🏈 Super Bowl Sunday Edition! Jobs & Earnings Highlights

Happy Super Bowl Sunday,

I’m not rooting for any team in particular today, but it would be nice to not see the Chiefs win again this year! No matter what you’re up to today or what team you’re rooting for, I hope you enjoy it.

My week has been pretty uneventful, I did go to a Pokemon Card show yesterday in Burlingame (which is near where I live) and got to gawk at a bunch of cool cards although I did not buy any.

More videos to come this week on both short and long form, and we should have another video where I review my subscribers’ portfolios coming out in a week or two!

Have a great week,

- Humphrey & Rickie

Market Report

US Job Growth and Rising Inflation Views Should Keep Rates Steady

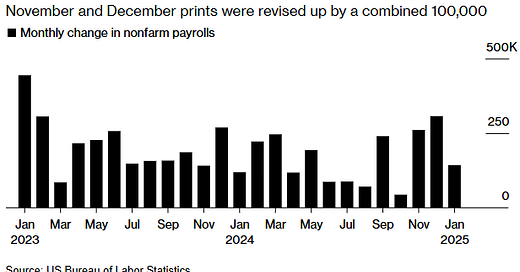

The January jobs report showed a moderating but still healthy labor market, with nonfarm payrolls increasing by 143,000 jobs last month, slightly below expectations but with upward revisions to the previous two months totaling 100,000 jobs.

The unemployment rate moved down to 4.0%, and while annual revisions showed job gains in 2024 were softer than initially reported (averaging 166,000 per month rather than 186,000), they remained solid overall.

The employment landscape showed particular strength in healthcare, retail trade, and government sectors, though some industries like mining, temporary help services, and auto manufacturing experienced declines.

Notably, weather conditions impacted work patterns, with nearly 600,000 people unable to work due to bad weather - the highest number in four years.

These labor market developments are occurring against a backdrop of rising inflation expectations and potential policy shifts that could impact economic conditions.

The University of Michigan's consumer sentiment survey showed increased inflation expectations across all political affiliations, dropping to a seven-month low in early February.

This combination of steady job growth and heightened inflation concerns appears to support the Federal Reserve's current stance of maintaining interest rates at their present levels, especially after implementing a full percentage point of rate cuts last year.

Amazon Echoes Microsoft, Says It Can’t Keep Up With AI Demand

Amazon's fourth-quarter results showed both strengths and challenges, particularly in its crucial cloud computing division, Amazon Web Services (AWS).

Despite AWS maintaining a steady 19% revenue growth to $28.8 billion for the third consecutive quarter, CEO Andy Jassy highlighted significant capacity constraints that could limit the company's ability to meet the surging demand for AI services.

These limitations stem from challenges in securing adequate hardware, electricity, and chips - both from third-party suppliers and Amazon's own design unit.

To address these constraints and maintain its competitive edge in cloud computing, Amazon is planning a massive $100 billion investment in 2025, with a substantial portion dedicated to data centers, homegrown chips, and AI-related infrastructure.

Turning to e-commerce, Amazon showed resilience despite growing competition from Walmart and newcomers like Temu and Shein. The company reported total revenue growth of 10% to $187.8 billion in the holiday quarter, slightly exceeding analyst expectations, with operating profit reaching $21.2 billion.

Disney Beats Earnings Expectations on Streaming and Moana 2

Disney reported strong fiscal first-quarter results that exceeded analysts' expectations, with earnings of $1.76 per share against the $1.42 estimate, and revenue growing 5% to $24.7 billion.

The success was primarily driven by their streaming services and the blockbuster film Moana 2, which generated $1.04 billion in global box-office sales.

The streaming division achieved profitability for the third consecutive quarter, benefiting from price increases of up to 25% for Disney+ and Hulu, along with measures like introducing an ad-supported tier and addressing password sharing. Despite losing some subscribers, Disney+ maintained 124.6 million accounts, surpassing analyst predictions of 119 million.

While the streaming and film studio divisions showed marked improvement, turning a previous loss into a $312 million profit, other areas faced challenges. The theme parks and experiences division's operating income remained relatively flat at $3.11 billion, impacted by hurricanes Milton and Helene and expenses related to the new Disney Treasure cruise ship launch.

