🤔📑 Preferred vs. Common Stocks: An Overview

We’re all probably familiar with common stocks since, well, they’re common! It’s the AAPL, MSFT, GOOGL, and TSLA stocks you often see.

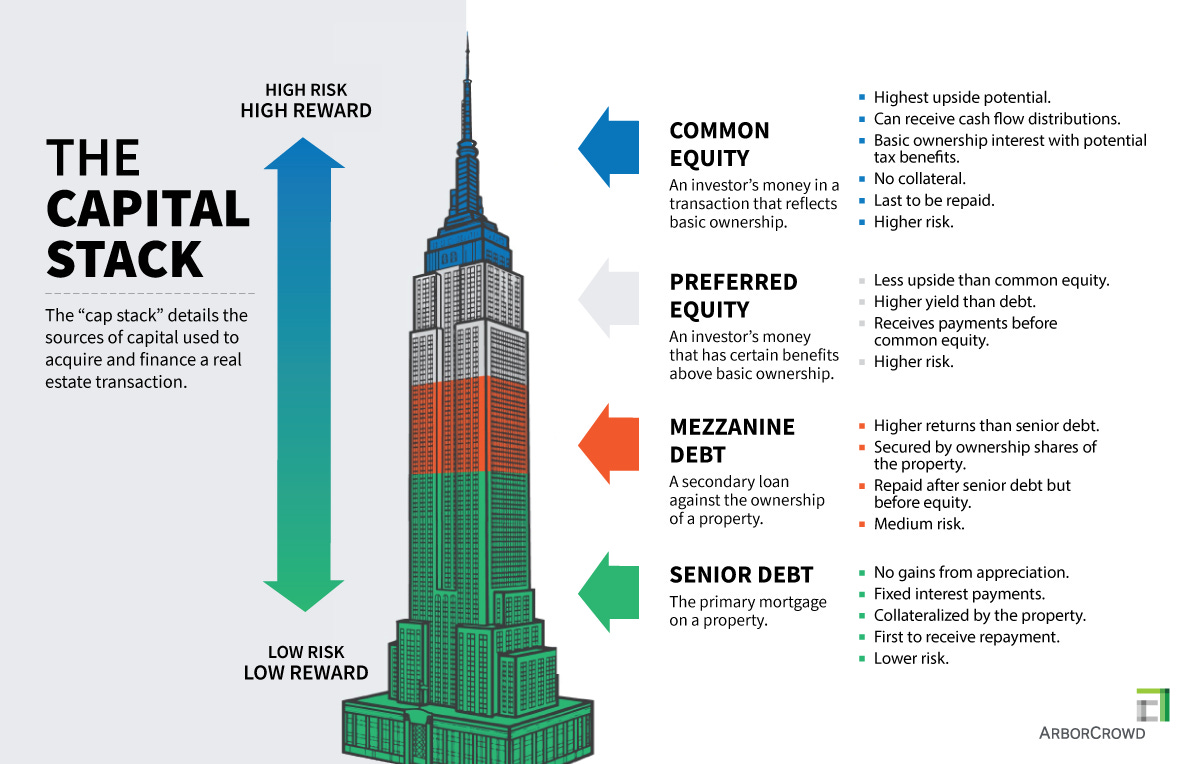

But what if I told you there’s another type of stock with characteristics of both stocks and bonds? In today’s article, we’ll be going over preferred stocks, a financial instrument that sits between a company’s debt and equity, the similarities and differences between preferred and common stock, the pros/cons, and how/why to invest in preferred stock. Let’s get started!

Common Stock

As a brief refresher or for those newer to investing, a common stock is an equity security that signifies an ownership stake in a company. Those who own common stock can elect board members and have a say in corporate decisions.

On the financial front, common stock represents the residual ownership in a company. When assessing a company's financial health, if the assets outweigh the liabilities, the leftover value, or the shareholders' equity, is what the common stock represents.

