🏘️⛑️ Signs of Recovery in Housing Market

Happy Sunday,

This week, we’re diving into a mix of recovery, disruption, and financial strain shaping today’s markets. The US housing market is showing some life after its worst year since 1995, with existing-home sales ticking up despite high mortgage rates and rising prices. Meanwhile, a Chinese AI startup is shaking Silicon Valley, delivering cutting-edge models at a fraction of the cost, even under US export restrictions. On the flip side, American consumers are feeling the squeeze, with credit card balances hitting record highs as inflation and stagnant incomes stretch budgets thin.

Let’s unpack these stories and explore what they mean for the week ahead.

- Humphrey & Rickie

Market Report

US Existing-Home Sales Pick Up at End of Worst Year Since 1995

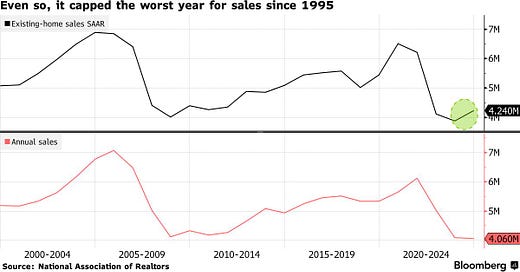

The US housing market showed signs of recovery in December 2024, with sales of previously owned homes rising for the third consecutive month to an annualized rate of 4.24 million - the highest since February.

Despite this modest momentum, 2024 was the weakest year for home sales since 1995, marking the third straight annual decline, a pattern only previously seen during major economic crises like the 2006 housing market collapse and recessions of the early 1980s and 1990s.

The market continues to face significant challenges, including high mortgage rates, elevated home prices, and low inventory. The median home sale price climbed 6% over the past 12 months to $404,400, driven by increased activity in the upper market segment.

Mortgage rates are projected to remain above 6% through at least 2027, continuing to strain potential buyers.

Chinese AI Startup Shocks Silicon Valley

DeepSeek, a Chinese AI company led by hedge fund manager Liang Wenfeng, shocked Silicon Valley, which made significant strides in AI development and challenged American rivals despite working with fewer and less advanced chips.

The company recently introduced R1, a specialized reasoning model, and its V3 flagship model has reached the top 10 in performance rankings on platforms like Chatbot Arena.

What makes DeepSeek remarkable is its ability to develop competitive AI models at a dramatically lower cost - training its latest model costs $5.6 million, compared to $100 million to $1 billion for similar models by other companies.

The company has distinguished itself through innovative approaches, such as skipping traditional model training steps and focusing on reinforcement learning.

DeepSeek is primarily research-driven, with a team composed entirely of local Chinese talent from top universities, and it has been able to maximize the potential of limited computing resources in the face of U.S. export restrictions on advanced chips.

However, there has been much speculation that DeepSeek currently has advanced Nvidia chips that it can’t disclose due to those export restrictions.

Americans Are Carrying Bigger Credit-Card Balances

Americans are increasingly relying on credit cards and struggling to pay off their balances, with revolving credit card balances reaching their highest levels since 2012, according to the Federal Reserve Bank of Philadelphia.

Major banks like JPMorgan Chase and Capital One report a growing number of consumers making only minimum payments, reflecting the cumulative effects of inflation and stagnant incomes.

Credit card rates remain around 21%, and the ease of credit access during the pandemic has led to more cards being issued to riskier consumers who are now facing significant cost-of-living challenges.

The trend highlights the financial strain many Americans are experiencing, particularly those whose incomes haven't kept pace with rising costs for essentials like rent, groceries, and insurance.

Notably, President Trump had previously suggested a temporary 10% cap on credit card rates during his campaign, though he hasn't recently promoted this idea.

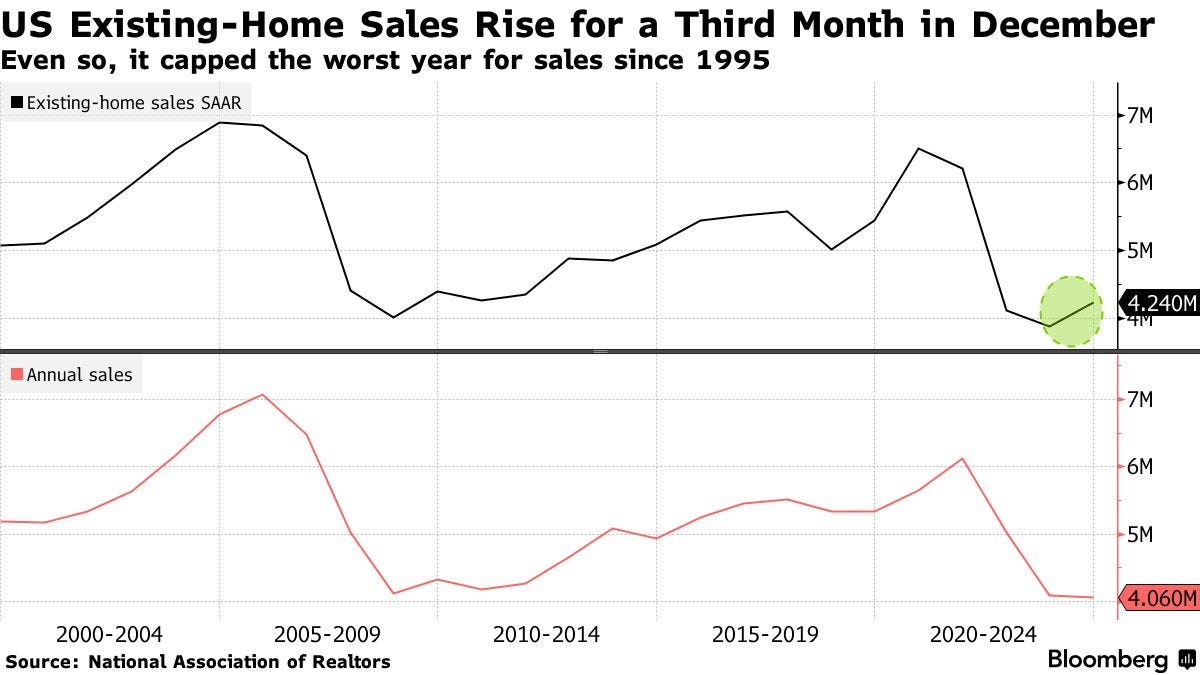

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like-minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day, you can support the channel and get access to a private community with other like-minded investors.