📉✂️ Only Two Rate Cuts?

Happy Sunday,

This is our 2nd to last edition for 2024! I can’t believe the New Year is around the corner. I hope you are getting to spend time with some of the people that matter most to you in life this week. If not, no worries - just know I’m thinking of you.

My week has been particularly uneventful. I’ve been thinking about setting some goals for 2025 but then someone told me about a book titled “Why Greatness Cannot Be Planned” and I’m about halfway through. The main point of the book is that you shouldn’t set objectives, or else it doesn’t allow for playful discovery. This is a little hard for me to get on board with (for now), because everything I’ve accomplished in life always had a goal/target that I worked backward from.

I do like to set process goals, rather than targets. So maybe that goal for me is “run three times per week” instead of “run a sub 4 hour marathon”. I find process goals easier to stick to, and then you just try to enjoy the process… rather than look ahead to the destination.

I’ll continue thinking about what I want to do in 2025, but one of our goals on the channel is to create more short videos… so if you have any suggestions on what you’d like to see, we’re all ears.

I hope you have a wonderful Sunday, and I’ll see you here on Wednesday - where we will have a shorter newsletter because it’s Christmas Day.

- Humphrey & Rickie

Market Report

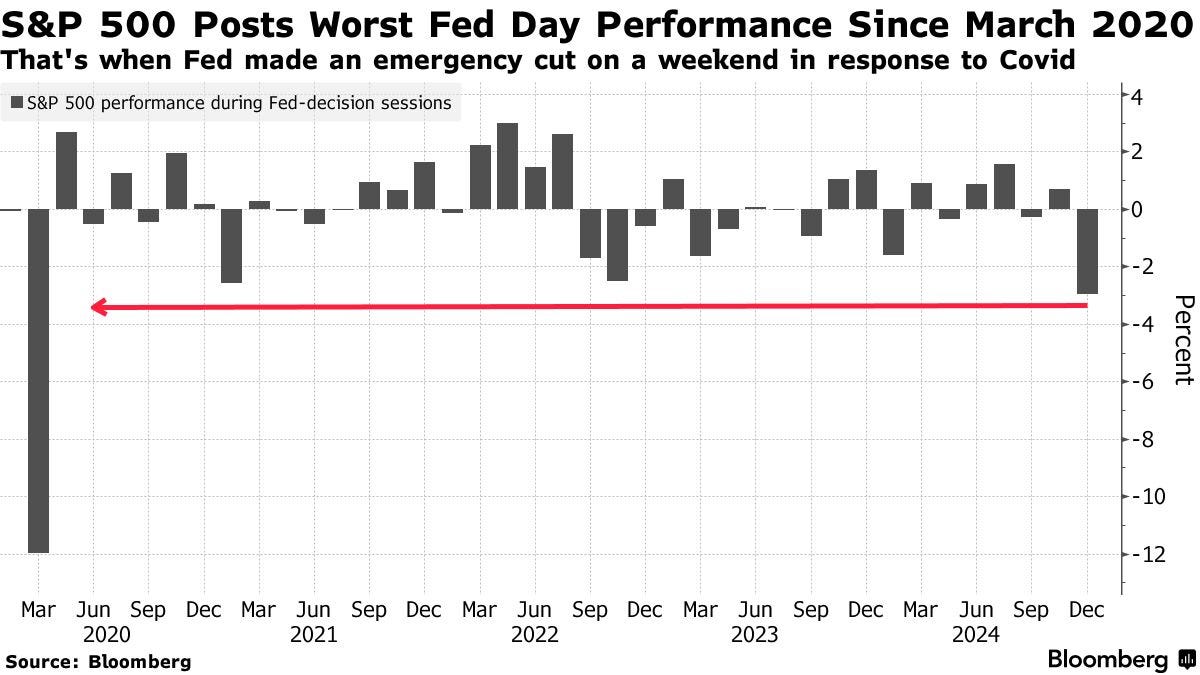

Federal Reserve Chair Jerome Powell's cautious stance on interest rate cuts in 2025, announced last Wednesday sparked a significant market selloff. The Fed’s unexpected projection of only two rate cuts over the next 12 months disappointed investors who had been anticipating a more aggressive easing cycle.

As a result, stocks tumbled with the S&P 500 experiencing its worst loss on a scheduled Fed decision day since September 2001, excluding the pandemic-related plunge in March 2020.

The market reaction highlights the extent to which investors had been relying on steady policy easing to support asset prices. The sudden shift in expectations led to a broad selloff across various asset classes, including bonds, currencies, and riskier market segments.

Fed’s Favored Inflation Gauge Cools to Slowest Pace Since May

The Federal Reserve's preferred measure of inflation, the core PCE price index, showed a modest increase of 0.1% in November from October, and a 2.8% rise from a year earlier.

This monthly increase was lower than economists' expectations and represents the slowest growth since May, indicating renewed progress on inflation after recent stagnation.

The report also revealed healthy increases in consumer spending and incomes. Adjusted for inflation, spending advanced 0.3%, driven primarily by purchases of goods, particularly automobiles.

Wages and salaries grew by 0.6%, the largest increase since March, although overall disposable income rose by just 0.3% due to declines in dividend income and government benefits.

US Housing Starts Fall to Four-Month Low on Multifamily Decline

US housing starts unexpectedly declined by 1.8% to an annualized rate of 1.29 million units in November 2024, the lowest level since July.

This decrease was primarily driven by a significant drop in multifamily construction, which fell by more than 23%. However, single-family home starts showed a 6.4% increase to an annualized rate of 1.01 million units.

The growth in single-family construction was largely concentrated in the South, which saw an 18.3% advance, likely due to recovery from hurricane-related delays in previous months.

Despite the overall decline in housing starts, building permits, an indicator of future construction, rose by 6.1% to an annualized rate of 1.51 million. This suggests potential growth in construction activity in the coming months.