📈🗃️ Small Business Optimism Surging!

Happy Wednesday all,

From small businesses buzzing with renewed hope to repeat corporate bankruptcies raising eyebrows, this week’s news covers both ends of the economic spectrum. As optimism soars post-election, inflation remains a looming challenge—and in the corporate world, some companies are finding that one bankruptcy just isn’t enough to stay afloat.

Meanwhile, global bond yields are climbing, wildfire losses are mounting in LA, and Elon Musk finds himself once again in the SEC’s crosshairs.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

SEC sues Elon Musk, alleging failure to properly disclose Twitter ownership (CNBC)

Meta announces 5% cuts in preparation for ‘intense year’ — read the internal memo (CNBC)

South Korea’s impeached President Yoon Suk Yeol arrested, local media reports (CNBC)

Capital One Is Sued by Regulator Over the Bank’s Savings Accounts (WSJ)

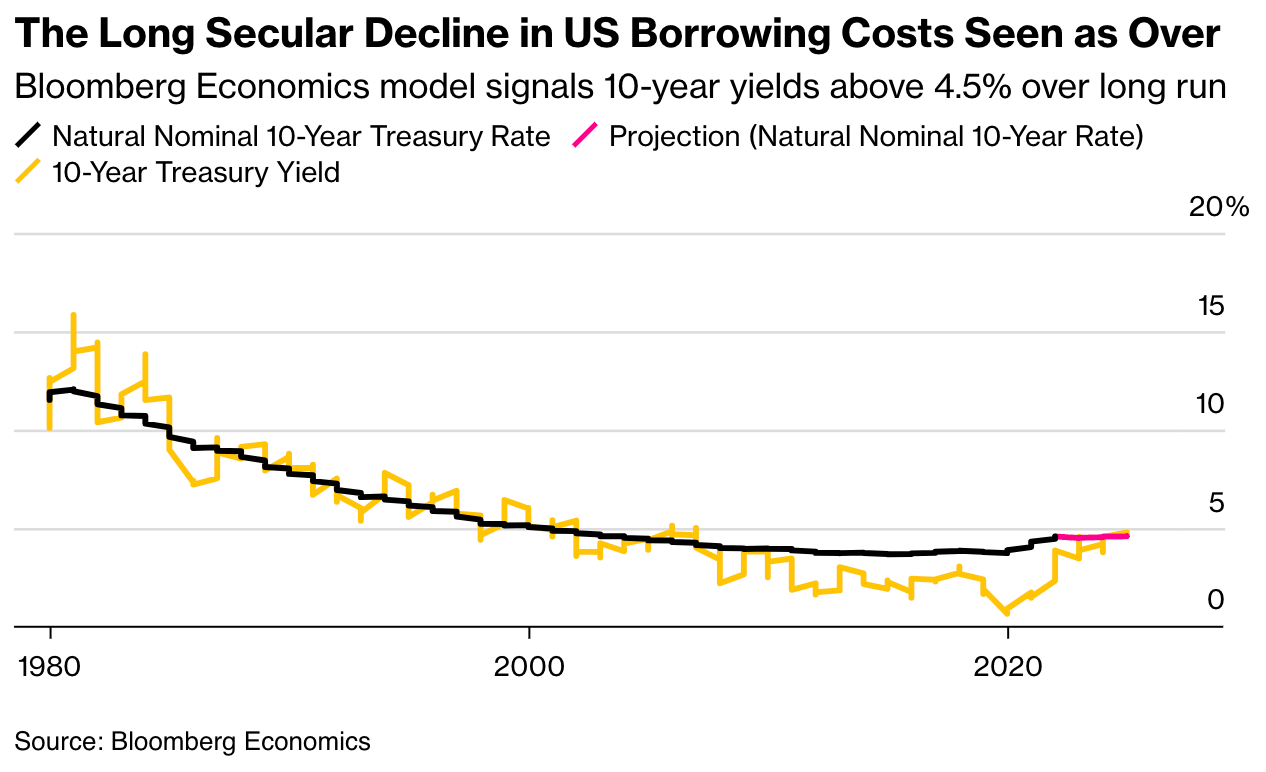

Why Bond Yields Are Surging Around the World (WSJ)

LA Wildfire Insurance-Loss Estimates Approach $40 Billion (BBG)

The Weekly Brief

US Small-Business Optimism Hits Highest Since 2018 Post Election

The National Federation of Independent Business (NFIB) optimism index for US small businesses rose to 105.1 in December last year, reaching its highest level since October 2018.

The surge was primarily driven by expectations of favorable policies under President-elect Donald Trump. The most significant gain in the survey came from the share of businesses expecting better business conditions.

While small business owners expressed optimism about the economic agenda of the new administration, they also reported improved sales expectations and a greater inclination to expand.

However, inflation remained the most pressing concern for business owners. Labor quality issues appeared to stabilize, and fewer businesses anticipated harder credit conditions in the coming months.

Repeat Corporate Bankruptcies in US Hit Fastest Pace Since 2020

The US corporate bankruptcy landscape has seen a significant uptick in recent years, with 2024 marking a 14-year high in filings. A notable trend within this surge is the rise of companies filing for bankruptcy protection multiple times in quick succession.

Over the past two years, more than 60 companies have filed for bankruptcy for a second or third time, the highest number since 2020.

This phenomenon is particularly prevalent in industries facing long-term industry challenges, such as retail, where companies like Party City and Joann Inc. have struggled to maintain profitability even after initial restructuring efforts.

While Chapter 11 bankruptcy can provide tools like debt reduction and lease renegotiation, it doesn't always address fundamental business model issues or changing market dynamics.

As a result, some companies find themselves unable to sustain profitability even after emerging from initial bankruptcy proceedings, leading to subsequent bankruptcy filings.