Hi all!

We had an eventful week last week. Bitcoin nearly crossed $100,000 but it felt like it hit the Wall from Game of Thrones. Winter is coming, as they say 🤣

Eventually it should cross $100,000 - but as of now - it’s back around to $96,500 level.

Funny enough, I re-downloaded the BlueSky app this weekend and lo and behold… here was the first post I ever made on that platform, from April 2023:

What are the prices of those assets today?

Bitcoin: $96,500, +242.44%

Ethereum: $3,333, +80.45%

S&P 500: 5969, +47.20%

Nasdaq: 19,003, +60.31%

Apple: $229.87, +40.37%

So… yeah… I wish I bought more.

Anyways, I’ve had a pretty chill weekend, and am excited for Thanksgiving coming up. Thank you for reading our newsletter as always — and make sure to check out our YouTube video linked at the end of this newsletter if you haven’t already… It surpassed 500,000 views in the first 4 days! One of our best performing videos to date.

- Humphrey

Market Report

Nvidia Earnings Beats Wall Street Estimates, Disappoints the Ultra Bulls

Nvidia's latest quarterly results and guidance drew mixed reactions from investors. While the company assured continued growth driven by AI demand, with CEO Jensen Huang announcing the shipment of new Blackwell products this quarter, the sales forecast for the current period fell short of some Wall Street projections.

Nvidia predicted fiscal fourth-quarter sales of about $37.5 billion, which, while above the average analyst estimate, didn't meet the highest expectations.

The company's data center unit saw revenue double from a year earlier to $30.8 billion, beating Wall Street estimates.

However, investors are concerned about the concentration of customers, with cloud service providers accounting for 50% of data center revenue, up from 45% in the prior period.

Additionally, the production and engineering costs of new chips are expected to weigh on profit margins, with gross margins projected to dip to as low as 73% this quarter from 75% in the previous period.

Despite these challenges, Nvidia's growth remains impressive, with sales expected to double for the second year in a row.

US Initial Jobless Claims Decline to Lowest Level Since April

U.S. jobless claims unexpectedly decreased to 213,000 in the week ending November 16, the lowest level since April, showing signs of a robust job market. This figure was below the median forecast of 220,000 applications.

The four-week moving average of new claims also fell to 217,750, the lowest since May.

However, continuing claims rose to 1.91 million in the previous week, reaching a three-year high, partly due to a strike at Boeing in Washington. Despite recent high-profile job cut announcements, such as General Motors Co.'s plan to lay off about 1,000 salaried workers globally, economists expect jobless claims to stabilize near current levels in the near term.

Target’s Slow Rebound Frustrates Investors, Sends Shares Falling

Target Corporation is facing significant challenges in its turnaround efforts, as it announced disappointing quarterly results and a reduced full-year profit outlook.

The company's shares dropped over 20% following the announcement, reflecting investors' growing impatience with the pace of recovery.

Target said it was struggling with decreased consumer spending on nonessential items like clothing and home products, as well as unexpected inventory costs related to the US port strike.

In contrast, Target's main competitors, Walmart and Costco, are showing stronger performance.

Walmart raised its full-year guidance, benefiting from growth in advertising and other newer businesses, while also gaining market share among higher-income shoppers.

Costco reported growth in nonfood sales, particularly in categories like jewelry and home furnishings.

This disparity in performance is putting increased pressure on Target's CEO Brian Cornell to revitalize sales and improve the company's competitive position.

