📉 💸 Powell Signals Rate Cuts Coming in September!

Happy Sunday,

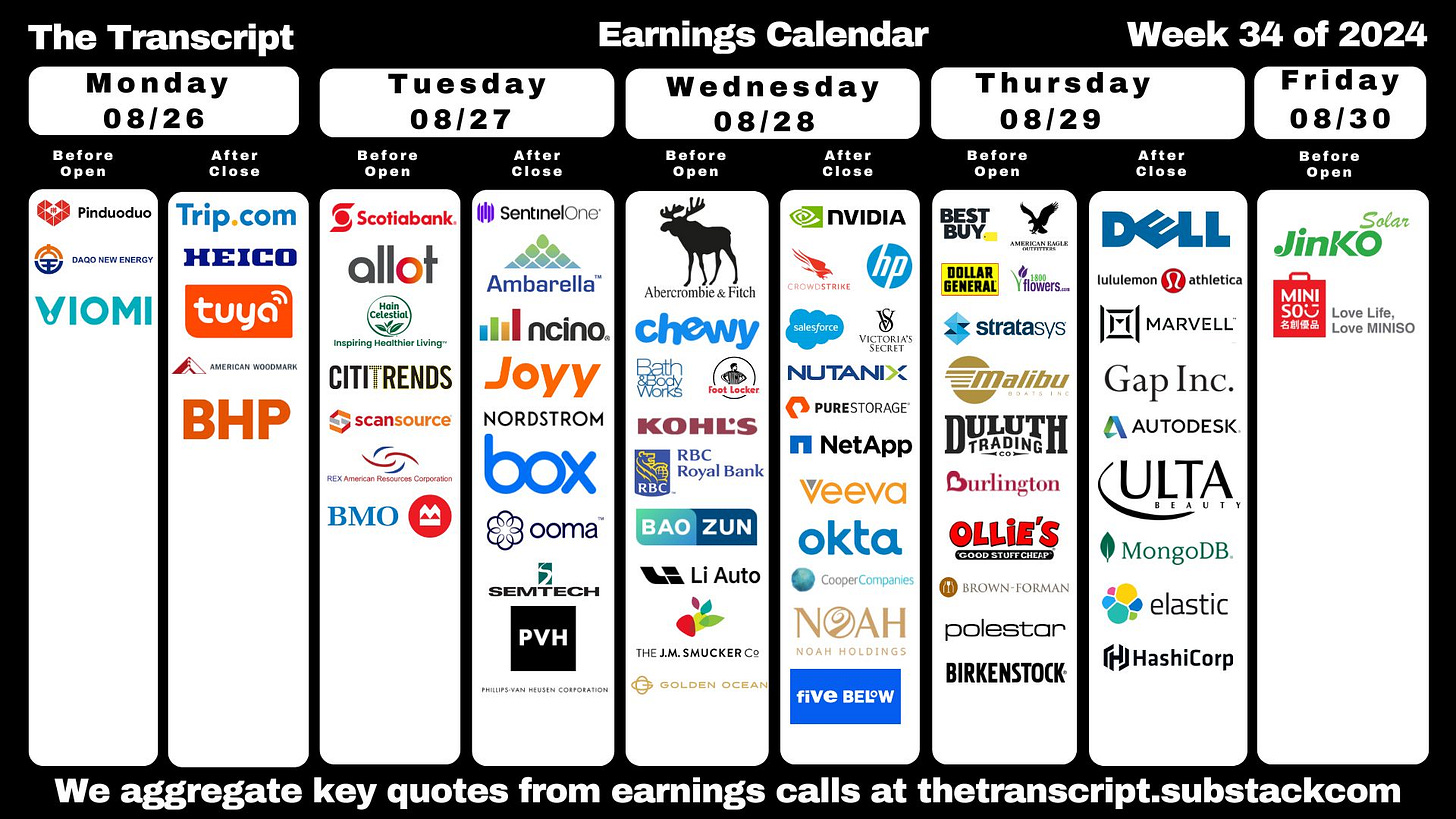

This week, all eyes turn to Nvidia as they prepare to release their Q2 earnings report on Wednesday. Analyst estimates for both revenue and profit have doubled since last year. Sky-high expectations for the chip maker and any discussion about delays or hiccups could have a significant impact on the stock price toward the end of the week.

I like to keep tabs on the companies I invest in (or that make up large portions of the indices that I invest in), not to trade on the news but mostly because I enjoy hearing about where the future of the business is headed. These kinds of reports are not going to make or break any investment decisions I make since I invest for the long term but what’s great about this approach is that it allows me to stay up to date with things I’m interested in and leaves me without the stress of feeling the need to make quick decisions based on the news.

I’ll be listening to the buzz, but good news or bad, I’ll be holding on.

Enjoy this Sunday Primer.

— Humphrey, Tim, & Rickie

Market Report

“The time has come for policy to adjust” - Jerome Powell

Federal Reserve Chair Jerome Powell has signaled a significant shift in monetary policy, announcing that the time has come to cut interest rates. Speaking at the Kansas City Fed's annual conference in Jackson Hole, Wyoming, Powell affirmed expectations that the Fed will begin lowering borrowing costs in September.

