🤔📈 Q3 Market Recap by Industry

Happy Wednesday all,

We just released a video this morning covering the East and Gulf Coast Port Strikes that started as of yesterday. About 50% of the United States’ ports are affected, which could, in turn, affect prices of goods and the supply chain and have broader global economic implications. I hope you find the time to watch that video and get up to date on what’s going on, it will be linked at the end of this newsletter.

In personal news, I’m heading to Japan with my mom for 6 days. I’ve done a lot of travelling this Fall, but this will be my last trip for a while. I’m looking forward to eating sushi every meal. Even breakfast. Also, the 7-11’s. My birthday is also on the 6th of October (Libra gang), so I’ll probably send you a fun Hump Days edition that day!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Nike withdraws guidance, postpones investor day as it gears up for CEO change (CNBC)

Apollo’s Marc Rowan Says Raising Money Is No Longer the Hard Part. Finding Deals Is. (WSJ)

Fed Drives Global Push to Cut Rates Despite Questions Over 2025 (BBG)

Port strike could reignite inflation, with larger economic impact dependent on how long it lasts (CNBC)

The Giant Hedge Fund That Hates Risk and Still Wins (WSJ)

Iran launches missile attack on Israel for killing of Hezbollah leader, general (CNBC)

The Weekly Brief

Q3 Market Recap: Turns out Building AI Costs a Lot of Money…

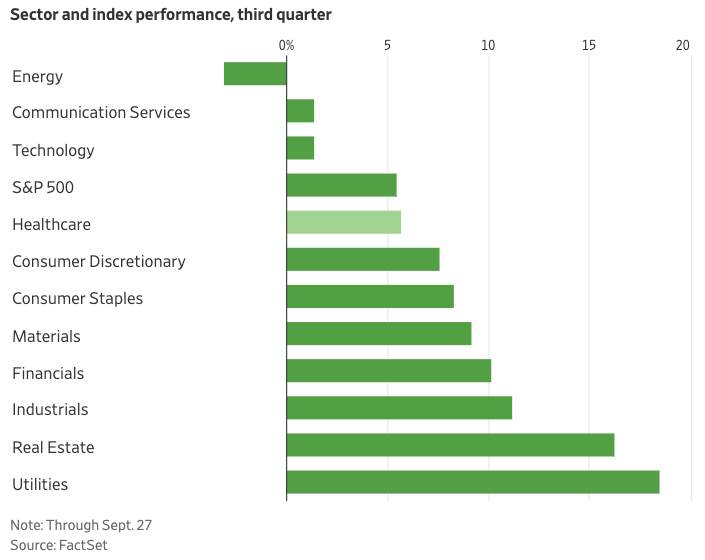

Usually, big tech performance leads the S&P 500, but this quarter, smaller companies emerged and value stocks beat out growth. The S&P 500 advanced 5.5% for the quarter, bringing its 2024 gains to 21%, the best performance in the first three quarters of a year since 1997.

Tech underperformed the index as investors began to question the enormous amounts of money being spent on AI projects.

“In recent months, Alphabet reported slowing growth in advertising sales at Google along with a near-doubling of capital expenditures from a year earlier, while Amazon forecast weaker-than-anticipated sales growth and said it would boost spending to meet demand for AI services.” - WSJ

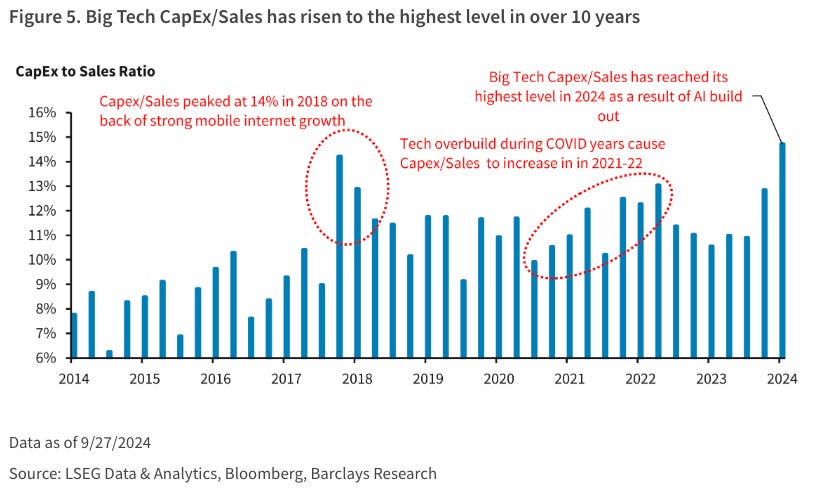

According to Barclays, Big Tech capital expenditures as a % of sales have risen to the highest in 10 years. Operating expenses have also been slowly increasing, which typically preludes an earnings slowdown.

“Big Tech capital spending spiked 3 times in the last decade: 1) 2018, as the mobile internet era matured; 2) 2021-2022, as more business and consumer activity shifted to devices post-COVID, and; 3) 2024, amid the AI buildout.” - Barclays

US Job Openings Climb to Three-Month High, Exceeding Forecasts

Job openings in August increased to 8.04 million from 7.71 million in July, led by the biggest jump in construction openings since 2009 as well as increases in the state and local government sectors. Analysts expected 7.69 million.

The hiring rate declined to 3.3%, matching the lowest reading since 2013 excluding the onset of the pandemic in 2020. Retail trade and transportation and warehousing saw the biggest declines.

The number of job vacancies per unemployed worker, a ratio the Fed follows quite closely, hovered near a three-year low at 1.1.

The quits rate fell to 1.9%, the lowest since June 2020.

US Manufacturing Activity Contracts for a Sixth Straight Month

“Demand remains subdued, as companies showed an unwillingness to invest in capital and inventory due to federal monetary policy — which the US Federal Reserve addressed by the time of this report — and election uncertainty” - ISM’s Manufacturing Business Survey Committee

Manufacturing activity continues to shrink as production and employment contracts remain constrained.

The ISM manufacturing employment index dropped to 43.9 in September, marking a fourth month of contraction.

Only 8% of respondents reported increasing employment, the smallest share since the onset of the pandemic.