Happy Sunday,

If you think great earnings always lead to soaring stock prices, think again. This week’s market moves tell a more complicated story. Alphabet crushed Wall Street estimates, but investors barely blinked. Meanwhile, Chinese retailer Shein quietly jacked up US prices by up to 400%, preparing for a new trade war. And Big Tech? They’re staring down the barrel of some of the highest expectations we’ve seen all year.

There’s a lot happening beneath the surface — and the real story is only just beginning.

- Humphrey & Rickie

Market Report

Alphabet’s Earnings Beat Estimates on Google Search Ad Business

Alphabet reported strong first-quarter financial results, beating analyst expectations for both revenue and profit. Sales, excluding partner payouts, reached $76.5 billion, exceeding the $75.4 billion average estimate.

Net income came in at $2.81 per share, significantly higher than the $2.01 Wall Street projection.

Google’s strong performance was largely driven by the continued strength of the search advertising business. Despite the positive results, Alphabet's stock, while seeing a brief gain, remained down roughly 13% for the year, reflecting the company's need to demonstrate sustained momentum amidst heavy investment in AI and increased competition.

Google Cloud generated $2.18 billion in operating profit, beating estimates and indicating improved profitability even as sales growth slowed slightly.

This unit is benefiting from the AI boom as startups increase their demand for computing power, though Google Cloud still trails competitors like Amazon and Microsoft.

Search advertising remained the core revenue engine, bringing in $50.7 billion, slightly above projections, with notable traction in sectors like insurance, retail, health care, and travel.

YouTube generated $8.92 billion in revenue, just shy of estimates, but showed growth in subscriptions and its podcasting platform.

Alongside these results, Alphabet announced a $70 billion share buyback and increased its dividend by 5% to 21 cents per share.

A significant factor contributing to the high net income was an $8 billion unrealized gain from Alphabet's investment in a private company, identified as Elon Musk's SpaceX.

Google has been an investor in SpaceX since at least 2015. This gain boosted Alphabet's net income for the quarter ending in March to $34.5 billion.

Shein Hikes US Prices as Much as ~400% Ahead of Tariff Increases

Chinese fast-fashion retailer Shein significantly increased the US prices of many products on Friday, April 25th, in anticipation of upcoming tariffs on small parcels imported from China and Hong Kong.

These tariffs stem from the US government's decision to end the "de minimis" rule, which previously allowed packages valued under $800 to enter duty-free, and to impose substantial per-item fees starting in May.

The price hikes varied considerably across categories, with Bloomberg data showing average increases of 51% for top beauty and health items, over 30% for home/kitchen and toys, and 8% for women's clothing, indicating an effort to pass these new costs onto American consumers.

This move follows earlier strategies by Shein and competitor Temu to mitigate tariff impacts, such as incentivizing suppliers to move production or shipping goods in bulk to US warehouses.

