Good morning,

Usually this edition would have been sent on Sunday, but yesterday when the Stock Market Futures market showed the market was down catostrophically, I wanted to wait until this morning to see if any new developments occurred.

Here’s what’s going on this morning:

The S&P opened at about -4% this morning and has now recovered slightly — trading closer to flat, even at times up to +2% on the rumor that Trump is considering a 90 day pause in tariffs for all countries except China. Now, if the S&P 500 closes down 4%, that would be three days in a row and would be the first time since the Great Depression.

The Federal Reserve has decided to have a closed door meeting to discuss the advance and discount rates.

Over the weekend while we did have some countries like India, Vietnam, and Taiwan have agreed to zero out their tariffs, with the total list of 50 countries calling to negotiate.

What You Should Do:

If you’re a passive investor you have nothing to worry about, stay objective, don’t get too emotional. If you had sold during the flash crash of COVID (which I personally know many people who did), the market recovered less than 3 months later and they lost out on a bunch of gains moving forward.

If you have extra cash, you can consider dollar cost averaging as the market goes downward - while it doesn’t feel amazing in the short term, in the long term (10+ years) you would expect the market to be up more than it is today.

- Humphrey & Rickie

Market Report

American “Liberation Day” Shocks the World as Reciprocal Tariffs Put On

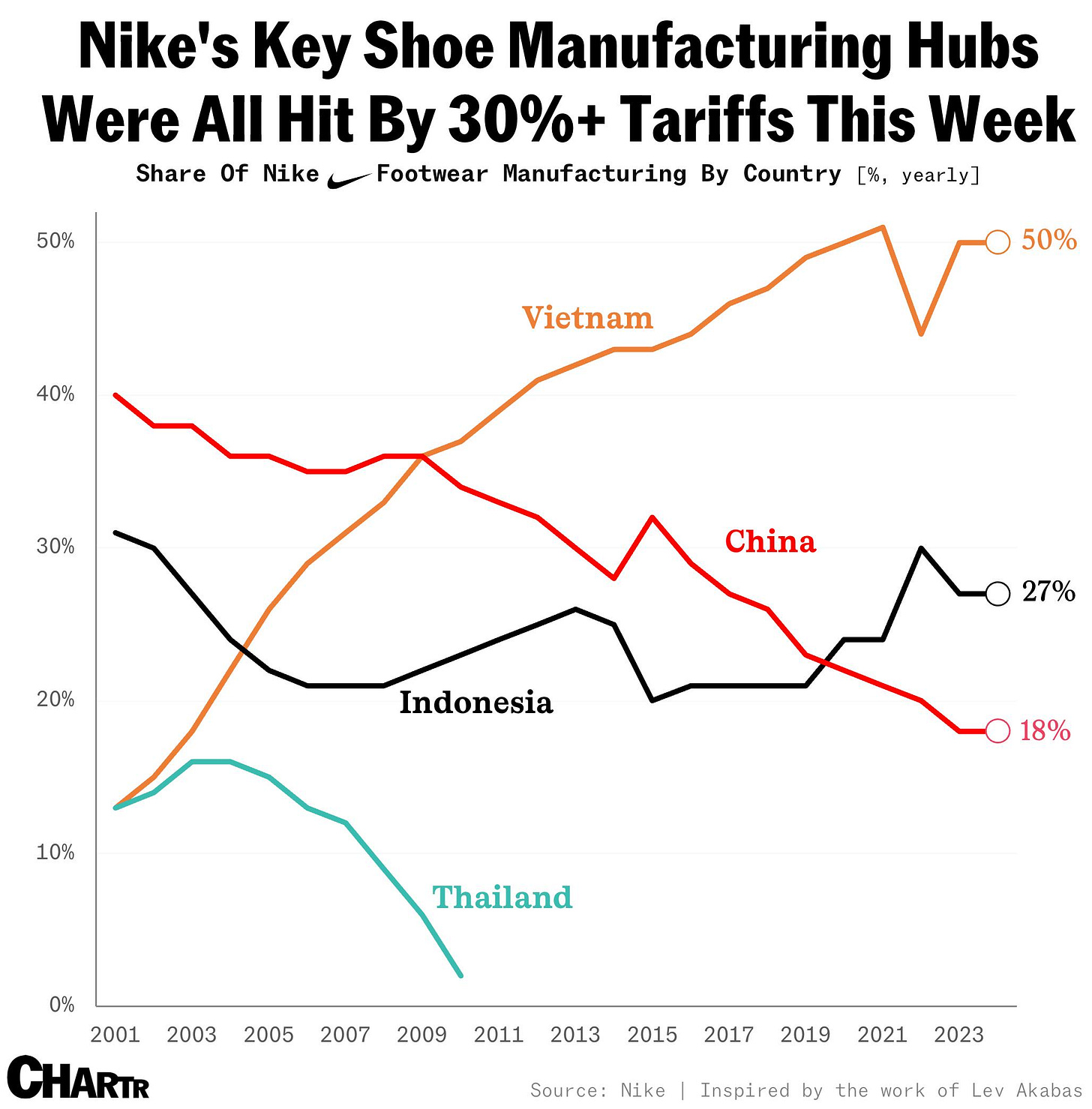

On April 2nd, President Trump announced that the US would impose ‘reciprocal’ tariffs on countries across the world. A flat 10% would be placed on all goods arriving abroad, while imports from 60 countries the US has a trade deficit with would receive higher levies.

What is the point of these tariffs? In the Trump administration’s view, America has been exploited by its trading partners, who have protected their own economies from fair competition to the detriment of US manufacturers.

What are reciprocal tariffs? A reciprocal tariff is a tax or import duty that a country imposes on goods from another nation as a direct response to similar tariffs that the second nation has already placed on the first country's exports.

These retaliatory measures basically say, "if you tax our products, we'll tax yours in return."

How did the Trump administration calculate tariff rates? The US Trade Representative posted an explanation detailing its methodology for calculating tariffs.

While the formula may look intimidating, it ultimately boils down to a country’s trade surplus with the US divided by its total exports.

From the US perspective, the tariff would be our trade deficit with the foreign country divided by total imports from that country.

How have countries reacted to these US tariffs? Several countries have announced retaliatory measures in response to the Trump administration's reciprocal tariffs.

