🚨📺 New Tariffs, Inflation Climbing & a Surprising Media Winner

Happy Sunday,

The economy is shifting, and the signs are everywhere. Consumer spending is stalling while inflation creeps back up, with Americans saving more and sentiment hitting a two-year low. At the same time, new tariffs on steel and aluminum are driving up costs for manufacturers, adding more pressure to an already fragile market. And in the media world, YouTube just overtook every other platform in TV viewing, signaling a massive shift in how audiences—and ad dollars—are moving.

Let’s get right into it!

- Humphrey & Rickie

Market Report

US Consumer Spending Barely Rises While Key Inflation Gauge Picks Up

Consumer spending in the U.S. remained weak in February, rising just 0.1% after a January slump largely attributed to bad weather.

Notably, spending on services declined for the first time in three years as Americans cut back on dining out and other discretionary services amid rising prices.

Inflation-adjusted disposable income also edged up by only 0.1%, reflecting growing financial strain on households. While spending on durable goods like cars rebounded, likely in anticipation of upcoming tariffs, overall consumer sentiment has fallen to its lowest level in over two years.

Inflation pressures are also mounting, with the Federal Reserve’s preferred core personal consumption expenditures (PCE) price index rising 0.4% month-over-month and 2.8% year-over-year—well above the Fed’s 2% target. This comes as President Trump’s tariff policies threaten to drive prices higher, raising concerns about stagflation or even recession.

The saving rate climbed to its highest level since June, suggesting consumers are prioritizing financial security over spending.

With the Federal Reserve holding interest rates steady for now, the market is expecting 3 rate cuts later this year to support growth as inflation and economic uncertainty weigh on households.

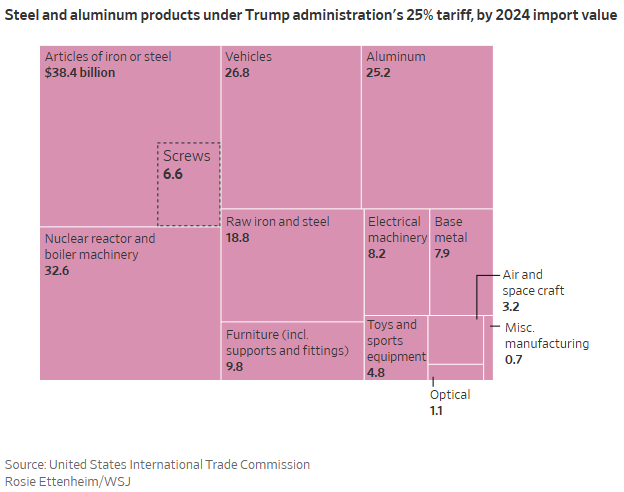

Tariffs on Steel and Aluminum Are Starting to Hit Manufacturers

President Trump’s expanded tariffs on steel and aluminum imports are beginning to cause ripple effects across US manufacturing supply chains, driving up costs for screws, nails, and bolts - essential components in industries ranging from automotive to construction.

The new 25% tariffs cover a broader range of products than previous levies, including fasteners, which now face additional import taxes layered on top of existing duties.

Manufacturers are struggling to find domestic suppliers for these components, as the US lacks sufficient production capacity for steel wire and fasteners to replace imports.

The price hikes are being felt across industries, with screws imported from China now costing 70% more due to combined tariffs. Domestic steel producers are also raising their prices, further straining manufacturers who rely on imported materials.

Price-sensitive customers in industries like automotive and appliances are pushing back against cost increases, forcing manufacturers to either absorb the added expenses or pass them along—a tough choice in an already challenging economic environment.

