📈 🤯 NVIDIA The World's Most Valuable Company

Happy Juneteenth all,

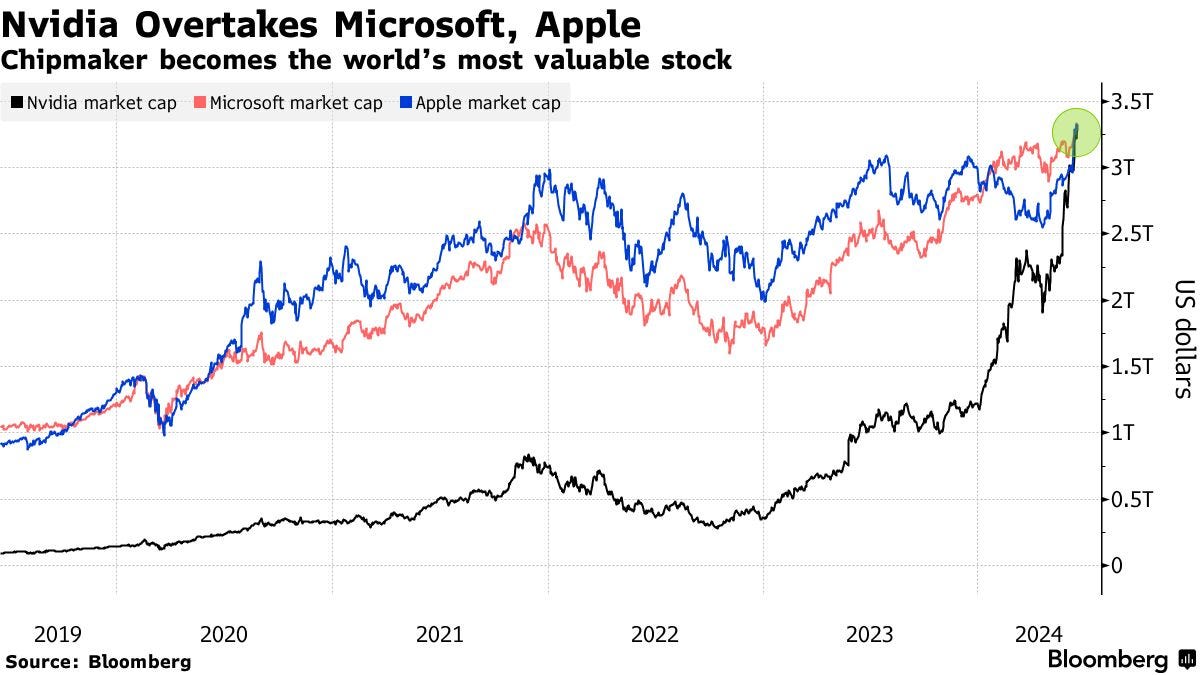

Lately it seems like the stock market is just absolutely ripping as Nvidia is now the world’s most valuable company, but it is a pretty tight race right now with Apple and Microsoft right there. Depending on any day of stock market trading, all of these companies could swap places with one another. The 4th largest company is Google with a 2.171 Trillion market cap.

I’m still working today even though its a national holiday, and I’m currently writing a video series on what goals you should be aiming for if you’re under $10K/$50K/$250K Net Worth. That should be on the channel next week. In the meantime, still just working on creating great engaging content for you all and leveling up my Chess skills (currently 800 elo!). Been thinking about golfing lately too. With the weather so nice, it’s hard staying inside.

Lastly, the Summer Solstice is tomorrow - so we’ll have the longest day of light of the year in the Northern Hemisphere.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

💻 Nvidia’s Ascent to Most Valuable Company Has Echoes of Dot-Com Boom (WSJ)

🪖 How Putin Rebuilt Russia’s War Machine With Help From U.S. Adversaries (WSJ)

🚀 Boeing Sent Two Astronauts Into Space. Now It Needs to Get Them Home. (WSJ)

🔋 The Deadly Mining Complex Powering the EV Revolution (BBG)

💸 JPMorgan Ignites $40 Billion Rush Into Indian Bonds (BBG)

🇯🇵 Japan’s Exports Grow Most Since 2022 on Boost from Weak Yen (BBG)

