📈😂 Senators Strike Deal To Ban Stock Trading By Congress Members (Finally...)

Happy Wednesday all,

I saw this on my Twitter timeline today and said to myself, well it’s about damn time. It never made sense that Congress had the ability to trade publicly available stocks, so I hope that this actually goes through. Creates the wrong incentives for politicians if they’re able to personally benefit from private/government information.

In personal news, I’ve been struggling with making short-form content lately. I’m just not sure what you all want to see on there. Sometimes I make IRL fun explainers, but they don’t seem to be aligned with the same mission that the content on YouTube reflects. I’ll think a bit more deeply about it these coming weeks and try to come up with a better plan!

On the main YouTube channel we published the third edition of my Portfolio Review series, I hope you check it out (will be linked at the end of the newsletter).

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

🛍️ Shoppers Have Fewer Choices. Brands and Retailers Like It That Way. (WSJ)

📈 Senators strike bipartisan deal for a ban on stock trading by members of Congress (CNBC)

📱 Apple Aims to Ship 10% More New iPhones This Year After Bumpy 2023 (BBG)

💰 UBS Sees $83 Trillion Wealth Transfer Over Next Three Decades (BBG)

🏡 The Cost of Title Insurance on Homes Is Out of Sync With the Risk (WSJ)

🗳️ Nancy Pelosi Signals Biden Should Re-Examine Decision to Stay in Race (WSJ)

🏛️ Biden Tightens Trade Rules for Steel, Aluminum From Mexico (WSJ)

The Weekly Brief

Powell Not Prepared ‘Yet’ to Say He’s Confident About Inflation

In a testimony to House lawmakers, Federal Reserve Chair Jerome Powell expressed cautious optimism about inflation receding but emphasized that the Fed is not yet confident that price gains are sustainably slowing to their 2% target.

While acknowledging some progress in inflation readings, Powell stressed the need for more data to strengthen confidence in the sustainability of this trend.

Regarding the Fed's balance sheet, Powell stated that officials have made significant progress in trimming it but still have "a good ways to go".

He also mentioned that regulators are close to agreeing on changes to the plan requiring big banks to hold more capital, potentially marking a win for Wall Street banks.

American Workers Have Slowed Down on Job Quitting For Now…

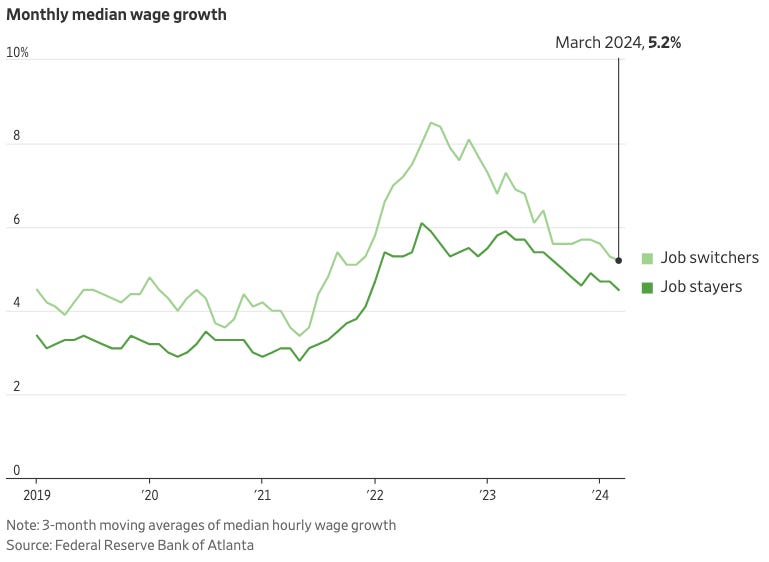

Recent surveys and data have found that American workers are becoming less inclined to switch jobs compared to the high turnover rates seen during the pandemic years.

Job satisfaction appears to be on the rise, with fewer adults actively seeking new positions.

The U.S. quit rate has fallen below pre-pandemic levels, settling at 2.2% in early 2024. Employees cite satisfaction with compensation and flexibility as key reasons for staying put.

This trend is particularly common among younger workers, with Gen Zers planning to look for a new job in the second half of 2024 down to 44%, from 74% last year.

Bank Earnings Season Kicks Off This Week

The largest U.S. banks - JPMorgan Chase, Citigroup, and Wells Fargo - are set to report their second-quarter earnings on Friday, July 12th. Investors are watching for signs of weakness in the banking system, the impact of higher interest rates, and potential cracks in consumer finances.

Key areas of focus include unrealized losses on bank balance sheets, commercial real estate exposure, lending profits, regional bank liquidity, and credit card delinquencies

Despite concerns, the largest banks so far have shown resilience due to their diverse business models and increased investment banking activity.