🧠🤖 More Chips... Need More Chips

Happy Wednesday all,

Markets are cooling, bond yields are surging, and AI keeps demanding more of everything—data, chips, even water. Meanwhile, Trump’s bold new investment plans and Honda’s fresh EV lineup signal big moves ahead. This week, we’re covering the slowdown in US job growth, climbing mortgage rates, and how rising bond yields could spell trouble for stocks.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

AI Wants More Data. More Chips. More Real Estate. More Power. More Water. More Everything (BBG)

Ackman Chases 1,200% Profit on Trump Trade (BBG)

Trump Imagines New Sphere of U.S. Influence Stretching From Panama to Greenland (WSJ)

Honda reveals two new ‘0 Series’ EVs to be produced in Ohio (CNBC)

Trump announces $20 billion foreign investment to build new U.S. data centers (CNBC)

The Weekly Brief

US Firms Add 122,000 Jobs in ADP Data, Fewest Since August

The US labor market showed signs of moderation in December 2024, according to ADP Research Institute data. Private-sector employment increased by 122,000, the smallest gain in four months and below economists' expectations of 140,000.

This slowdown in hiring was accompanied by a cooling in wage growth, with workers who changed jobs seeing a 7.1% increase in pay, while those who stayed in their positions experienced a 4.6% gain, the slowest since mid-2021.

Education and health services, construction, and leisure and hospitality saw the largest increases, while manufacturing, natural resources and mining, and professional and business services experienced declines.

Last Time Bond Yields Surged Like This, Stock Markets Sank

The US 10-year Treasury yield has climbed to almost 4.7%, the highest level since April, following a surge of over one percentage point since mid-September 2024. The rise in bond yields is pretty similar to back in 2022 and 2023, which were also accompanied by significant declines in global stocks.

However, the current stock market rally has only experienced a mild slowdown, which leads some analysts at Goldman Sachs to believe there could be potential for further downside if yields continue to increase.

Goldman Sachs analysts noted that the correlation between equity and bond yields has turned negative again, indicating that continued yield increases without positive economic data could negatively impact equity markets.

The rise in yields is primarily driven by increases in longer-maturity rates and real yields, reflecting concerns about US fiscal and inflation risks.

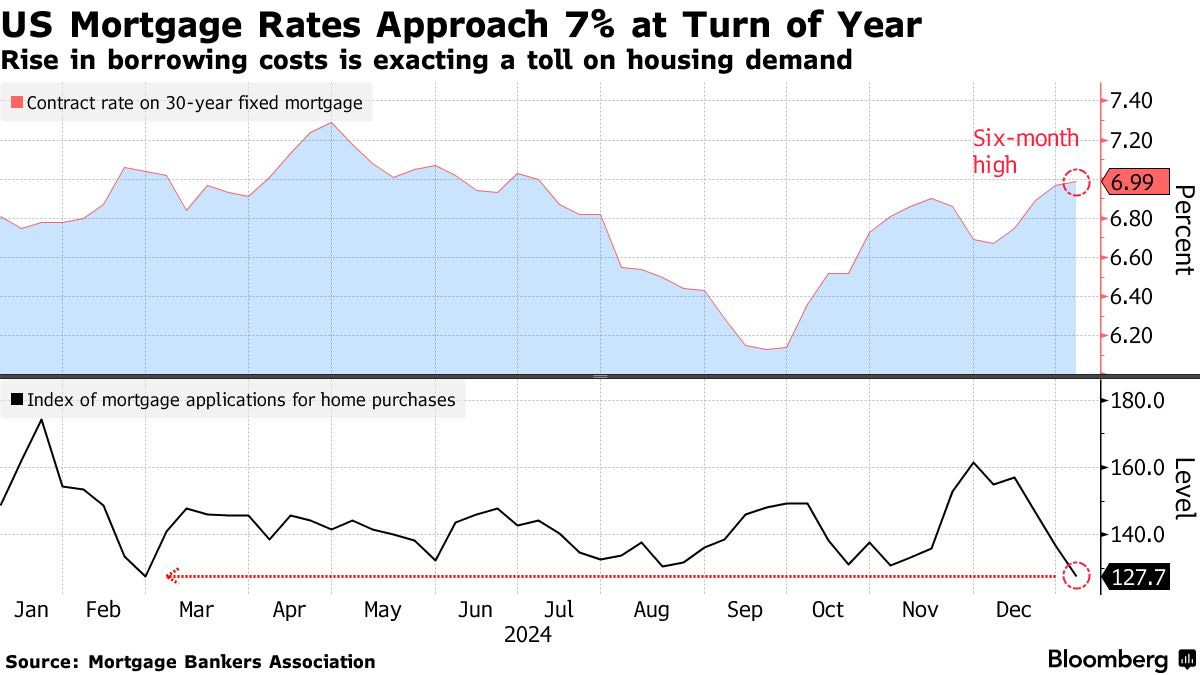

US 30-Year Mortgage Rate Just Shy of 7% Weighs on Home Purchases

According to the Mortgage Bankers Association (MBA), US mortgage rates edged up to near 7% and home-purchase applications fell to the lowest level since February 2023.

MBA’s index of home-purchase applications declined 6.6% while the refinancing index increased 1.5%.

Mortgage rates generally track the 10 year US Treasury yield, which are soaring due to strong economic data, fewer rate cut expectations, and concerns about inflation.

You’ll Find This Interesting

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.