Employers have added 2.75 million jobs in the past year, with the unemployment rate hovering around 4%.

Though job vacancies and hiring rates have decreased, the labor market remains resilient. The Federal Reserve's interest rate hikes have tempered inflation without causing significant layoffs.

However, potential challenges loom.

Higher interest rates could eventually pressure businesses to cut jobs if profits decline.

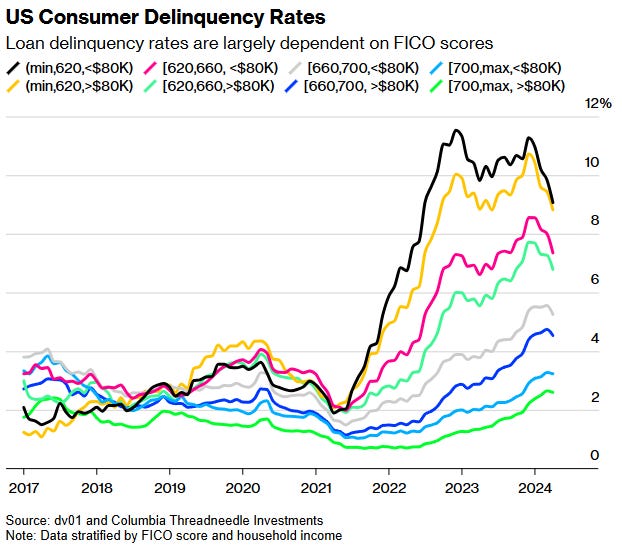

Rising credit-card debt and delinquencies indicate strain on lower-income consumers, while sectors like commercial real estate and retail face difficulties.

Promotions Are Hard to Come By + Less Job Openings for Gen Z

The labor market has seen a notable slowdown in both job quitting and promotions, leaving fewer opportunities for new and entry-level workers.

The annual rate of promotion into management has declined across generations, with only 2.1% of Gen Z workers promoted in 2023, down from 2.5% in 2021.

The lack of new team formations and reduced hiring needs have contributed to this trend, with employers less desperate for workers compared to the labor supply crunch during the pandemic.

This slowdown has been particularly painful for workers who saw rapid promotions in previous years, creating a more challenging environment for career advancement and new job seekers.

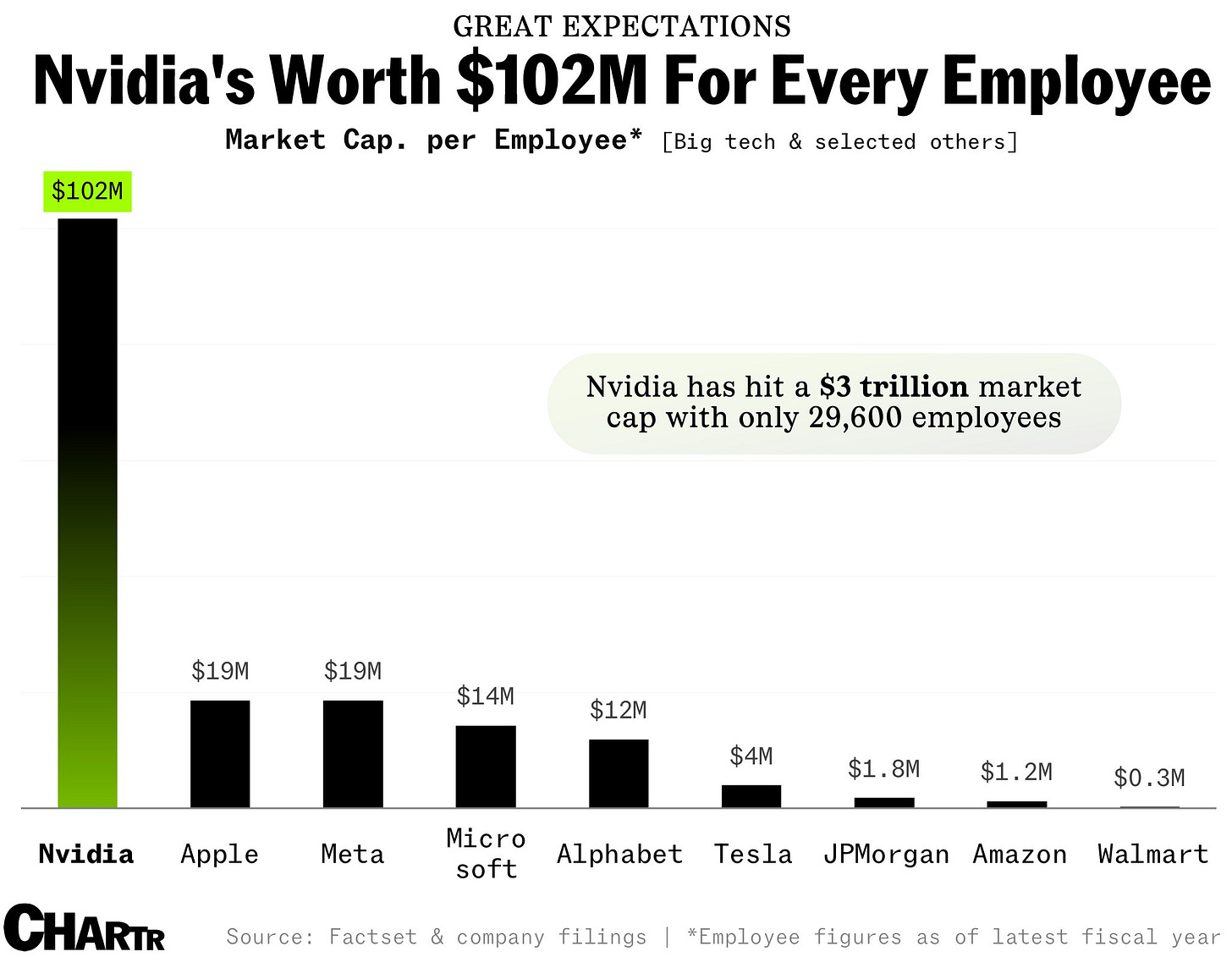

Big Tech Is Driving the S&P Rally But The Others Have to Step Up

As Big Tech's profit growth is projected to slow for the remainder of 2024, broader market participation will be necessary for the market to continue rising.

Sectors such as materials, health care, energy, consumer discretionary, industrials, and financials are expected to see significant profit growth.

This shift is already in progress, with substantial outflows from tech stocks by BofA clients and increased investments in consumer discretionary.

Forecast Ahead

The Federal Reserve is expected to maintain steady interest rates for the seventh consecutive meeting this Wednesday. After raising rates significantly since March 2022, the Fed has kept them at a two-decade high since July.

Despite persistent inflation and solid growth outlooks, Fed leaders see no urgency to cut rates.

Bloomberg predicts the new dot plot will indicate fewer cuts than previously projected, with Powell likely sounding dovish. Inflation was 2.7% in April, above the Fed's 2% target, and recent strong payroll data has reduced expectations for near-term rate cuts.

Great post. Love the infographics, and all of the topics. Ha, and of course, always enjoy the Memes of the Week.