📺📈 Netflix Shares BOOM After Subscriber Growth

Happy Wednesday all,

I hope you are doing well. I worked on a 1 hour long tutorial type video the past week on the entire Stock Market. That video is being edited now and will provide a lot of value to you in the coming weeks when it goes up on YouTube.

In personal news, I’m going to Paris February 10-17th! I’m going for a conference. Any recommendations, please send them my way. I’m also thinking about starting a podcast, but that is still a work in progress in my head.

In terms of the markets, halfway through the week, and we’ve got some key stories that are making waves across industries and markets. From Netflix’s record-breaking subscriber growth to President Trump’s ambitious AI venture, and his latest tariff threats—there’s a lot to unpack. Dive into this week’s headlines and key updates to stay ahead of the curve.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Netflix to hike prices on standard and ad-supported streaming plans (CNBC)

Microsoft loses status as OpenAI’s exclusive cloud provider (CNBC)

Procter & Gamble earnings beat estimates as shoppers buy more household staples (CNBC)

A List of Trump’s Key Executive Orders—So Far (WSJ)

‘We Still Have an Inflation Problem.’ A Fed Newcomer Wants to Go Slow on Rate Cuts. (WSJ)

Pension Funds Want Private Equity to Open Up About Fees and Returns (WSJ)

United Sees Profit Rebound as Airlines Buck Winter Doldrums (BBG)

Elon Musk’s Politics Are a Sales Opportunity for Polestar, CEO Says (BBG)

