🏦😮💨 Soft Landing Achieved?

Happy Wednesday all,

Rickie here. I’m back at home after two weeks across Germany, Austria, and Switzerland. I won’t bore you with the details but it was great to just disconnect and be in nature. Where I’m from, there aren’t many mountains to hike so to see the Swiss Alps in person was a huge treat! I’ll attach a picture below.

Humphrey’s currently at the White House right now and I’m sure he’ll have really cool updates once he’s back at his desk! We’ve got a great newsletter for you this week!

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

Why Wall Street thinks Brian Niccol is the person to revive Starbucks — and end the Howard Schultz era (CNBC)

China’s Huawei is reportedly set to release new AI chip to challenge Nvidia amid U.S. sanctions (CNBC)

Google Monopolized Search Through Illegal Deals, Judge Rules (BBG)

Goldman, JPMorgan Say Markets Pricing in Higher Recession Odds (BBG)

Mars Near $30 Billion Deal for Cheez-It and Eggo Maker Kellanova (WSJ)

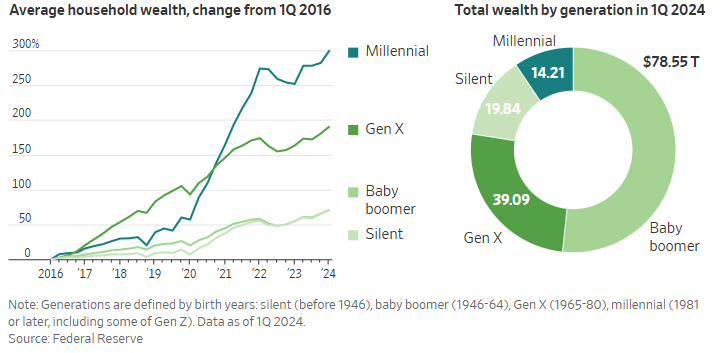

The Dramatic Turnaround in Millennials’ Finances (WSJ)

The Weekly Brief

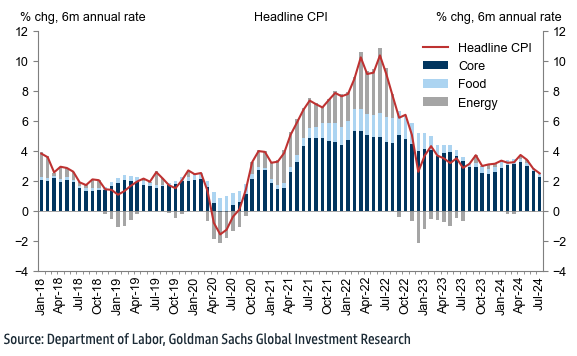

Core US Inflation Eases a Fourth Month, Sealing Odds of Fed Rate Cut

U.S. inflation rate eased for the fourth consecutive month in July, with core consumer price index (CPI), which excludes food and energy, rising 3.2% year-over-year, marking the slowest pace since early 2021.

The overall CPI increased by 2.9% annually, the smallest rise since March 2021, driven largely by shelter costs, which accounted for nearly 90% of the monthly advance.

While core inflation rose 0.2% month-over-month, the Federal Reserve is expected to lower interest rates in September, given the inflation deceleration and a softening labor market.

Despite some positive trends, such as falling prices for apparel, cars, and airfares, shelter prices remain a concern, with owners' equivalent rent and rent of primary residence both increasing.

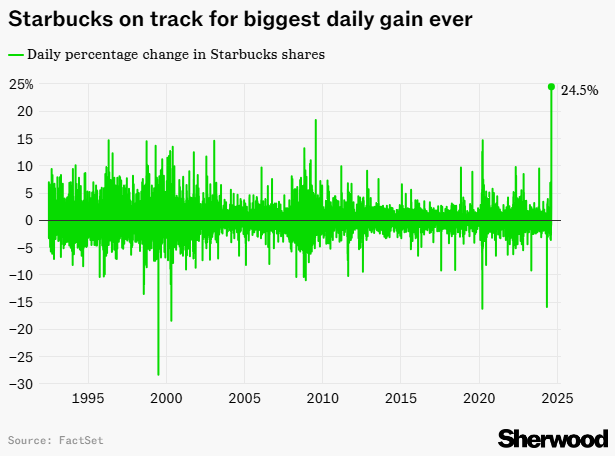

Starbucks Fires CEO and Brings in Chipotle CEO Brian Niccol!

Starbucks appointed Brian Niccol, the current CEO of Chipotle Mexican Grill, as its new CEO, following the immediate resignation of Laxman Narasimhan, who served for just over a year.

This leadership change comes amid declining sales and stock performance at Starbucks, which had seen a 20% drop in its stock value this year.

Niccol, credited with revitalizing Chipotle by doubling its revenue and significantly boosting its stock value, is expected to bring similar success to Starbucks.

The announcement led to a 24% surge in Starbucks' stock, while Chipotle's shares fell by 13%, reflecting investor uncertainty about its future leadership. Rachel Ruggeri, Starbucks' CFO, will serve as interim CEO until Niccol takes over.

US Department of Justice Considering a Breakup of Google…

The U.S. Department of Justice is considering breaking up Alphabet Inc.'s Google following a landmark court ruling that found the company monopolized the online search market.

This would be the first such move to dismantle a company for illegal monopolization since attempts to break up Microsoft two decades ago.

Potential divestments could include Google's Android operating system, Chrome web browser, and possibly its AdWords platform.

Other less severe measures being considered include forcing Google to share more data with competitors and implementing restrictions to prevent it from gaining an unfair advantage in artificial intelligence products.

How Markets Could Move After the First Fed Rate Cut

In the 13 rate-cutting cycles from April 1980 to March 2020, healthcare and consumer staples sectors have consistently outperformed in the six months following the first rate cut, likely due to these periods often coinciding with recessions.

These defensive sectors showed a hit rate greater than 62% for meeting or exceeding S&P 500 median returns.

However, during the two "soft landing" cycles of the mid-1990s, cyclical and growth sectors like communication services, financials, tech, and consumer discretionary performed better, with the S&P 500 overall showing higher average returns.

This suggests that while defensive sectors typically excel during recession-linked rate cuts, cyclical and growth sectors may thrive in softer economic transitions.