⛽️❌ New Russian Oil Sanctions Coming?

Happy Wednesday all,

I’m currently in Los Angeles! I’m attending a YouTube AAPI end of year event tonight. This feels very surreal to me because I will be presenting an award to a bigger YouTube channel tonight in front of many peers I respect and have watched for a very long time. It also feels surreal to me because I don’t think I’ve “made it” in terms of YouTube but being invited to these events is prestigious and I’m grateful to be there.

This YouTube / Social Media thing is fascinating as a profession because you are constantly defined by external numbers (followers, subscribers, views) - and that means “something” to someone out there — but at the very center of it… you are still just, you. I don’t feel any different today than I did 5 years ago when I started making content. Numbers get bigger, I stay the same.

I’ll be sure to share some pictures or stories in the next edition of Hump Days, but until then, hope you’re having a good week and today’s edition is jam-packed, as usual.

- Humphrey & Rickie

👀 Eye-Catching Headlines

GM exits robotaxi market, will bring Cruise operations in house (CNBC)

Dividend Stocks Are Primed for a Comeback in 2025 (WSJ)

Kroger-Albertsons Merger Blocked by Court, Handing Victory to Biden Antitrust Enforcers (WSJ)

BLS Needs Culture Revamp After Botched US Releases, Review Finds (BBG)

Mondelez Exploring Takeover of US Chocolate Maker Hershey (BBG)

Xi Readies Bargaining Chips for US Trade War (BBG)

US Labor Costs Revised Down in Sign of Easing Inflation Pressure (BBG)

The Weekly Brief

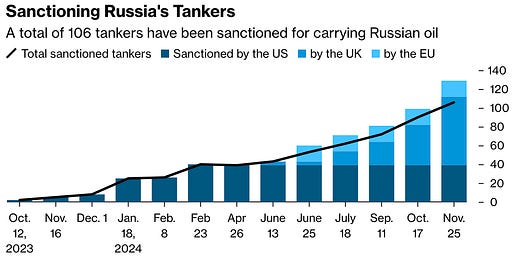

US Considers New Russia Oil Sanctions to Weaken Russia

The Biden administration is considering implementing stricter sanctions on Russia's oil trade in its final weeks before Donald Trump takes office.

These potential measures could target Russian oil exports and the tanker fleet used to transport Russian oil.

The new sanctions could resemble those imposed on Iranian oil, potentially punishing buyers of Russian crude. While this approach carries risks, including potential global economic strain and tensions with major Russian oil consumers like India and China, the Biden administration hopes to strengthen Ukraine's position in any future negotiations.

US Job Postings Requiring College Degree Decline in Indeed Data

The US job market has seen a notable shift in educational requirements since the pandemic, with the share of job postings requiring a bachelor's degree declining from about 20% in 2019 to 17.6% in October 2024, according to data from Indeed Hiring Lab.

This change could potentially open up tens of thousands more job opportunities for the over 60% of Americans without a college degree.

The trend was driven by labor shortages during the pandemic recovery, prompting employers to find skilled workers regardless of formal education, with major companies like IBM dropping degree requirements to expand their candidate pool.

Many recent grads are finding it more challenging to secure jobs matching their skills, with over 40% being underemployed in positions that typically don't require a university degree, according to a Federal Reserve Bank of New York study.

Walgreens in Talks to Sell Itself to Private-Equity Firm

Walgreens, a major pharmacy chain, is reportedly in talks with private equity firm Sycamore Partners for a potential sale that could take the company private in early 2025.

This news comes as Walgreens has faced significant challenges, with its market value plummeting from over $100 billion in 2015 to around $7.5 billion before the deal talks were reported.

The company's shares have been on a downward trajectory for nearly a decade due to pressures on both its pharmacy and retail businesses, exacerbated by competition from e-commerce giants and stagnating margins in the retail pharmacy sector.

Despite attempts to diversify and restructure under new CEO Tim Wentworth, including closing underperforming stores and scaling back its primary-care business, Walgreens has struggled to turn things around.