🔥📈 Stocks and Crypto on Fire, Retail Sales Up

Happy Sunday,

If you received a prior email with no subject, or a Sunday Template subject line - apologies - it looks like our subject line did not update before hitting send.

I recently got back from Dubai last week and while I was there I went go on a falconry tour in the desert. As part of that tour, I got to ride a camel! And what better way to share it than with you guys. Camels are incredibly friendly, and they don’t bite (because they’re herbivores). I can’t think of a better mascot for our newsletter!

We have a brief Sunday report for you today and I hope you enjoy!

- Humphrey

Market Report

Investors Race to Stocks At a Pace Unseen Since 2008

Since Donald Trump’s election victory, the US stock market saw a significant rally, with the S&P 500 surpassing 6000 for the first time.

Investors are showing increased optimism, pouring nearly $56 billion into US equity funds in a single week - the second-largest weekly inflow on record.

The bullish sentiment has largely been driven by expectations of lower taxes, fewer regulations, and potential boosts to US manufacturing under Trump's second term.

The market enthusiasm has extended to various sectors, including technology stocks, small-cap companies, and even cryptocurrencies, with Bitcoin reaching over $90,000.

However, some analysts caution that investors may be overlooking potential risks, such as increased inflation and market volatility.

The stock market's valuation is considered high, with the S&P 500 trading at 22 times expected earnings, above its five-year average.

Additionally, bond markets are signaling concerns about larger deficits and higher inflation, with the 10-year Treasury yield rising.

US Producer Prices Rise, Risking Inflation Pressure

US Retail Sales Increase on Autos in Start to Holiday Season

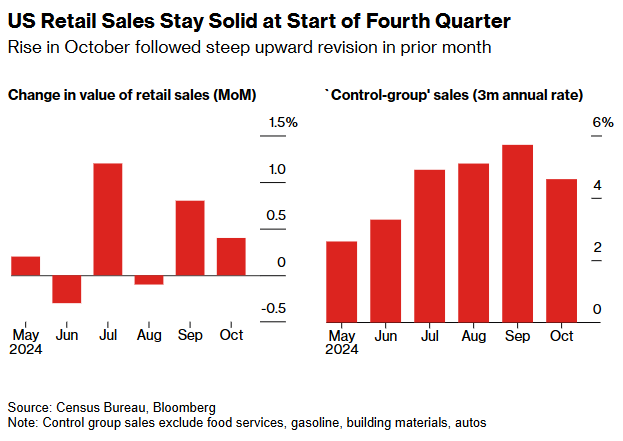

US retail sales showed moderate growth in October, increasing by 0.4% after an upwardly revised 0.8% gain in September. The rise was primarily driven by a jump in auto purchases, while other categories showed mixed results.

Eight out of 13 retail categories saw increases, with electronics and appliance stores leading the way.

However, the control group sales, which are used to calculate GDP, decreased by 0.1% in October, indicating a potential slowdown in consumer spending.

Despite the mixed data, the upward revisions to previous months suggest that consumers entered the final quarter of the year on a stronger footing than initially thought.

MicroStrategy’s $26 Billion Bitcoin Cache Is Larger Than IBM, Nike Cash Holdings

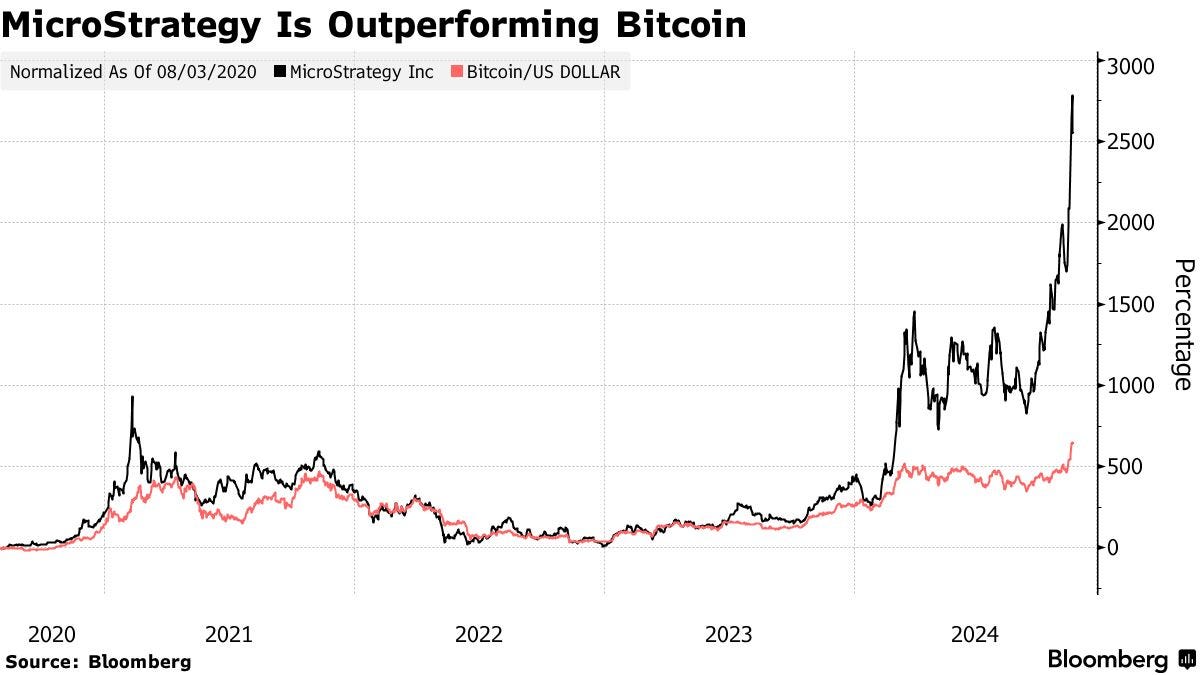

MicroStrategy, under the leadership of Michael Saylor, has adopted an unconventional strategy of holding Bitcoin instead of cash as its primary treasury reserve asset.

This approach has propelled the company into the ranks of the wealthiest corporations in terms of financial assets, with its Bitcoin holdings valued at approximately $26 billion.

This surpasses the cash and marketable securities of major companies like IBM, Nike, and Johnson & Johnson.

MicroStrategy's Bitcoin investment, which began in 2020 as a hedge against inflation, has resulted in a surge of over 2,500% in the company's stock.

MicroStrategy has continued to accumulate Bitcoin through various funding methods, including operational cash, stock issuance, and convertible debt sales.

Despite the volatility associated with cryptocurrency, MicroStrategy plans to raise an additional $42 billion over the next three years to further expand its Bitcoin holdings.