This decision comes as inflation has shown signs of moderating and the labor market has begun to cool.

Powell emphasized the Fed's commitment to maintaining a strong labor market while continuing progress towards price stability, with the central bank's inflation target of 2% in sight.

While the exact timing and pace of rate cuts will depend on incoming data and economic conditions, this announcement marks a pivotal moment in the Fed's two-year battle against inflation and suggests a potential "soft landing" scenario for the economy.

The Fed funds futures market is currently pricing a full percentage point worth of rate cuts in 2024.

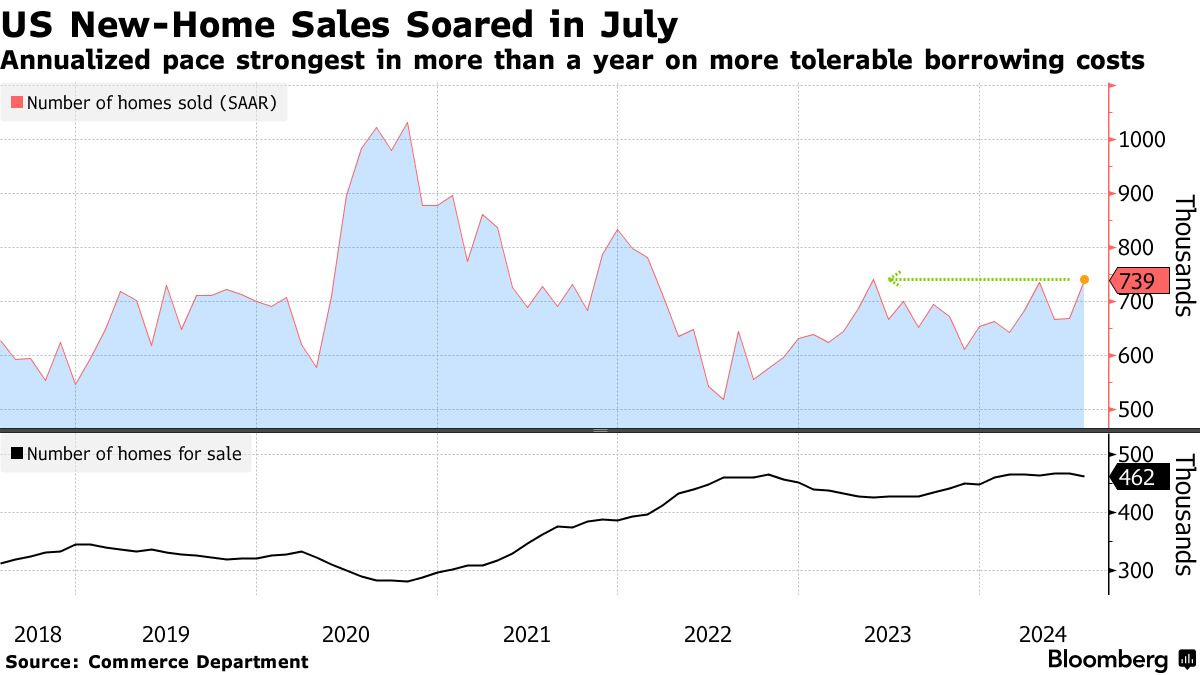

US New-Home Sales Surge to Highest Level Since May 2023

New home sales in the U.S. surged to their highest level since May 2023, with a 10.6% increase in July to an annual rate of 739,000 units.

This unexpected rise was attributed to lower mortgage rates, which have fallen to 6.5% from a 2024 peak of nearly 7.3% in April, and increased inventory options for buyers.

The uptick in sales was observed across all four major regions, with the West experiencing the most significant growth since February 2022. This positive trend in the new home market contrasts with the still-constrained supply of existing homes, making new constructions more attractive to potential buyers.

Despite the rise in sales, median new home prices decreased by 1.4% year-over-year to $429,800, reflecting ongoing efforts by builders to attract buyers through competitive pricing and incentives.

Applications for US Jobless Benefits Barely Increased Last Week

U.S. unemployment benefit applications showed a slight increase last week, rising by 4,000 to 232,000 for the week ending August 17, according to the Labor Department.

The four-week moving average, which smooths out weekly volatility, decreased to its lowest point in a month.

Continuing claims, representing those receiving ongoing unemployment benefits, edged up to 1.86 million for the week ending August 10.

NASA Picks SpaceX to Rescue Astronauts Stuck in Space

NASA announced that SpaceX's Crew Dragon capsule will be used to bring home two NASA astronauts, Barry Wilmore and Sunita Williams, who are currently aboard the International Space Station (ISS).

This decision comes as a setback for Boeing's Starliner spacecraft, which was originally intended to transport these astronauts. The Starliner will now return to Earth uncrewed in early September due to safety concerns, particularly regarding thruster issues and helium leaks experienced during its mission to the ISS.

As a result, Wilmore and Williams will extend their stay on the ISS from one week to about eight months, returning in February with SpaceX's Crew-9 mission.

While NASA Administrator Bill Nelson expressed confidence that Starliner would eventually fly crews again, the decision raises questions about Boeing's future in NASA's commercial crew program and the agency's plans for staffing the ISS moving forward.