The Weekly Brief

Netflix Shares Soar to Record After Huge Gain in Subscribers

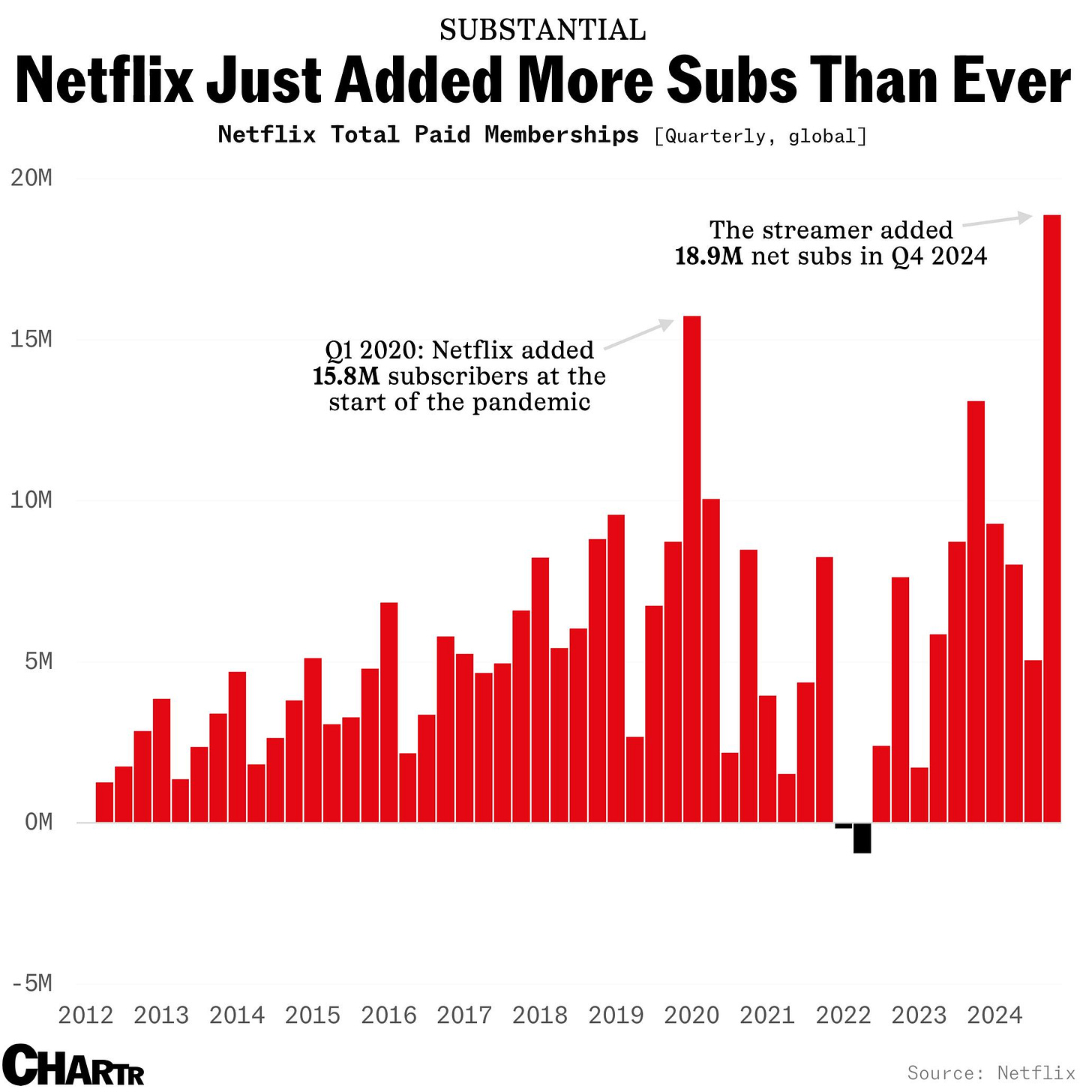

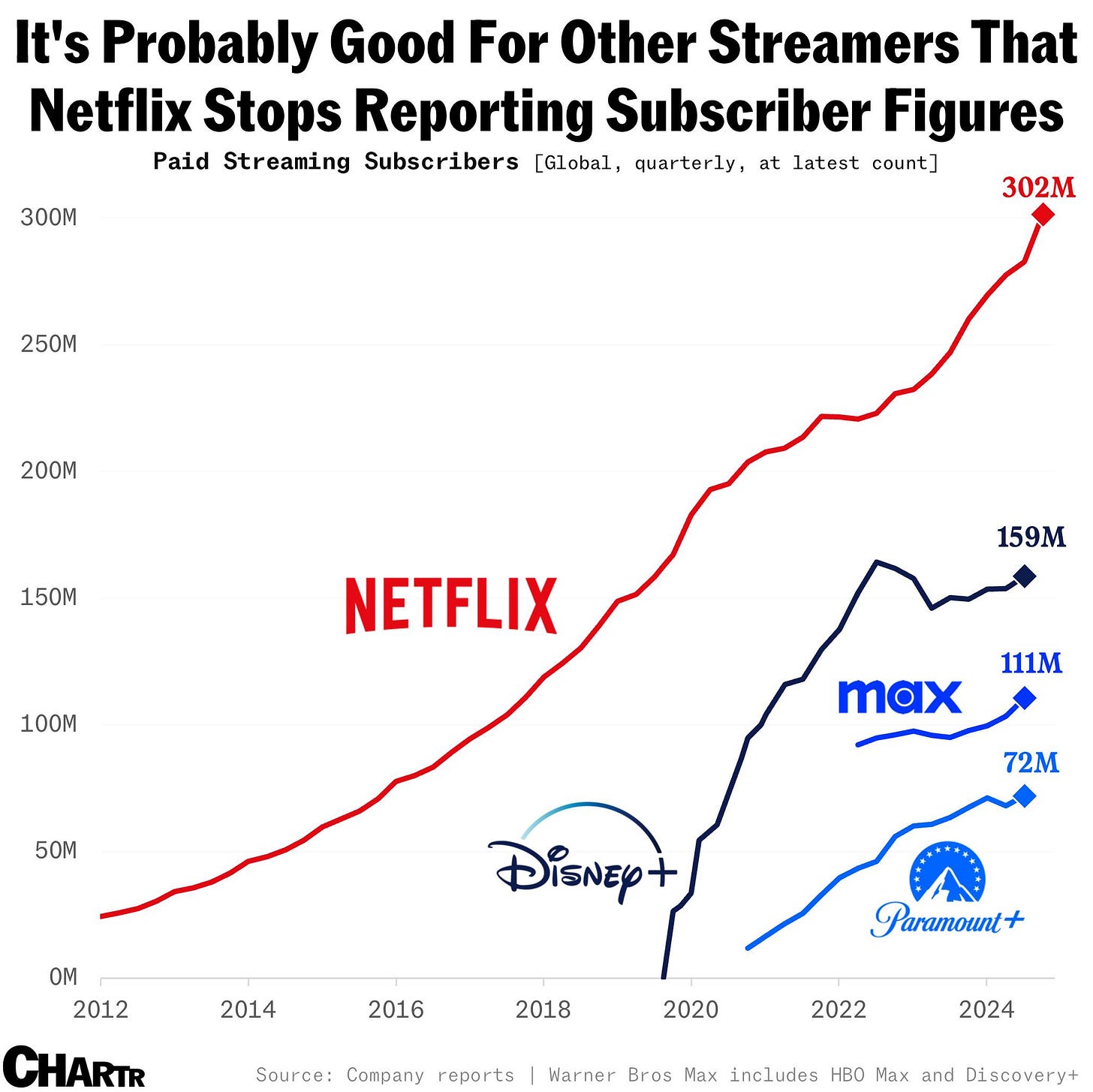

Netflix reported its largest quarterly subscriber gain in history, adding 18.9 million customers in the fourth quarter of 2024. This record-breaking growth brought Netflix's global subscriber base to over 300 million, surpassing Wall Street expectations.

The company's success this quarter was attributed to its first major live sporting events (Christmas NFL games), the return of popular series like "Squid Game," and the introduction of new content such as the Jake Paul vs. Mike Tyson boxing match.

The company reported a 16% increase in revenue to $10.2 billion for the quarter and projected revenue growth of up to 14% for 2025, reaching as much as $44.5 billion.

Netflix also announced price hikes in several markets, including the US, where the most popular plan will increase by $2.50 to $17.99 per month.

This quarter also marks a significant shift in Netflix's reporting strategy, as it will be the last time the company discloses quarterly subscriber numbers.

President Trump Announces $500bn AI Infrastructure Venture w/ SoftBank, OpenAI, and Oracle

President Donald Trump announced a major joint venture yesterday aimed at boosting artificial intelligence infrastructure in the United States. The initiative, called "Stargate," involves SoftBank Group Corp., OpenAI, and Oracle Corp., with an initial investment of $100 billion and a goal to increase to $500 billion.