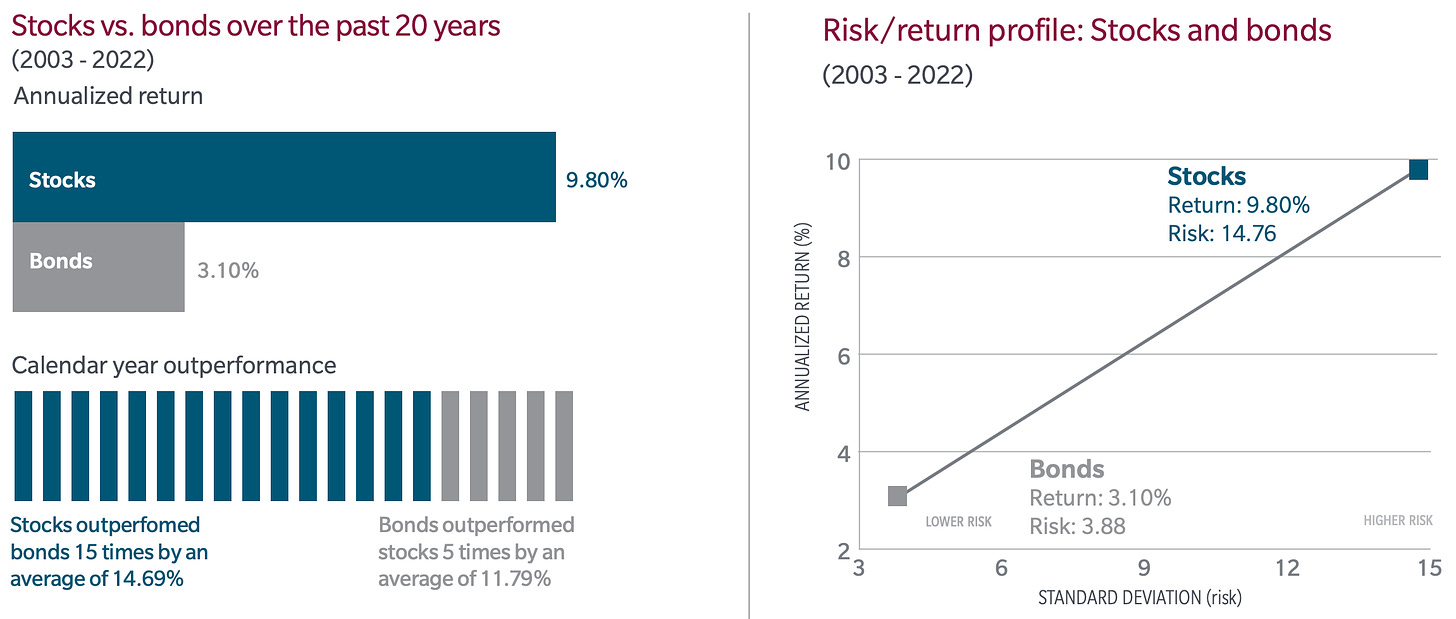

Common stocks are an important part of any investor’s portfolio. However, they only receive what's left after all other stakeholders, such as creditors and preferred shareholders, have been paid. Thus, they have a greater amount of risk when compared to CDs, preferred stocks, and bonds.

However, with greater risk comes a greater potential for rewards. Over the long term, stocks tend to outperform other investments but are more exposed to volatility over the short term.

Preferred Stock

Preferred stock is a unique type of equity representing ownership in a company. Distinct from common stock, preferred stockholders enjoy a superior claim on company dividends and assets.

Despite this preferential treatment, they usually have limited or no voting rights concerning corporate decisions. In liquidation scenarios, preferred stockholders are positioned behind creditors and bondholders but ahead of common stockholders.

Their stock blends the characteristics of both bonds due to its fixed dividends and equity, given its potential for price appreciation, which can be enticing for investors who value predictable cash flows and income.

Dividends on preferred stocks are typically larger than those on common stocks. Benchmark interest rates like LIBOR can influence these dividends and can be either fixed or adjustable.

There are different types of preferred stock that you should be aware of:

Keep reading with a 7-day free trial

Subscribe to Hump 🐪 Days to keep reading this post and get 7 days of free access to the full post archives.