📈☄️ S&P Stages Comeback, CPI Report on Wednesday!

Hi all,

I hope you’re having a restful Sunday. I am back stateside after 10 days in Great Britain, and am feeling quite relaxed and freshly fueled with optimism and motivation. I guess that’s what time off does for you! A highlight was definitely seeing the Isle of Skye and Loch Ness, which I had to drive about 5.5 hours on the OTHER side of the road to get to. Below are some of my favorite photos, and one of me at the top of the hike.

In terms of important reports this week for the markets, I’ll be keeping an eye out on the latest CPI report this coming Wednesday, and I’ll keep you updated too. With an almost certain rate cut in September coming, I really do think we could see a leg up in the markets toward end of Q3 and Q4. The one uncertainty is still inflation and if the dust from the Japan markets will settle in the next few weeks.

Enjoy this Sunday Primer edition of Hump Days.

— Humphrey

Market Report

S&P 500 Stages a Comeback As Investors Watch CPI Report This Week

US Yield Curve Uninverts For First Time Since July 2022

The yield curve briefly uninverted last Monday, marking the first time since the summer of 2022 that the 10-year Treasury yield exceeded the 2-year yield.

Historically, yield curve inversions have often preceded recessions, but this time, despite the longest inversion in history, a recession has not yet occurred.

Analysts suggest that real economic pain often follows when the yield curve uninverts, typically due to a sharp drop in the two-year yield, signaling the Federal Reserve's shift to rate-cutting mode.

Rate Cuts in September Likely Coming Regardless of July Inflation

U.S. inflation (report released this Wednesday) in July is expected to have increased, with the consumer price index projected to rise by 0.2% from June for both the headline and core measures, which exclude food and energy.

This slight acceleration from June's figures is not anticipated to impact the Federal Reserve's plans for a potential interest rate cut in September, as inflation continues to trend downward at some of the slowest annual rates since early 2021.

The estimated increase in inflation is expected to be core services excluding housing, though a continued slowdown in shelter costs is expected.

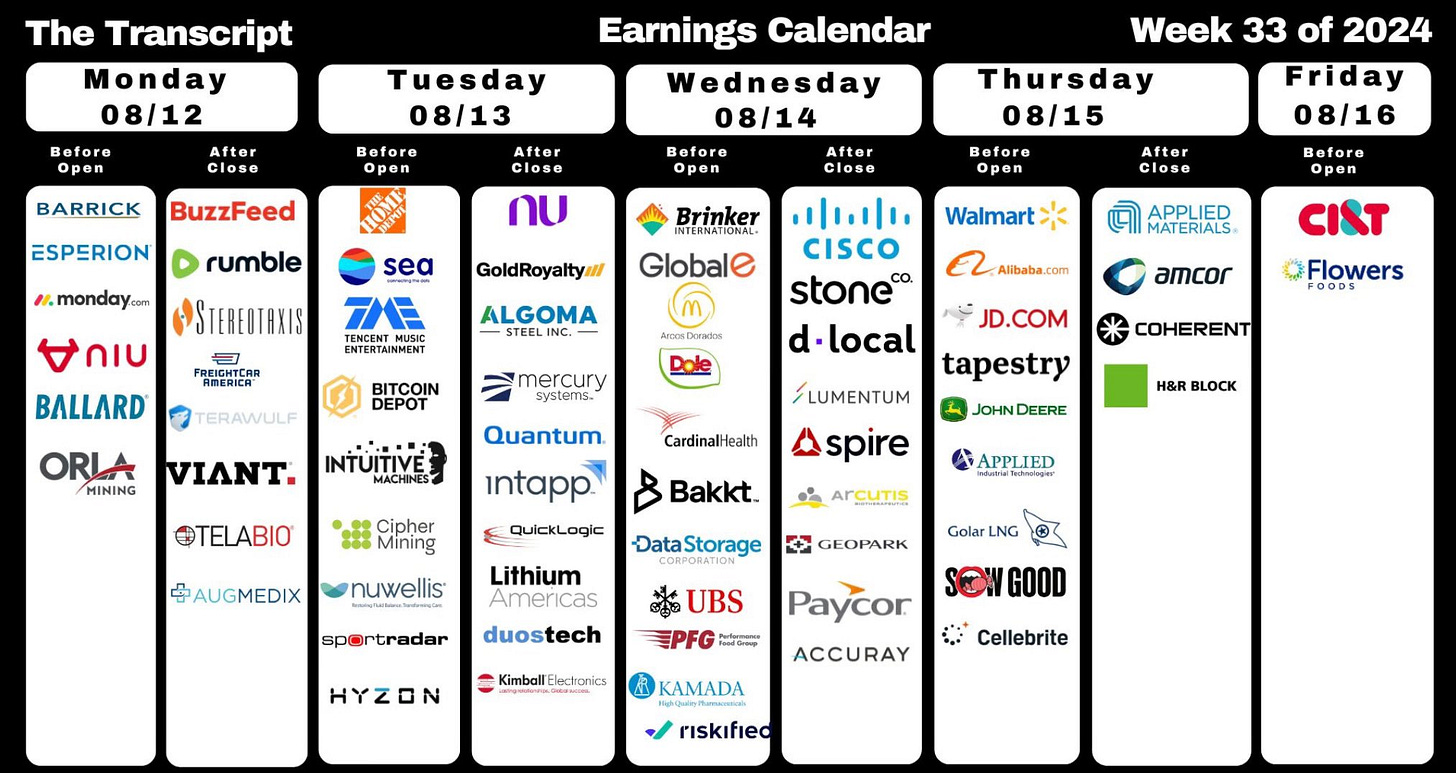

Earnings Growth in US Finally Showing Up Outside Tech Megacaps

As the quarterly earnings season for Corporate America nears its end, signs of recovery are showing up among companies previously ignored by the artificial intelligence boom.

Despite the slowing profit growth of large-cap companies, smaller names are gaining momentum, with S&P 500 earnings, excluding the Magnificent Seven, expected to grow by 7.4% in the second quarter.

However, AI enthusiasm has been tempered as major players like Amazon, Microsoft, and Alphabet delivered lukewarm results, raising concerns about the immediate returns on AI investments.

The earnings season has also been marked by intense stock reactions, with S&P 500 companies experiencing average price movements of 4.9% on earnings announcement days, significantly higher than the historical average.