China has already implemented a 34% tariff on all goods imported from the US. while Canada has stated it will match the US auto tariffs in addition to keeping existing tariffs on other American goods .

The European Union has also voiced its intention to implement countermeasures, which may include reinstating previously suspended tariffs on steel and aluminum and imposing new tariffs on specific US exports.

On the other hand, some countries have explored or offered to lower their tariffs on goods from the United States. Vietnam has proposed completely removing all tariffs on imports from the US in an effort to reach a trade agreement while Taiwan has indicated its intention to negotiate with the US towards a "zero tariff" framework, aiming to eliminate trade barriers rather than retaliate.

US Hiring Picks Up In March Amid Tariff Worries

US job growth beat all expectations in March as the labor market remained resilient amidst tariffs and global trade tensions. Nonfarm payrolls increased by 228,000 while unemployment ticked up 0.1%.

However, when looking deeper at the data, some one-off factors helped with the unexpected jump in payrolls.

Leisure and hospitality employment jumped due to a rebound from bad weather while retail employment bounced back partially due to the resolution of workers on strike at Krogers.

Some analysts also speculate that the jump in transportation and warehousing payrolls could be due to companies’ strategy to rush goods into the country before tariffs kick in.

On the other hand, federal government payrolls posted the first back-to-back decline since 2022 as the Trump administration continues with plans to shrink the federal workforce. As many as 500,000 government-related jobs could be cut by the end of the year.

Trump Extends TikTok Deal Deadline by 75 Days

ByteDance is currently in discussions with the US government to find a way for TikTok to continue operating in the United States, following an extension that provides an additional 75 days for ByteDance to reach a deal to sell TikTok to an American buyer.

A leading proposal involves a group of US investors, including Oracle, Blackstone, and Andreessen Horowitz, which would see a spin-off of TikTok's US business with new outside investors holding 50% ownership, existing US investors holding 30%, and ByteDance retaining a minority stake just under 20%.

However, the current proposed arrangement faces scrutiny, particularly regarding the plan to keep TikTok's algorithm under ByteDance's control, which critics argue fails to address national security concerns about potential Chinese influence and data access.

President Trump has expressed optimism about reaching a deal and has even suggested potential tariff relief in exchange for China's approval.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.

Great Hump Day post! In particular, I like the beginning, the brief discussion about dollar-cost averaging and being a passive investor, which I do practice and am -- and am fortunate to be. Overall a great read this Monday afternoon.

Have a great week!