Happy Wednesday all,

We’re in the process of making the next edition of the popular portfolio roast series on the channel! It seems like a lot of you really like the content and we really enjoy making it. If you want to submit your portfolio, or just be involved in the community where we discuss investing, stocks, and personal finance - just join our Discord!

Click here: https://discord.gg/xJzsaGaaDE

In personal news, I have been traveling way too much and I have one more trip next week to Japan with my mom. Only going to be there for 6 days, but it will be a fun time and I hope to get some short-content out of it! Then, Q4 will consist of me making a lot more YouTube videos for you all.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

The Art Market Is Tanking. Sotheby’s Has Even Bigger Problems. (WSJ)

They Bought Homes With Their Friends—and Now They Want Out (WSJ)

September consumer confidence falls the most in three years (CNBC)

The Rate Cut Happened. Not All Borrowing Costs Are Going Down. (WSJ)

Traders Boost Fed Bets With November Cut Size Seen as a Toss-Up (BBG)

Nike CEO John Donahoe is out, replaced by company veteran Elliott Hill (CNBC)

Bond Anomaly That Twisted Yields From US to Germany Is No More (BBG)

The Weekly Brief

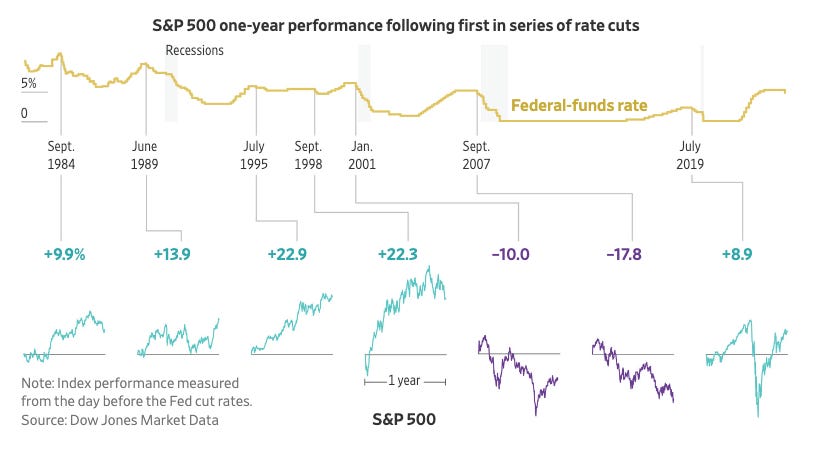

Markets Usually Do Well After Rate Cuts

Historically, stocks and corporate bonds have tended to perform well in the 12 months following the start of a rate-cutting cycle, especially if economic growth remains stable.

However, the outcomes depend heavily on whether rate cuts successfully boost the economy or fail to prevent a recession.

Treasury yields often rise moderately during rate cut periods, while corporate bond spreads may narrow if the economy stays healthy.

The U.S. dollar typically weakens as lower rates make it less attractive to foreign investors.

Gold prices often benefit from rate cuts due to a weaker dollar and increased economic uncertainty.

China Unleashes Stimulus Package to Revive Economy and Markets

China's central bank unveiled a comprehensive package of monetary stimulus measures to revive the country's slowing economy and boost investor confidence.

The People's Bank of China announced a cut to a key short-term interest rate, plans to reduce bank reserve requirements, and measures to support the property sector and stock market.

These include lowering mortgage costs, easing rules for second-home purchases, and providing liquidity support for equities.

While the stimulus package was larger than expected and led to gains in China's stock market, some analysts question whether it will be sufficient to address longer-term economic challenges like deflationary pressure and the real estate crisis.

Justice Department Sues Visa, Alleges Illegal Monopoly in Debit-Card Payments

The U.S. Justice Department filed an antitrust lawsuit against Visa, alleging that the company illegally monopolized the debit card market.

The lawsuit claims Visa used various tactics to stifle competition, including punishing merchants who routed transactions to other networks, paying tech companies like Apple to limit innovation, and threatening potential competitors with high fees.

The DOJ argues that Visa's practices have allowed it to maintain a dominant 60% market share in debit payments and extract excessive fees, ultimately leading to higher prices for consumers.

OpenAI Pitched White House on Unprecedented Data Center Buildout

OpenAI proposed to the Biden administration the construction of massive 5-gigawatt data centers across various U.S. states to advance AI development and compete with China.

This unprecedented expansion would require as much power as five nuclear reactors or enough to power nearly 3 million homes per center.

OpenAI argues that these facilities would create jobs, boost the economy, and maintain U.S. leadership in AI.

However, energy executives express skepticism about the feasibility of powering such large data centers, citing challenges in infrastructure, permitting, and timeframes.

The proposal comes amid growing concerns about the increasing energy demands of AI and data centers, with some estimates suggesting data centers could consume up to 9% of U.S. electricity generation by 2030.

We need more nuclear!