🤔🧑💻 Nvidia Beats Earnings but the Stock Price... Goes Down?

Happy Friday all,

This is the rare Hump Days Friday edition, where basically I traveled too much this week that I forgot to send it out on Wednesday, as well as Thursday. Apologies. Sometimes the bulk of the newsletter is written but the intro hinges upon the time that I have to write it. Anyways, updates…

I was in Michigan the past two days visiting with United Wholesale Mortgage, a fun story I’ll have to share with you guys at some point, but they are the nation’s top mortgage lender and I did learn that wholesale interest rates for home loans are usually 1% lower, on average, than a retail mortgage. The trip really opened my eyes to how that industry works - but I still need to do a lot of my own research.

I also have a fun video we’re shooting this weekend, a home tour of a $27 million dollar mansion that is a White House replica, you heard that right. You can gawk at the Zillow listing here, and I’m so excited to bring you guys behind the scenes of what it looks like and also answer… who the heck would buy a White House replica home? It will be posted on the main channel within the next two weeks!

I’m really trying to broaden out the content for you all and still keep it as educational as possible.

Enjoy this week’s Hump Days!

- Humphrey

👀 Eye-Catching Headlines

Allstate Approved to Raise Home Insurance Rates by 34% in Wildfire-Prone California (BBG)

CrowdStrike Cuts Guidance in Wake of Cyber Outage That Hit Millions (WSJ)

