Happy Wednesday all,

It’s been a crazy past few weeks, and I hope that you have been keeping up on the YouTube channel with all the updates re: tariffs. It doesn’t sound like this volatility is going away anytime soon. We’ll keep you updated here and on the channel for any new developments.

In personal news, I have been working on a new website, running a lot (training for the San Diego half marathon), and trying to just live a balanced life and still grow the social media channels. One of my favorite golfers, Rory McIlroy, was able to capture the Masters this past weekend - and that was genuinely one of the best Masters Tournaments I’ve seen in recent years. He also gave me a heart attack for more than half the round because he would hit the worst shots followed up by god-tier shots no one would be able to pull off.

Other than that, no super big updates on my end, but I’ll keep you posted. I did film a video on How to Survive and Profit from a Recession, so that should be out next week. I hope you are all well.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Proposed SNAP cuts could pressure low-income shoppers — and retailers that serve them (CNBC)

Nvidia says it will record $5.5 billion charge tied to H20 processors exported to China (CNBC)

Critical chip firm ASML misses order expectations amid tariff uncertainty (CNBC)

What the Weak Dollar Means for the Global Economy (WSJ)

Xi Fights Trump’s Tariffs With Global Charm Offensive (WSJ)

The Weekly Brief

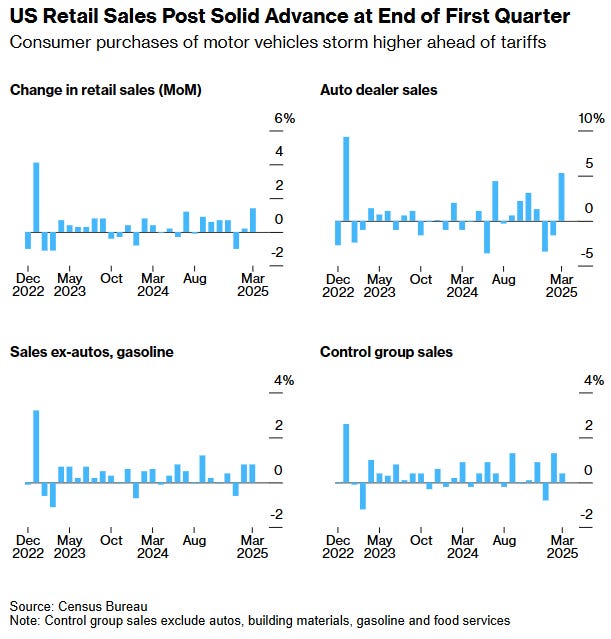

Retail Sales Jump By Most in Two Years As Consumers Rush to Buy Cars

Retail purchases increased by 1.4% in March, the most in two years. Excluding autos, sales climbed 0.5%.

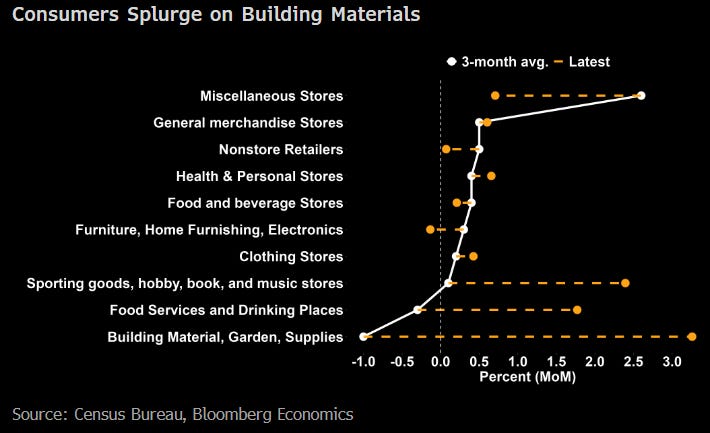

Sales of building materials, sporting goods, and electronics all jumped, likely indicating that consumers were trying to beat tariff implementation. Spending at restaurants and bars, the only service-sector category in the sales report, increased by the most since January 2023.

While importers are the ones who pay for tariffs, they will ultimately pass at least some of those extra costs on to consumers, even if the pass-through takes a few months to take effect.

Since this retail sales data isn’t adjusted for inflation, tariffs could distort the numbers going forward, as an increase could simply reflect higher prices rather than greater sales activity.

Nvidia Warns That US Bans on Chips to China To Cost $5.5 Billion

On Monday, the US informed Nvidia that it would require a license to export H20 chips to China for the indefinite future in an effort to restrict products that could be used in a supercomputer in China.

Nvidia had specifically designed the H20 to comply with earlier US export restrictions targeting more powerful chips. As a direct result, it anticipates a $5.5 billion writedown in the current quarter related to inventory and commitments for the now-restricted chip.

While the Biden administration had reportedly prepared similar rules for the H20 but didn't implement them, Trump's team, led by Commerce Secretary Howard Lutnick, has shown a strong resolve to tighten controls.

If the restrictions remain in place over the long-term, analysts expect the ban to cost Nvidia $14-$18 billion in annual revenue and significantly reducing its China data center business.

China Open to Trade Talks As Long As US “Shows More Respect”

According to Bloomberg News this morning, China outlined several preconditions before agreeing to resume trade talks with the Trump administration, emphasizing the need for respectful engagement and a clear, consistent US position.

China also seeks assurances that the US is willing to address its core concerns, including the impact of technology export controls perceived as aiming to contain China's modernization and policies related to Taiwan.

China also wants the US to designate a point person to oversee talks. According to Bloomberg’s sources, “China believes the best way forward is for officials designated by the two presidents to oversee the talks.”

You’ll Find This Interesting

Chart of the Week

Got This Far and Want to Continue Building Wealth? Follow my Twitter!

Wow. You must be a die-hard reader. Well, lucky you - I’m now daily tweeting on how to build your wealth: https://twitter.com/humphreytalks

It’s also a place where I post more real-time news and live reactions to events.

Make sure you’re following. https://x.com/humphreytalks

Thanks for this. I’m a new subscriber and got here by way of your youtube videos that I listen to while training and cleaning and stay with me long after. The mineral import chart is an eye opener.