🥔🥣 Post Holdings (POST): Deep-Dive Analysis

Table of Contents

Company Description

Investment Thesis

Investment Risks

Company Overview

Post Consumer Brands

Foodservice Segment

Refrigerated Retail Segment

Weetabix

Why Post Holdings?

Case Studies: BellRing, 8th Ave, etc

More on Post’s Acquisition Strategy

Company Description

Post Holdings is a portfolio company with subsidiaries that manufacture and distribute products across a variety of food categories, including cereal, egg products, and refrigerated side dishes. The company reports four segments—Post Consumer Brands, Weetabix, Foodservice, and Refrigerated Retail—and owns a majority stake in 8th Avenue Food and Provisions, a manufacturer of private-label consumables. Many of the company’s brands have been purchased via acquisitions; the company has spent over $10 billion on 17 acquisitions since 2012. Based in St. Louis, MO, Post is headquartered in St. Louis, MO, and became a publicly traded company in 2012, when spun out of Ralcorp Holdings. The company reported over $6.6 billion in revenue over the last 12 months and has a market capitalization of $4.9 billion.

Investment Thesis

Post has a relatively large exposure to private-label food.

Post makes 80% of store-brand cereal.

As consumers continue to struggle, private labels will perform well.

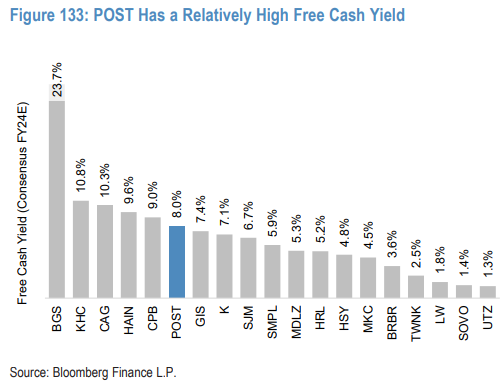

Post generates substantial free cash flow (FCF), one of the highest FCF yields in its comparable peers.

Wall St. expects Post to spend 50% of FCF over the next 2 years on debt paydown and share buybacks.

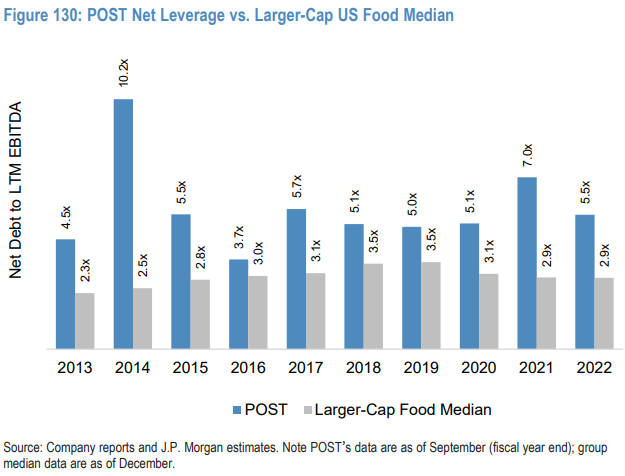

Investor concern about debt is likely overblown.

Post has relatively little debt maturing over the next three fiscal years (just 6.5% of its total versus a weighted average of 28.8% in packaged food).

100% of its debt is fixed (at a weighted 5% coupon).

Post’s business model is highly differentiated and is a unique investment opportunity. There isn’t anything quite like Post Holdings.

M&A is a critical long-term goal.

Post seeks to generate high rates of return on deals rather than top-line growth opportunities.

Low-growth assets are appealing to Post as long as it can generate consistent cash flow.

Dividend is not a focus. Buybacks are.

GAAP EPS is not a focus. Free cash flow is.

Investment Risks

Levered balance sheet.

4.9x net debt to consensus forward EBITDA versus a 2.5x group median.

The success of Post Holdings hinges on management’s ability to source deals that can generate high rates of return.

Declining growth in the Refrigerated Retail segment.

The Weetabix segment hinges on the wellbeing of the UK consumer.

Recent expansion into pet food is concerning as the pet market has weakened substantially over the past few years.

According to the American Pet Product Association (APPA), the percentage of US households with pets declined in 2023 to an estimated 66% (down from 70% in 2021), implying a 4% contraction in pet households.

Per web traffic from Petfinder, the largest pet adoption site in North America, trends were down 25% Y/Y in September versus -18% in August and -11% at the beginning of the year. Compared to a peak in 4Q20, web traffic is down over 50%.

Company Overview

Post operates four business segments: Post Consumer Brands (48% of revenue), Weetabix (6%), Foodservice (32%), and Refrigerated Retail (13%).

Post Consumer Brands

Post Consumer Brands primarily sells cereal and granola products, pet food, and nut butters, largely in the U.S. Post is the third largest seller of ready-to-eat (RTE) cereal in the U.S. (20% share) and is the #1 seller in the value segment and the #1 provider of private label, holding 80% share in the space.

Post has recently expanded into the pet food space (will discuss in detail later), and those businesses are reported under this business segment.

The RTE cereal category is a very large and important segment to food retailers and consumers, with ~$10bn sold in the US over the last year. For comparison, this is 13% more than crackers, 63% more than soup, and 67% more than pasta.

Sales growth in the Consumer Brands segment has largely been bolstered by five acquisitions:

Keep reading with a 7-day free trial

Subscribe to Hump 🐪 Days to keep reading this post and get 7 days of free access to the full post archives.