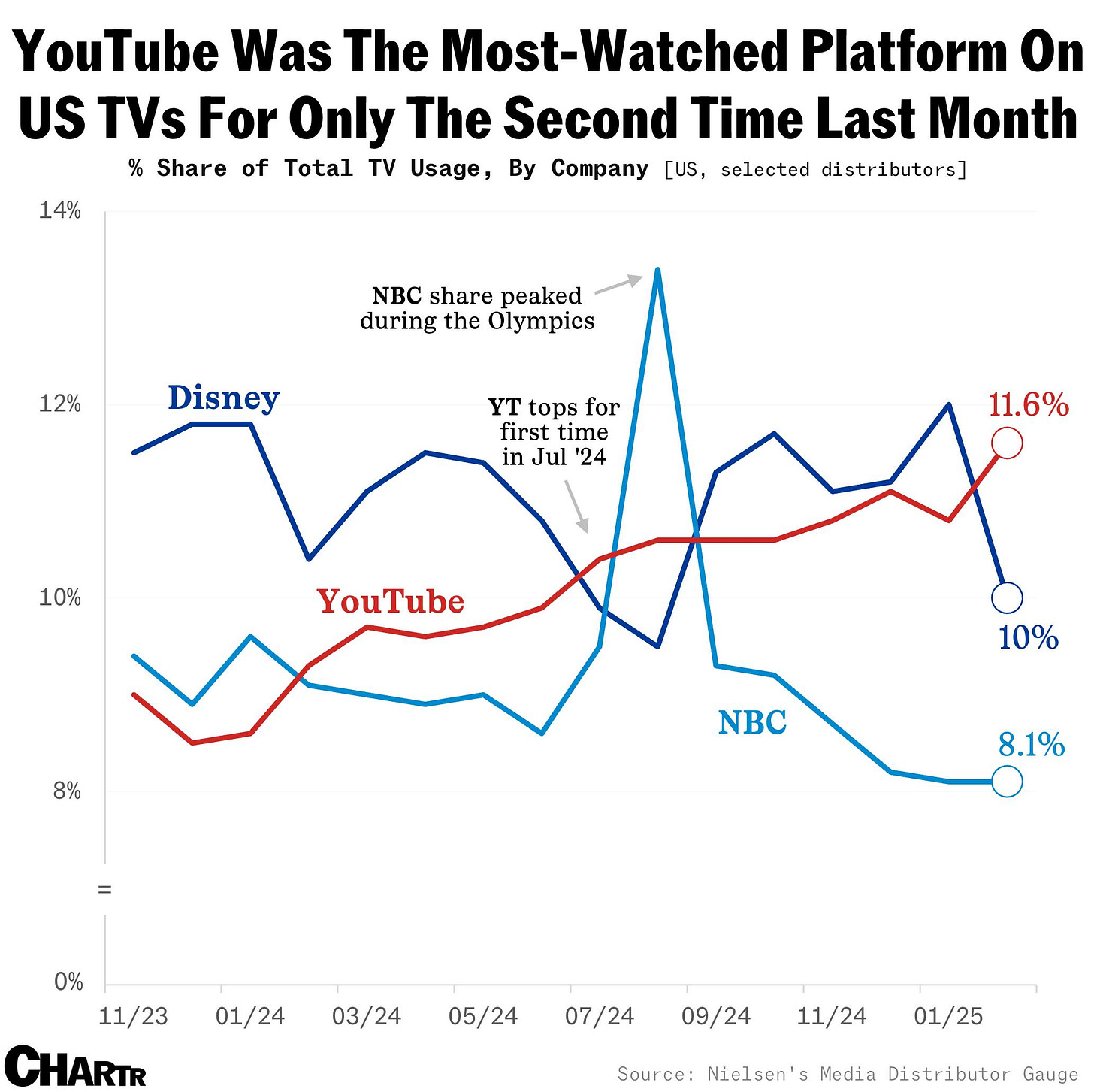

Americans watched YouTube more than any other platform on TVs

YouTube reached a significant milestone in February 2025, capturing an 11.6% share of US television viewing, according to Nielsen’s Media Distributor Gauge report.

This marks the platform’s best performance to date and the second time it has topped Nielsen’s rankings since tracking began in November 2023.

YouTube’s growth reflects a shift in viewing habits, with more Americans watching content on their TVs rather than phones or computers. Viewership has surged by 53% over the past two years, driven largely by older audiences; adults aged 65+ now account for 15.4% of YouTube’s TV usage, nearly doubling their contribution since February 2023.

Disney, which led the rankings in January with a 12% share, thanks to College Football Playoff broadcasts, fell to second place at 10% in February. Meanwhile, Fox climbed to third with an 8.3% share, boosted by record-breaking Super Bowl viewership across platforms like Fox Broadcast and Tubi.

Forecast Ahead

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.