💸📉 Risk of Inflation Falling BELOW 2%?

Happy Wednesday all,

The debate last night was pretty eventful wasn’t it? It was definitely more productive than the one with Trump vs. Biden a couple of months ago, at the very least. I was watching it live on TikTok which is so weird for me to say (type, actually). Something about watching a serious debate on TikTok just seems so odd to me, but it just goes to show how far the platform has come since its lip-syncing and cringey dance video days.

This week on the YouTube channel, we’re posting a video touring the $27,000,000 Western White House here in California! We’re happy with how it turned out so be sure to give it a watch and let me know your thoughts!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

iPhone 16, Apple Intelligence, AirPods 4 and more: Everything revealed at Apple Event 2024 (TechCrunch)

JPMorgan Leads Banks in Dimming Outlooks, Spoiling Win on Rules (BBG)

US Airlines May Soon Face Cash Penalties for Delayed Flights (BBG)

Starbucks’s New CEO Targets Hectic Stores, Overwhelming Menus (WSJ)

How Apple Rules the World (BBG)

The Covid Pandemic Left an Extra 13 Million Americans Single (BBG)

Private Equity Fights Insurance for $15 Trillion Retirement Prize (BBG)

The Weekly Brief

Bond Market Sees Risk of Inflation Falling Below Fed Target

Bond investors are increasingly concerned that inflation may be slowing too much, potentially even falling below the Federal Reserve's 2% target. The 10-year breakeven rate, a key indicator of inflation expectations, has dropped to 2.02%, suggesting investors anticipate inflation averaging below the Fed's goal over the next decade.

This shift comes as the Fed prepares for its first potential rate cut since 2020, with traders fully pricing in a 25-basis-point cut at the upcoming September meeting.

Some strategists warn that the market may be underestimating longer-term inflation risks, while others see the current trend as a sign that the Fed's inflation battle is largely over.

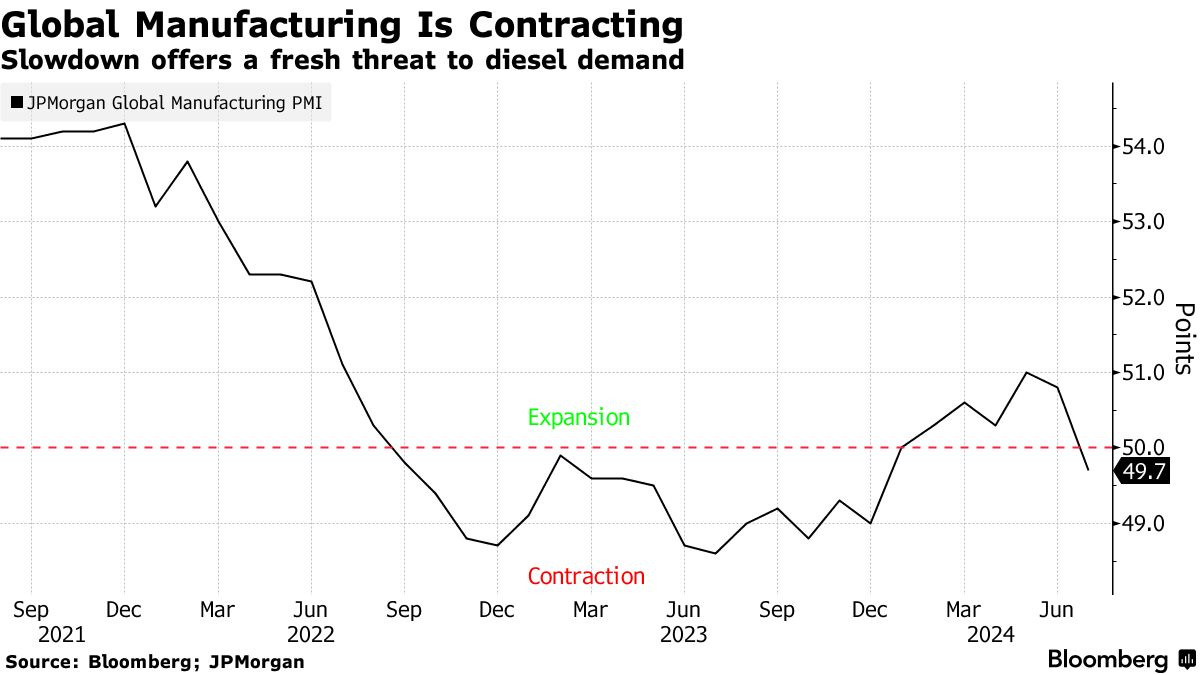

OPEC+ Pauses Oil Supply Hike in Effort to Reverse Price Slump

OPEC+ has decided to postpone its planned oil supply increase of 180,000 barrels per day for October and November by two months, in response to recent steep declines in crude prices and concerns about fragile demand.

Despite this delay, the coalition's longer-term plan to gradually restore 2.2 million barrels per day of idle supplies remains in place, with the completion date pushed back to December 2025.

The decision comes amid downbeat economic data from major consumers like China and the US, which has sent oil prices to their lowest levels since late 2023.

U.S. Incomes Climbed Last Year, Census Bureau Says

The U.S. Census Bureau reported that inflation-adjusted median household income rose to $80,610 in 2023, a 4% increase from 2022, marking the first annual increase since 2019.

Income gains were uneven across demographic groups, with White non-Hispanic households seeing the largest increase.

The female-to-male earnings ratio decreased for the first time in two decades.

Despite these positive trends, economists caution that many Americans still feel the cumulative effects of price increases and high interest rates, and that incomes are only now returning to 2019 levels rather than continuing the pre-pandemic growth trajectory.