🤖🦾 Nvidia Posts Strong Sales!

Happy Sunday,

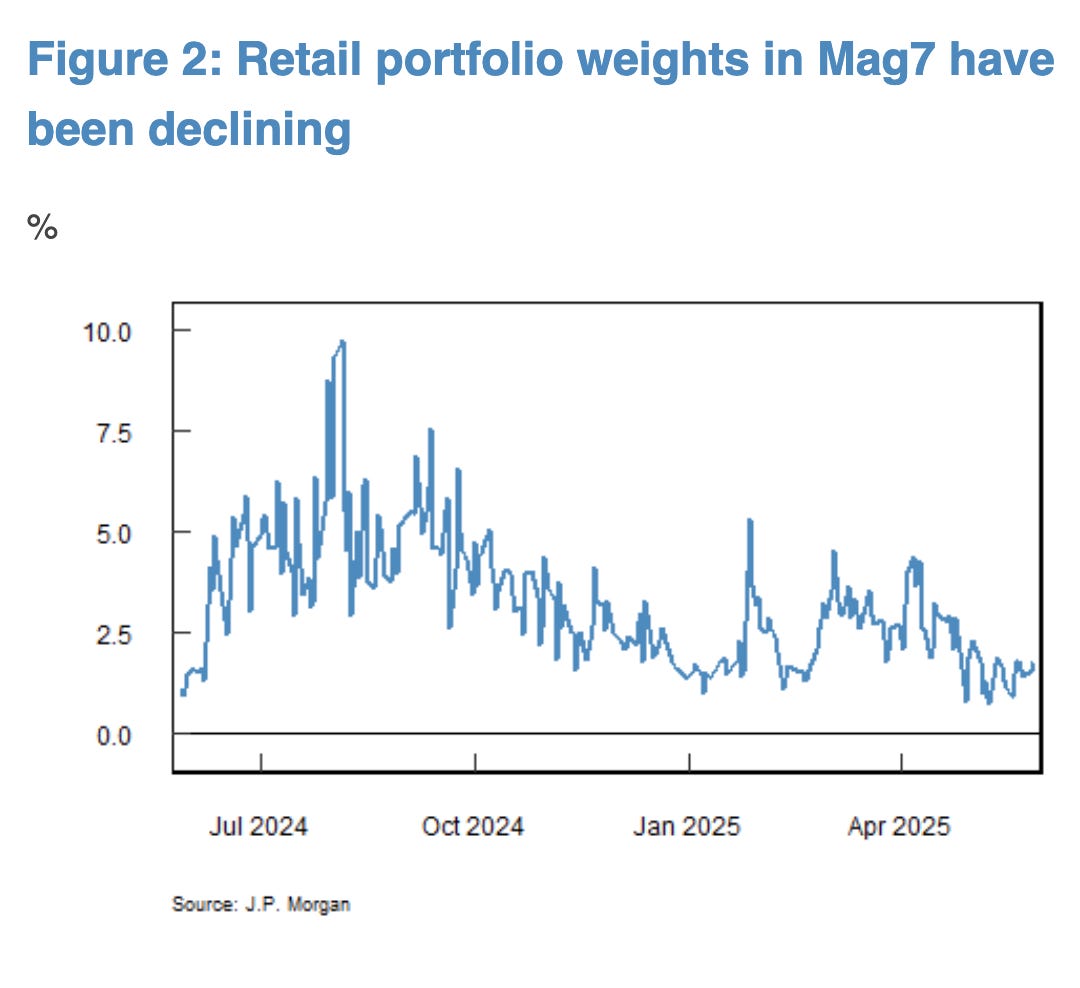

This week, we’re looking at the ripple effects of two major developments: Nvidia’s blockbuster earnings amid rising geopolitical headwinds, and a proposed “revenge tax” that could redefine how foreign capital flows into the US.

In just a few minutes, you’ll learn:

Why Nvidia’s dominance is being tested by restrictions on China

How Middle Eastern AI ambitions could reshape the balance of power

And why a little-known tax proposal might trigger a capital flight

Let’s get into it.