The venture plans to build new infrastructure for OpenAI, including data centers and physical campuses, with the first computing system to be constructed in Texas. The president said he would use executive orders to help ease regulations surrounding construction projects, including through easier access to energy.

The announcement was made at the White House, with Trump joined by SoftBank's Masayoshi Son, OpenAI's Sam Altman, and Oracle's Larry Ellison.

While SoftBank and OpenAI are the lead partners, SoftBank will be in charge of financing, and OpenAI will oversee operations. Other technology providers include Arm Holdings, Microsoft, and Nvidia.

Trump Threatens to Impose 25% Tariffs on Mexico & Canada, 10% on China

President Trump announced plans to impose 25% tariffs on imports from Canada and Mexico, potentially starting February 1, 2025. Trump cited concerns about illegal immigration and drug trafficking as the primary reasons for these tariffs.

This move comes despite the existing United States-Mexico-Canada Agreement (USMCA) and could significantly impact the $1.8 trillion in goods and services trade between the three countries.

The proposed tariffs have already caused market reactions, with the Canadian dollar and Mexican peso falling against the US dollar. Both Canada and Mexico have indicated they would retaliate if these tariffs are implemented, potentially triggering a trade war.

Trump has also hinted at potential tariffs on other countries, including China and the European Union, suggesting a broader protectionist stance in his trade policy.

While he has not yet imposed immediate tariffs on China, he has ordered a review of trade practices due by April 1, 2025.