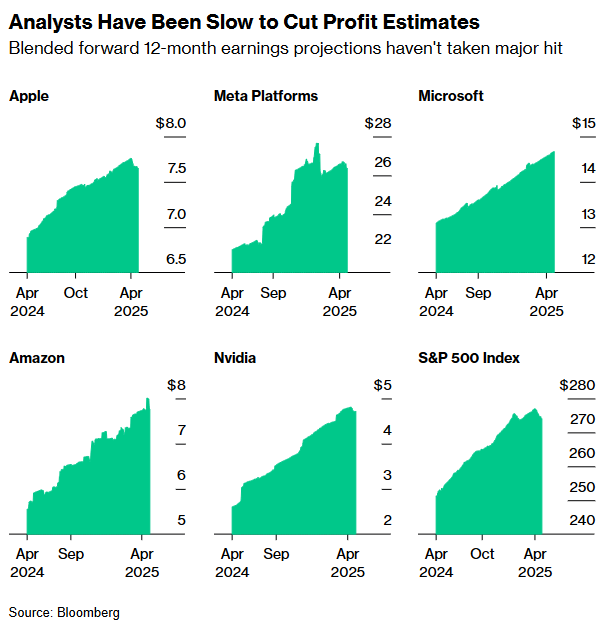

Big Tech’s Earnings Face High Wall Street Estimates

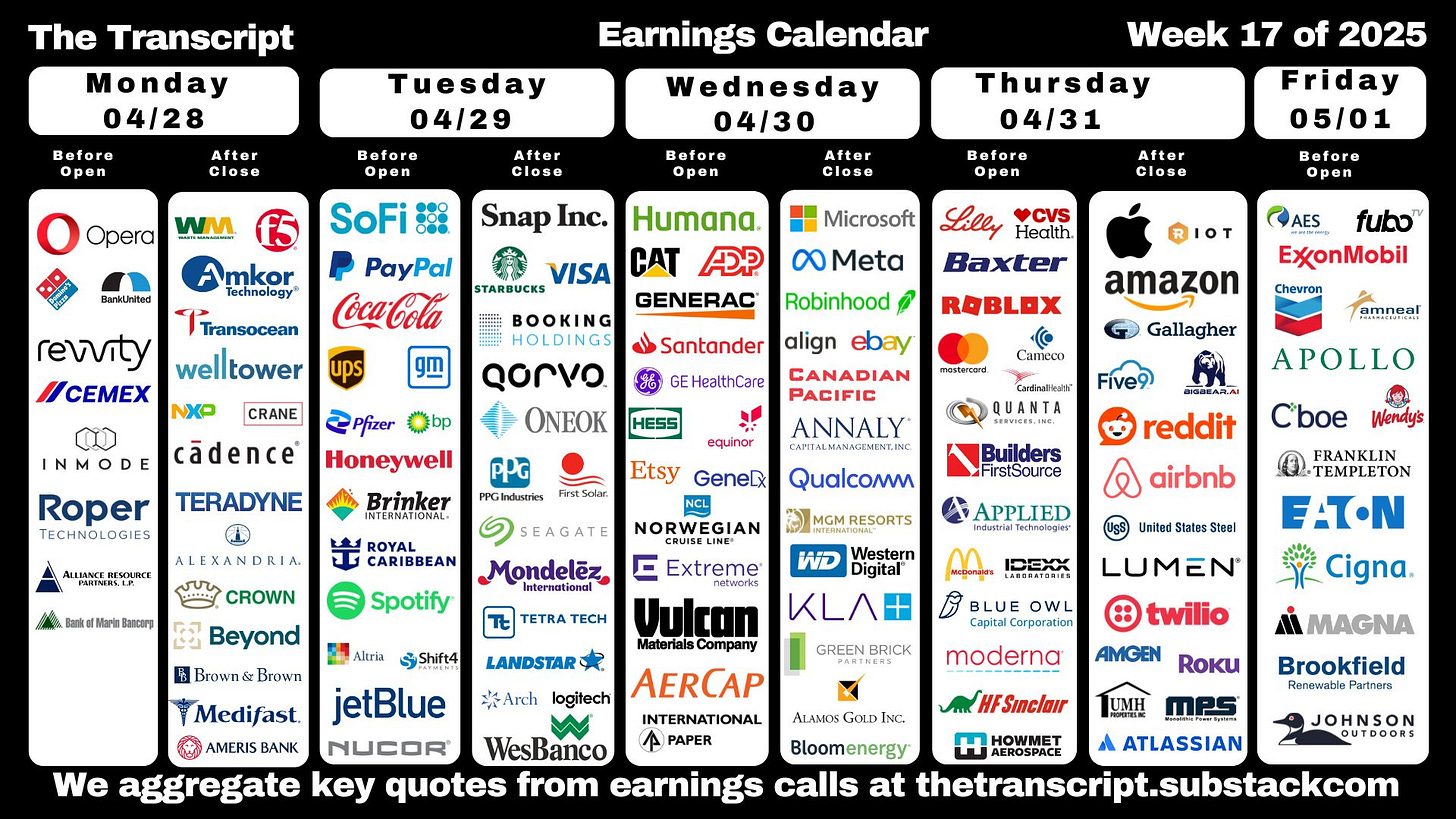

Big Tech companies like Microsoft, Apple, Meta, and Amazon are set to report quarterly earnings this week amidst a drastically changed market environment compared to just three months prior.

Concerns about AI profitability have been replaced by anxiety over trade policy impacts, pushing investors towards safer assets. Despite the heightened uncertainty and market downturn, Wall Street analysts have maintained relatively high expectations, forecasting an average of 15% profit growth for the "Magnificent Seven" tech giants in 2025.

This sets a high bar for the upcoming reports, as any earnings misses or weak outlooks could worsen the market selloff, particularly if they suggest companies are pulling back on spending. Recent reports from Tesla (poor results) and Alphabet (beat expectations but offered little guidance) provided a mixed preview.

Key areas of focus for investors will be the impact of tariffs on profit margins – potentially turning expected S&P 500 profit growth into a contraction – and the status of massive capital expenditure plans, especially after Microsoft paused some data center projects.