📈🇺🇸 Stock Optimism Surging in America!

Happy Wednesday all,

Rickie and I are currently at VidSummit in Dallas, Texas! It’s a YouTuber conference where a lot of the panels and events are on how to grow your YouTube channel & business. We are enjoying meeting other creators and industry professionals, and so far, the conference seems less busy than years prior. At this point in my YouTube career, there aren’t too many new insights in terms of how to grow the channel via optimizing videos. I think I have the fundamentals down of how to make great videos, but the things I need to learn instead are about building a business and brand…aka being a ‘better’ entrepreneur.

We’re currently editing the Western White House video, so expect to see that video live on the channel next week. Stocks had a turbulent day today, but expect to see a more detailed recap of the trading week this coming Sunday.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

A Third of Hedge Funds Have Not Fully Recovered From 2022’s Losses (Institutional Investor)

Harris to propose $50,000 tax deduction for small business startup expenses, ahead of Trump debate (CNBC)

Quantifying What Fed Cuts Mean for GDP and Inflation (Apollo)

How Immigration Remade the U.S. Labor Force (WSJ)

This Once Hot Real-Estate Type Is Now Being Offered as Office Space (WSJ)

High Rates Expose Global Banking’s Multi-Trillion-Dollar Weak Spot (BBG)

Retail Needs Some Therapy as Cautious Consumers Trade Down (WSJ)

The Weekly Brief

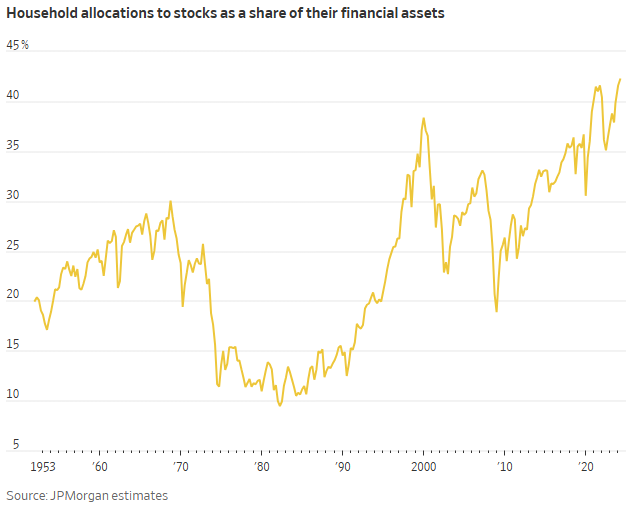

Americans Are Really, Really Bullish on Stocks

Americans are exhibiting unprecedented enthusiasm for the stock market as major indexes reach new highs in 2024.

The S&P 500 has surged ~18% this year, setting over three dozen fresh records and minting new millionaires.

U.S. households' stock allocations have reached a record 42% of their total financial assets, and the number of 401(k) accounts worth at least $1 million has increased by 31% from the previous year.

Investors remain optimistic despite some concerns about market volatility, with bullish sentiment near its highest levels of the past year.

This optimism has largely been fueled by a strong economy, expectations of interest rate cuts, and steady inflows into equity funds, particularly those tracking smaller companies.

Professional investors have also embraced the rally, with net bullish bets on S&P 500 futures at their highest level since 2020.

U.S. Manufacturing Activity Contracts for a Fifth Straight Month

U.S. manufacturing activity contracted for the fifth consecutive month in August, with the Institute for Supply Management's manufacturing gauge moving up slightly to 47.2, still below the 50-point mark indicating expansion.

The sector faced challenges including faster declines in orders and production, with new orders dropping to a 15-month low and export orders shrinking at the fastest rate since early 2024.

While employment in manufacturing improved slightly, it remained in contraction for the third month.

Elevated borrowing costs and uncertainty surrounding the upcoming presidential election are contributing factors, prompting some companies to delay capital expenditures and hiring.

Despite these headwinds, there is cautious optimism that potential interest rate cutrs by the Federal Reserve later this month could offer some relief to the struggling sector.

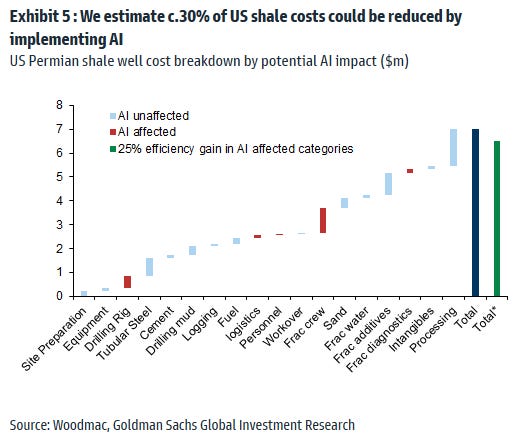

Potentially Negative Effects of AI on Oil Production Costs and Oil Prices

The team and I came across an interesting research piece this week from Goldman Sachs discussing how AI could have a major impact on oil prices. Yes, oil.

The increasing adoption of AI in the energy sector is expected to have a modest net negative impact on oil prices in the medium to long term.

According to Goldman, AI could potentially reduce oil production costs by improving logistics and resource allocation, with estimates suggesting a 30% reduction in new shale well costs and a $5 a barrel decrease in the marginal incentive price.

Additionally, AI could increase recoverable oil reserves by 8-20% through improved recovery factors.

While AI may boost oil demand slightly due to higher incomes, raising oil prices by $2 a barrel, this effect should be overshadowed by the negative price impacts of electric vehicles and lower natural gas prices.