🚗 Fisker files for bankruptcy protection in wave of EV startups (CNBC)

The Weekly Brief

Solar is Growing Faster Than Any Electricity Source

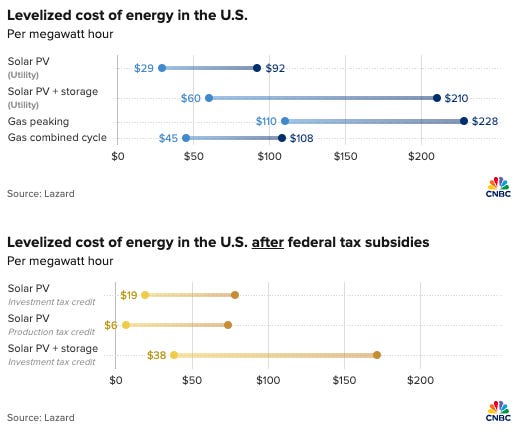

Solar energy is rapidly expanding in the United States, surpassing the growth of other electricity sources as demand for power surges.

Although solar currently accounts for just 3.9% of the U.S. power mix, its cost competitiveness and falling prices for solar modules and batteries have made it increasingly attractive.

Major tech companies like Amazon, Microsoft, Meta, and Google are driving demand for utility-scale solar projects, with these firms representing 40% of such demand over the past five years.

In 2024, solar is expected to account for 58% of new electricity generation in the U.S.

Despite the promising growth of renewables, challenges remain. The aging U.S. power grid and the slow approval process for new projects pose significant hurdles.

While the backlog of renewable projects seeking grid connection is immense, only a fraction of these projects typically get completed.

Additionally, the intermittent nature of solar and wind energy necessitates the development of longer-duration battery storage to ensure reliability.