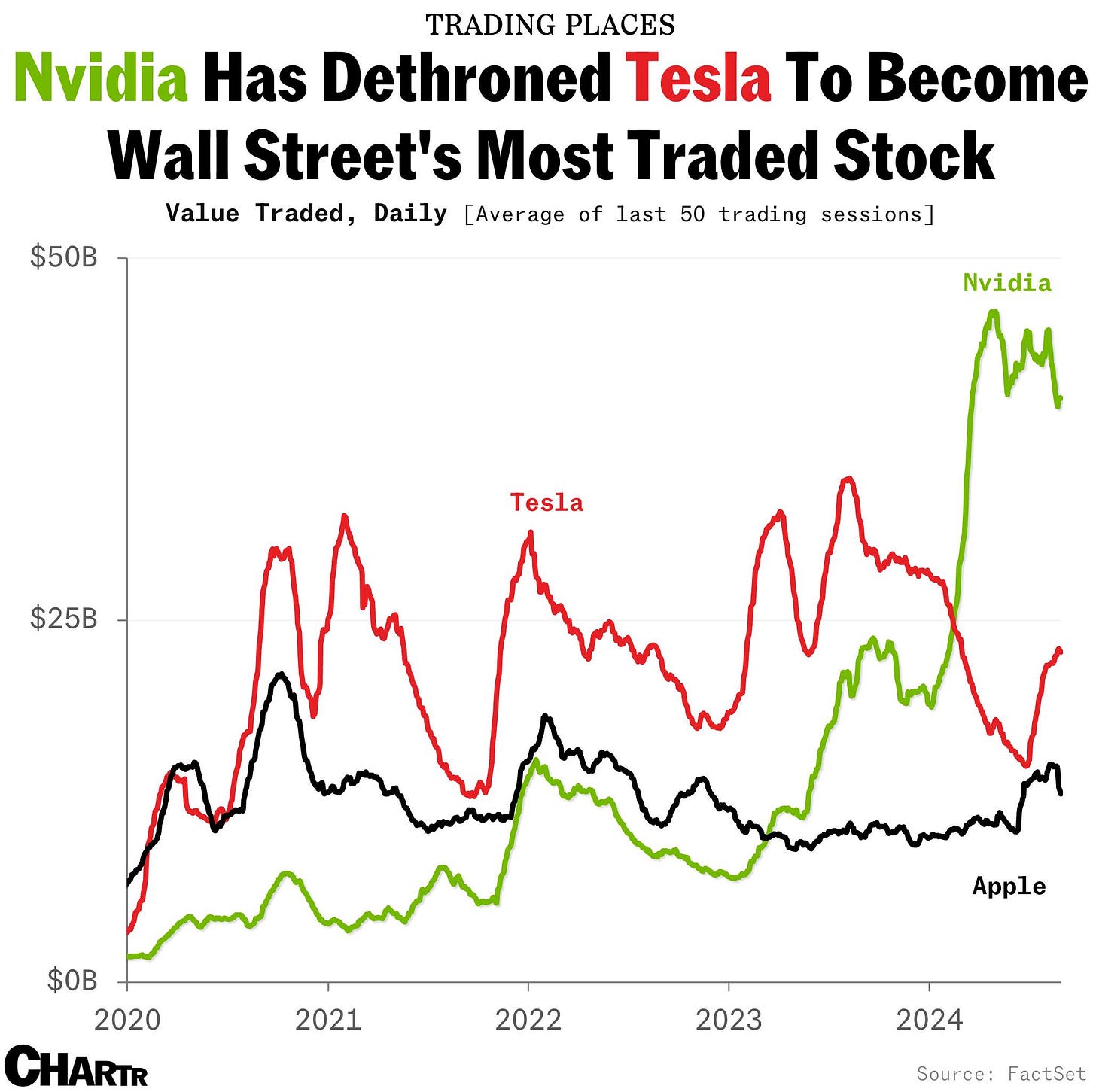

The AI Chip Behind Nvidia’s Supersonic Stock Rally (BBG)

Salesforce beats earnings estimates, CFO Amy Weaver to step down (CNBC)

CrowdStrike beats quarterly consensus but lowers full-year guidance (CNBC)

OpenAI in talks to raise funding that would value it at more than $100 billion (CNBC)

Big Lots Is Considering Bankruptcy Filing After Sales Slump (BBG)

The Weekly Brief

Nvidia Earnings Fails to Impress Investors…

Nvidia's latest quarterly earnings report, while impressive, fell short of the lofty expectations set by investors.

The company reported revenue of $30 billion and earnings per share of $0.68, surpassing analyst estimates of $28.9 billion and $0.65 respectively. Nvidia's forecast for the third quarter, projecting revenue of $32.5 billion, also disappointed some analysts who had anticipated even higher figures.

This, coupled with news of production challenges for the company's upcoming Blackwell chips, led to a decline in Nvidia's stock price by as much as 8.4% in after-hours trading

Despite the market's reaction, Nvidia's performance remains strong, with its data center division generating $26.3 billion in revenue, a 154% increase from the previous year. The company continues to dominate the AI chip market, holding an 80% market share.

CEO Jensen Huang remains optimistic about the future, predicting that a trillion dollars of equipment will be needed to replace outdated gear in data centers worldwide.

However, concerns persist about potential delays in the rollout of the Blackwell chips and whether Nvidia can maintain its impressive growth trajectory in the face of increasing competition and market expectations.

Buffett’s Berkshire Tops $1 Trillion in Market Value

Berkshire Hathaway Inc. has become the first non-tech U.S. company to reach a $1 trillion market capitalization.

The conglomerate, led by Warren Buffett, has seen its stock rally by 30% in 2024, outpacing the S&P 500's 17% gain, driven by strong insurance results and economic optimism.

Despite concerns about its large cash reserves and reduced stakes in companies like Apple, most analysts view Berkshire's "all-weather" portfolio as a strength in the current economic climate.

US Cities Post Higher Unemployment as Many See Wages Squeezed

The July Metropolitan Area Employment and Unemployment report from the Bureau of Labor Statistics showed a broad-based slowdown in U.S. labor markets.

Unemployment rates increased in 350 out of 389 metropolitan areas compared to July 2023, with eight large metro areas showing lower employment levels than in July 2019.

While national unemployment remains historically low, this widespread weakening has influenced the Federal Reserve's decision to consider interest rate cuts.

Las Vegas led major cities in job gains with a 3.7% increase, followed by Salt Lake City, Miami, Phoenix, and Richmond.

Notably, average weekly earnings declined in 43% of metropolitan areas, including in five of the eight highest-paying areas, suggesting a squeeze on wages alongside rising unemployment.