🙀🗣️ Roaring Kitty GME Portfolio Update

Happy Monday,

GameStop is on top of the news again after “Roaring Kitty” posted a screenshot of his $115M position in GME on Reddit. This was his first portfolio update in 3 years, and it sent the stock into an absolute frenzy. I’m not sure how it ever got that high (or why he’s still holding), but I’d just be careful entering into a position now following all the hype.

Enjoy this belated Sunday Primer, everyone! Hope you have a great week ahead!

- Humphrey, Tim & Rickie

Market Report

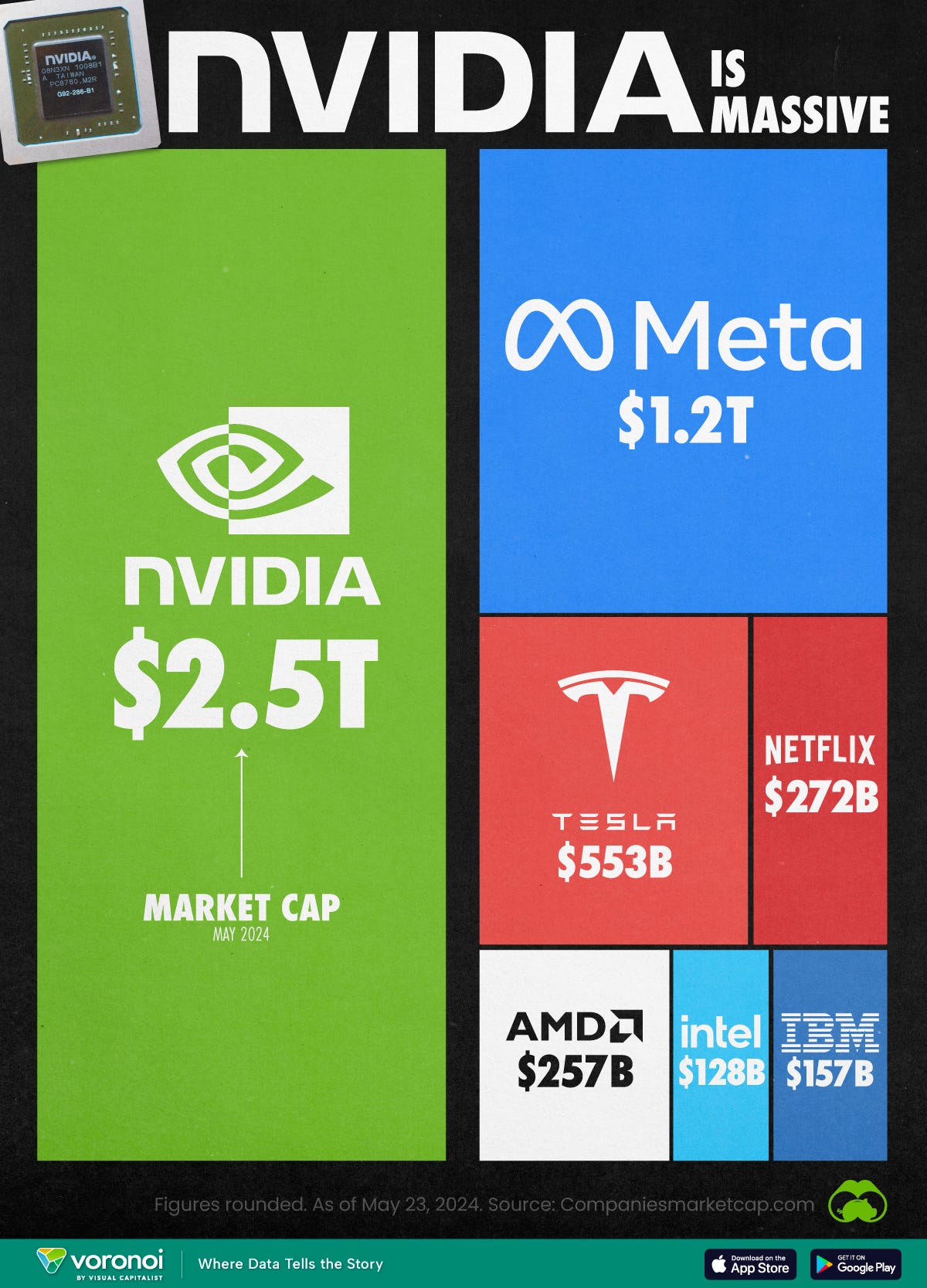

Nvidia is Worth More Than All of These Companies Combined…

Housing Market Seeing a Rise in Listings But Less Demand

The US housing market is experiencing a rise in listings amid higher mortgage rates exceeding 7%, which has dampened buyer interest and led to more price reductions as inventory lingers.

Despite initial optimism for rate cuts, the resilient economy has kept borrowing costs high, with the average 30-year mortgage rate hovering near 7%.

This has pushed the median sale price to a record $390,613 and reduced home sales, causing listings to accumulate. The impact varies geographically, with Sun Belt markets cooling and some western metros starting to recover.

The market's sluggishness is causing frustration among realtors, and price growth is expected to slow, although pent-up demand from Millennials may provide some support.

Companies Buying Back Stock Like Crazy

In May, Corporate America announced a record $201 billion in stock repurchase plans, driven significantly by Apple's $110 billion buyback, marking a 41% increase from the previous year and the fifth highest on record for any month.

This surge in buybacks, reflecting confidence in cash flow and operational stability, provides a potential boost for equities amidst economic uncertainties.

The January-May period saw the second-highest total of buyback announcements ever, with the number of companies participating being the second-most on record.

Disposable Income Slows Down as Consumers Rely on Credit

Recent data shows that American consumer resilience is waning, with modest increases in real disposable incomes and a low saving rate. Many households have exhausted pandemic-era savings and are increasingly relying on credit.

This has led to a decline in real spending in April, particularly on cars, restaurants, and recreational activities.

The labor market is cooling, reducing income growth and pushing families to spend less amid reduced savings and higher debt.

Companies like Best Buy have noticed a shift toward cheaper brands, and recent earnings reports show consumers prioritizing staples over discretionary items.

Forecast Ahead

Big Number

May has been the busiest month ever in the US leveraged loan market, with corporate borrowers capitalizing on strong investor demand for higher-rate debt to price $160 billion in leveraged loans, the most since 2013, according to Bloomberg.

Over 80% of these loans involved repricings aimed at reducing interest expenses, despite repricings being generally unfavorable to loan buyers.