Fed Officials Urge Patience on Rate Cuts, Offer Hints on Timing

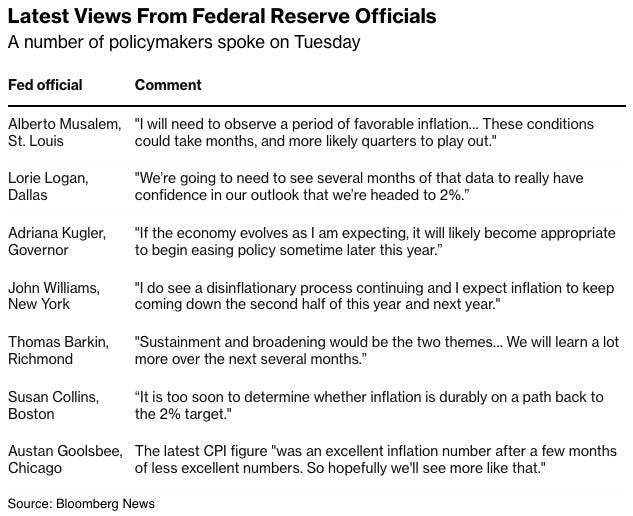

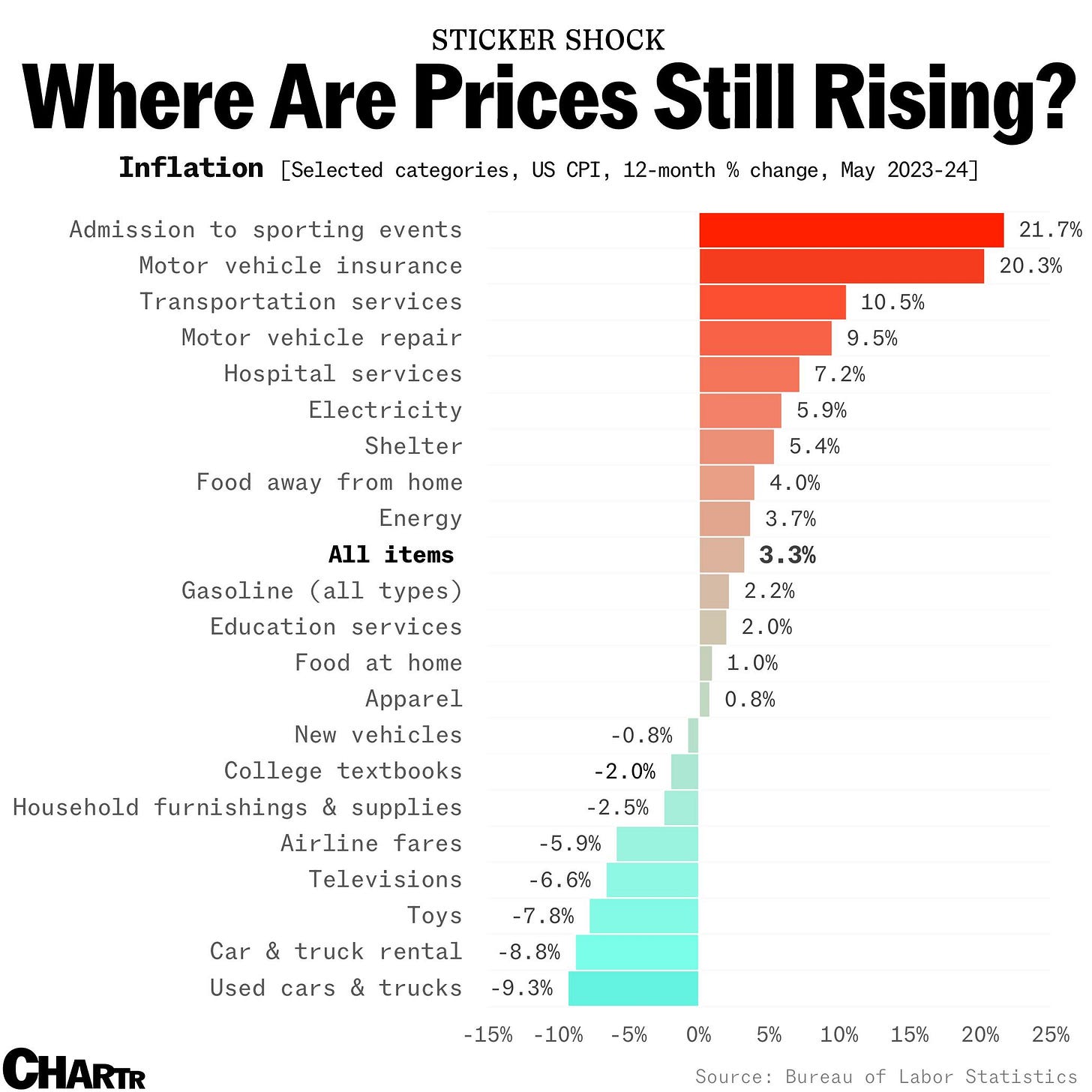

Federal Reserve officials on Tuesday emphasized the need for more evidence of cooling inflation before considering lowering interest rates, with differing views on the timing of such a move.

Fed Governor Adriana Kugler suggested rates might be cut "sometime later this year" if economic conditions align with her expectations, while St. Louis Fed President Alberto Musalem indicated it could take "quarters" for the data to justify a reduction.

Despite recent promising inflation data, policymakers remain cautious, as reflected in their quarterly projections, with some officials not anticipating any rate cuts in 2024.

The overall sentiment among Fed officials is to maintain a cautious approach, closely monitoring economic data before deciding on rate reductions.

Nvidia Becomes the World’s Most Valuable Company as AI Hype Speeds Ahead

Nvidia has become the world's most valuable company, surpassing Microsoft and Apple. The company's market capitalization reached about $3.3 trillion, driven by demand for its AI-focused chips, boosting sales by over 125% last year. N

Nvidia's rise underscores the significance of AI to investors, and its CEO, Jensen Huang, has become one of the world's wealthiest individuals, with a net worth climbing to $119 billion.

The company's stock has risen over 170% in 2024, reflecting its dominance and the broader tech sector's shift towards AI.

WeBull is giving away a free Coca-Cola stock ($62 value) when you Deposit $500 - ending June 30

If you deposit a minimum of $500 into WeBull you will get a guaranteed share of Coca Coal (valued right now at $62) deposited into your account. That’s probably one of the best promotions I’ve ever seen because that’s effectively like a 12-13% bonus on a $500 deposit. Use this link if you’re interested. Of course, if you don’t have $500 to move around - don't feel obligated to do it, but I thought I'd at least share this because its only eligible for this month.