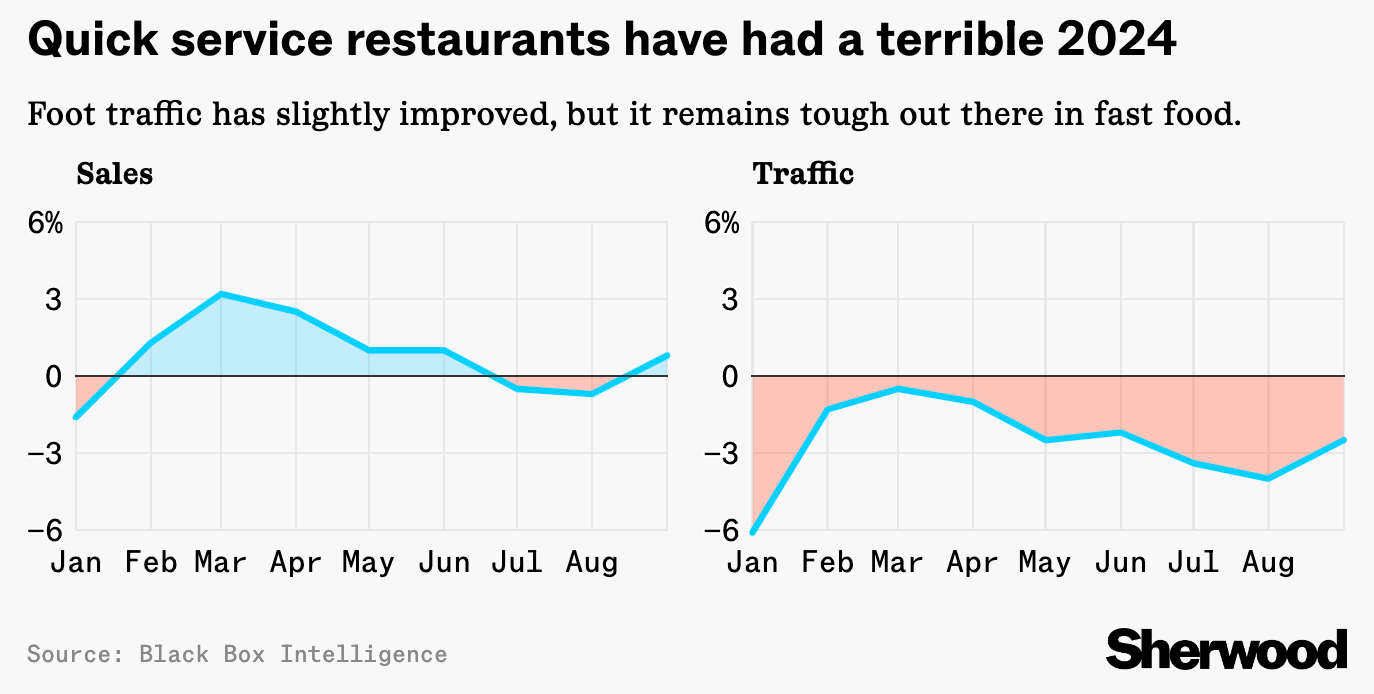

Fast Food Turned From Cheap Eat to a Luxury for Most Americans

Fast food chains are facing a significant shift in consumer perception and behavior due to rising prices. Once known for their affordability, many fast food items are now viewed as luxuries by a majority of Americans.

McDonald's menu prices have doubled, reflecting a 100% increase since 2014, while Taco Bell's prices rose by 81%, and Chick-fil-A's by 55% during the same period.

The average price increase across various fast food items has been around 60% from 2014 to 2024, compared to a national inflation rate of approximately 31% during the same timeframe.

In addition, a Lending Tree survey revealed that 78% of Americans now view fast food as a luxury, with 62% eating less fast food due to costs.

This change has led to decreased foot traffic and sales for major chains like McDonald's and Yum Brands. In response, fast food companies have introduced complex discounting strategies, often through mobile apps, in an attempt to win back customers.

I had a friend tell me to buy Nvidia in August so I did because we enjoy talking stocks and she wanted me to learn how to buy my own stocks. I was up for it and I made sure I could afford to lose the money if things went haywire. Well, 4 months later on $20k I invested in tech stocks she told me to buy, I'm only up about $200. A little lackluster for sure. But I'm a good sport and I'll hang onto all of them and see what they do in the next few years. All the rest of my money is being manages by people who know what they are doing. lol!

Really enjoyed this week's edition!