🎥🍿 Netflix Earnings Out...

Happy Sunday,

Today is Easter, it’s also 4/20. So if you were a weed-smoking believer of Jesus, it’s probably a really good day for you. Bonus points if you celebrated exactly at 4:20 PM today.

I’m currently in Los Angeles, and I'm going back home today. I came down to see a few friends down here, but also got some good work done. I also sort of ran 9.5 miles with the Venice Run Club. I say sort of because they abandoned me / are disorganized, so I got lost. The run club in SF I run with at least waits up for you and makes sure you know the route. But hey, I still had fun.

I hope you enjoy today’s edition of Hump Days, we’ll see you on YouTube this week!

- Humphrey & Rickie

Market Report

Netflix reported a record profit for the first quarter of 2025, significantly easing concerns about potential slowdowns amid economic uncertainty. Earnings per share jumped 25% to $6.61, surpassing analyst predictions, while sales met expectations at $10.5 billion.

This performance was attributed to recent price increases and a strong global programming lineup. For the first time, Netflix didn’t disclose subscriber addition numbers; instead, it focused investors on traditional financial metrics like revenue and profit.

Netflix gave strong guidance for Q2, forecasting 15% sales growth and a 44% jump in earnings, again exceeding Wall Street estimates.

Management indicated they see no significant negative impact from broader economic trends or market volatility, citing the historical resilience of entertainment during downturns and the availability of lower-priced subscription options.

Looking even further ahead, the WSJ revealed that Netflix had long-term goals aiming for a $1 trillion market capitalization by 2030. This includes plans to double annual revenue from 2024 levels, achieve approximately $9 billion in global ad sales, triple operating income, and grow its subscriber base to around 410 million by focusing on international markets like India and Brazil.

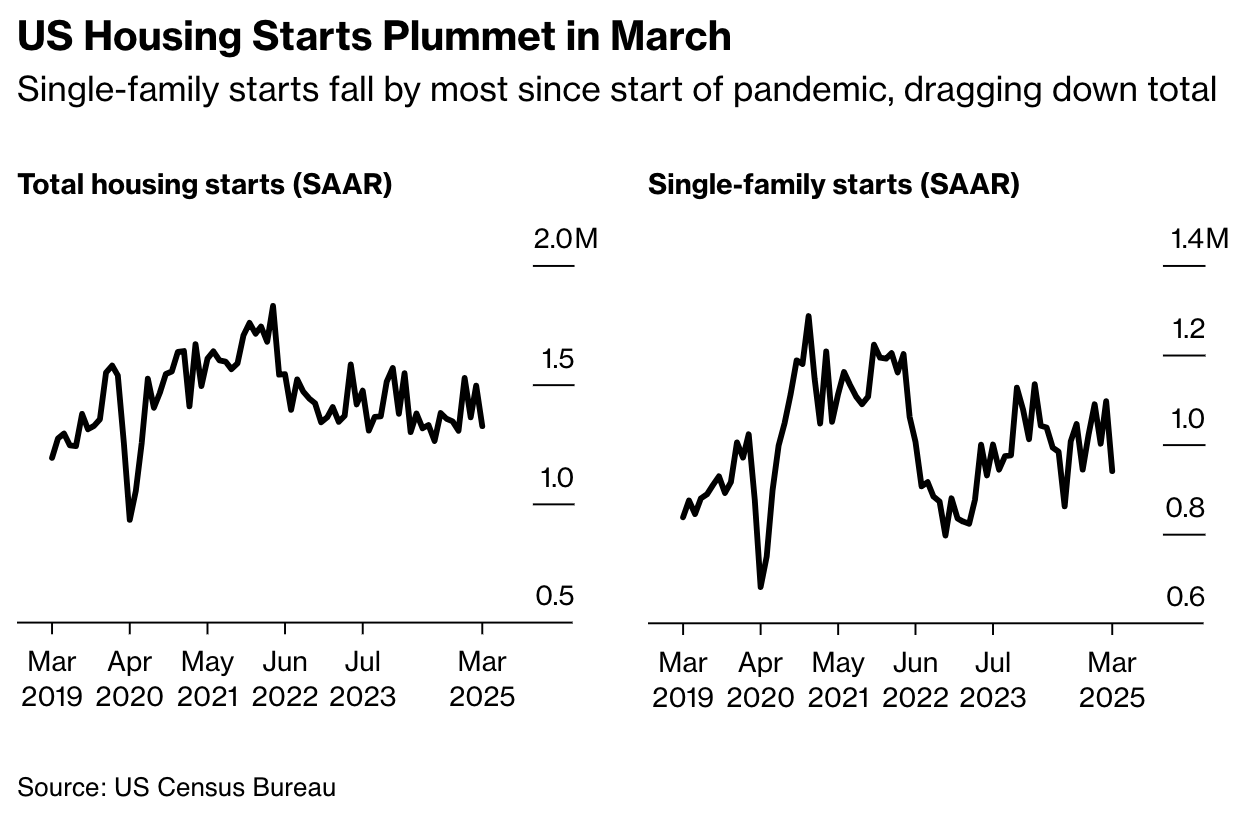

Housing Construction Slows as Tariffs Drag Down Builder Confidence

New residential housing construction fell by the most in March in a year, as weaker demand and high mortgage rates persisted.

Construction of new single-family homes dropped 14.2% to an annualized 9.40 million rate, the steepest decline since the onset of the pandemic.

Prices have somewhat declined from their peak as homebuilders have tried to use incentives and promotions to clear excess inventory, which is the largest since 2007.

In its first quarter earnings call, one of the homebuilding giants, Lennar, said that demand for homes has struggled as consumers have been increasingly tight with high levels of personal debt, hurting their ability to get mortgages.

US Judge Rules Google Illegally Monopolized Ad Tech Markets

In a significant setback for Google, a US District Judge ruled last week that Alphabet illegally monopolized the markets for online advertising exchanges and publisher ad servers – the tools websites use to sell ad space.

The judge found Google engaged in a decade-long pattern of "willful" anticompetitive conduct to acquire and maintain its dominance in these areas, harming rivals, publishers, and ultimately consumers through exclusionary practices.

This ruling marks the second time in a year a court has found Google to be an illegal monopolist, following a previous decision regarding online search.

While the Justice Department and states initially sought a breakup of Google's ad tech business in 2023, the Court found that Google's key acquisitions (DoubleClick and Admeld) were not anticompetitive, potentially making a forced divestiture more challenging.

Google plans to appeal the adverse parts of the ruling, while the Justice Department hailed it as a major victory.