The traditional TV networks experienced declining profits due to higher programming costs and reduced entertainment channel subscriptions.

Looking forward, Disney maintains its forecast for high-single-digit earnings growth in fiscal 2025, with plans to repurchase $3 billion in shares and find a successor to CEO Bob Iger before his contract ends in December 2026.

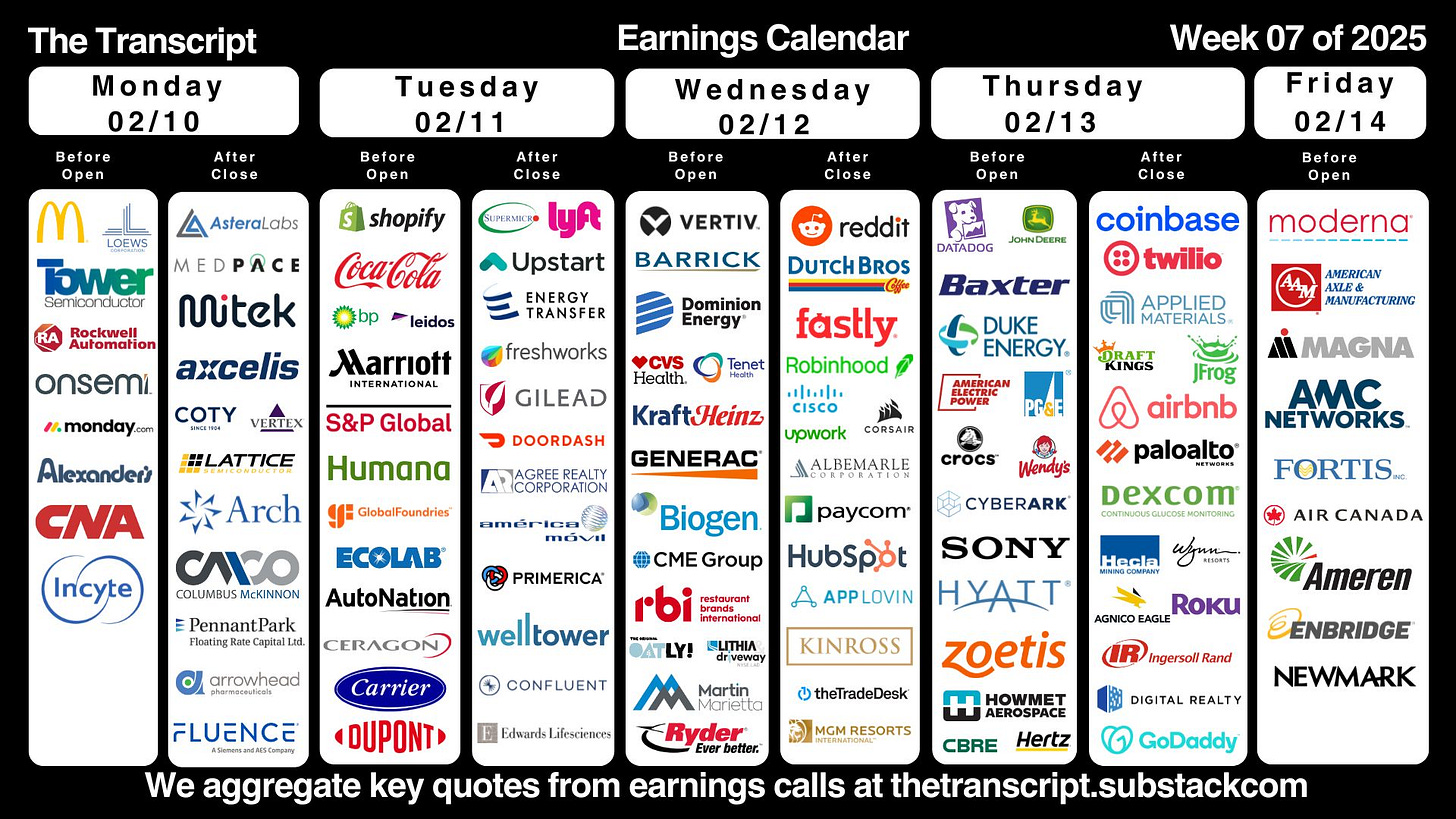

Forecast Ahead

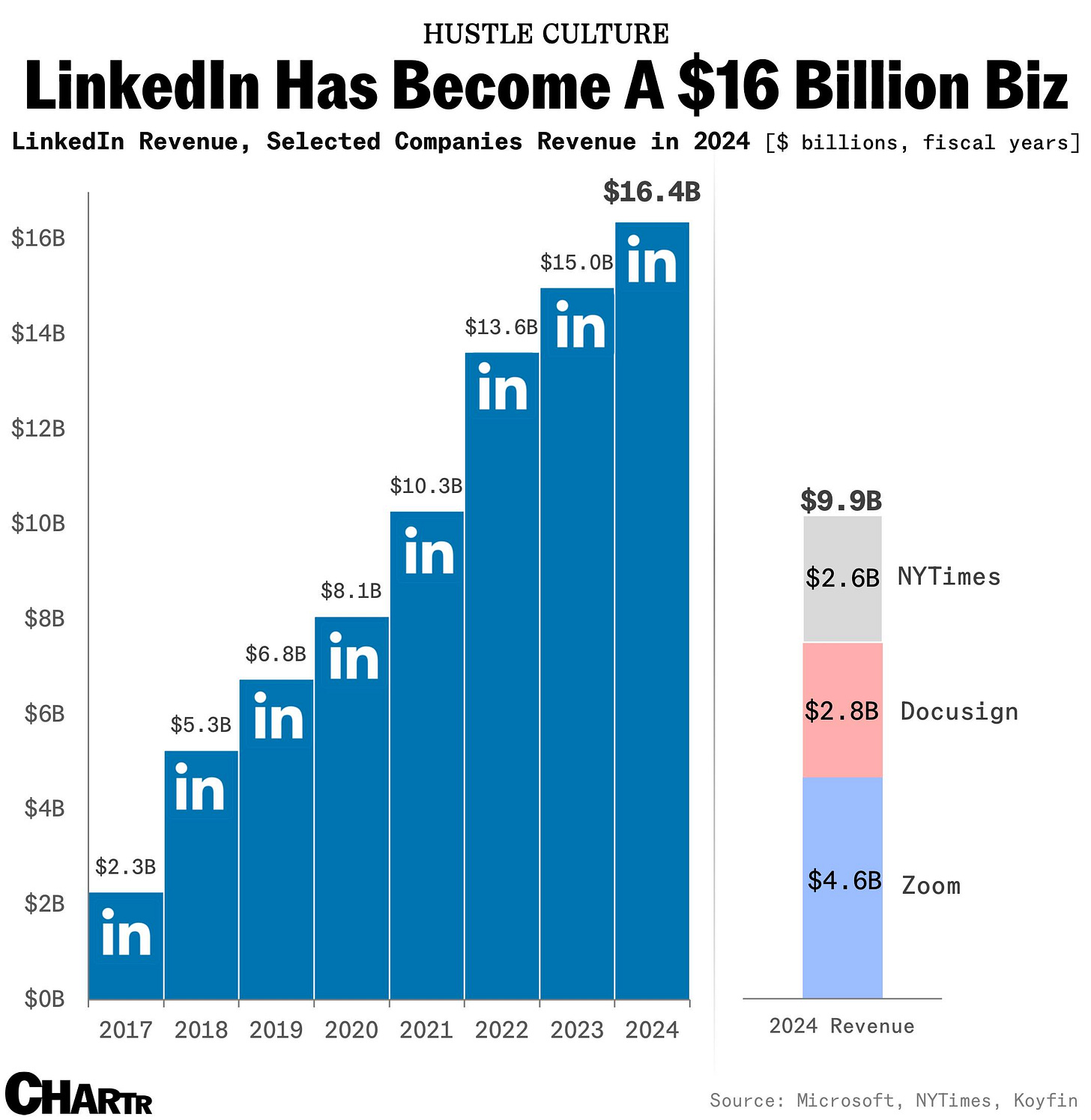

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.