- Humphrey & Rickie

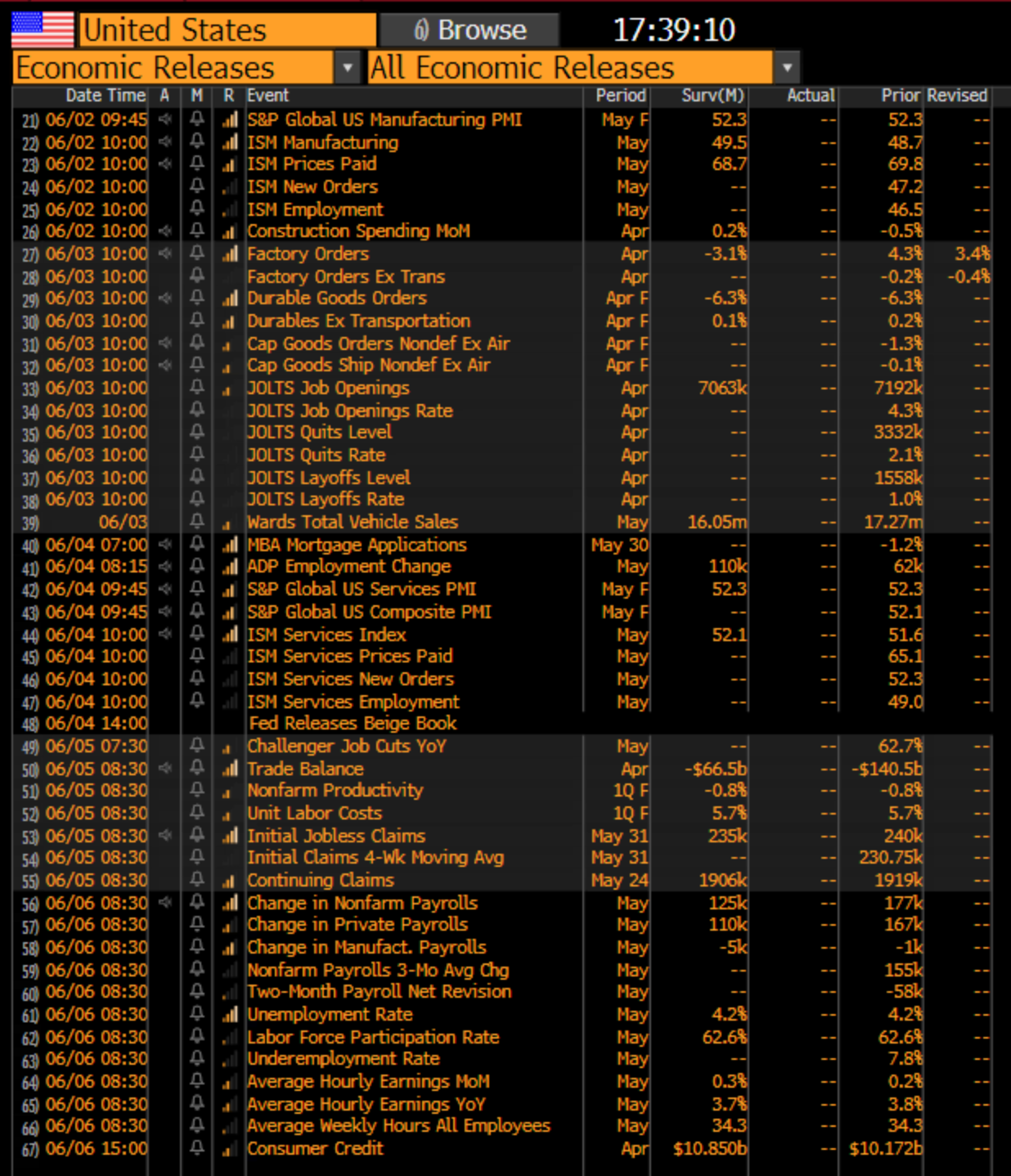

Market Report

Consumer Spending Slows Down as Imports Fall by a Record Amount

US consumer spending saw a slight 0.1% increase in April after a stronger March, while goods imports experienced a record nearly 20% plunge as companies reacted to higher tariffs imposed by the Trump administration on Chinese goods.

This dramatic drop in imports led to a significant narrowing of the US merchandise-trade deficit.

Meanwhile, the Federal Reserve’s preferred inflation gauge, the core PCE price index, remained subdued, rising just 0.1% month-over-month and 2.5% annually, the smallest yearly gain in over four years.

The slump in imports is expected to provide a boost to second-quarter GDP, with the Atlanta Fed forecasting a 3.8% increase.

While real disposable income rose and the saving rate increased, the slight rise in consumer spending was driven by services, offsetting a decline in durable goods purchases, with analysts watching closely to see if companies begin to pass more tariff-related costs on to consumers.

Nvidia Reports Strong Sales Amid China Uncertainty

In the first quarter, Nvidia reported sales of $44.1 billion, a 69% increase year-over-year. The data center unit, a division that’s larger by itself than all of Nvidia’s nearest rivals combined, had sales of $39.1 billion. Gaming-related sales, once Nvidia’s main business segment, were $3.8 billion.

Looking forward, the company expects revenue of $45 billion in the second quarter, though new export restrictions on China will cost Nvidia roughly $8 billion.

In April, the Trump administration placed new restrictions on exports of data center processors to Chinese customers, effectively shutting Nvidia out of the market.

During the earnings call, CEO Jensen Huang said that the company is discussing whether it can come up with something “interesting” for the Chinese market, but has nothing currently.

While Nvidia is being pushed out of China, new opportunities are emerging as President Trump recently visited Saudi Arabia and other states in the Middle East, where he announced large AI projects. This would be a stark reversal from a push by former President Biden to clamp down on the region’s access to AI technology.

New ‘Revenge Tax’ Could Reduce Foreign Investment in the US

A new provision in President Trump's proposed tax bill, referred to as a "revenge tax," would enable the US to impose new taxes of up to 20% on US investments held by foreigners, including governments, individuals, and companies with American operations.

This measure is designed as a retaliatory tool, applicable only when other countries are deemed to be imposing discriminatory or unfair taxes on US\ companies.

While interest on US Treasurys is expected to be exempt, the tax could apply to passive investment income like dividends and interest, as well as profits repatriated by US subsidiaries of foreign firms.

The proposal has sparked concern among investors and analysts, who fear it could escalate trade tensions into a "capital war," reduce foreign appetite for US assets, and negatively impact the dollar.

According to Barclays, European investors have bought around $200 billion of US equities in the past five years.

Industry groups like the Investment Company Institute and the Global Business Alliance have warned that such a tax could inadvertently limit crucial foreign investment in the US, thereby hindering growth in American capital markets and job creation.