Happy Sunday,

I haven’t personally written an intro in a few editions now, so I apologize about that. Life has been a little crazy lately and I’ve been heads-down making a lot of content.

Personal Finance is one of those content topics that is hard to innovate around, and once you make all the videos you need to make (affordability, budgeting systems, stock investing, etc), it can start to feel repetitive in nature. Perhaps that’s why all the other finance creators start going toward News videos, or other creators go toward the “live-call” model that Dave Ramsey has where people call in about their situations. It provides a novel way to still learn personal finance concepts.

I’ve been thinking about how I want to freshen up the content on YouTube as well as short-form platforms, and so far I don’t have that many good leads. If you have any opinions, I’d love to hear from you (you can reply directly to this email), while I can’t guarantee I use your opinion or idea, it still would be fun to see what you think could be interesting. It has been 5+ years of making videos on YouTube, and I do think this is a natural part of the process - and one strength of mine is staying consistent. I’ll continue to do so until innovation or inspiration strikes.

In personal news, I’ve been ramping up the running mileage, did 7.5 miles yesterday and it felt pretty good. Planning on a marathon at the end of this year. Will keep you posted. Enjoy this.

- Humphrey

Market Report

US Jobs Report Shows Evidence Labor Market Is Softening

The February US jobs report presented a mixed economic picture with both positive signals and concerning trends. Nonfarm payrolls increased by 151,000 (slightly below expectations of 160,000), while the unemployment rate rose to 4.1%.

While job growth occurred in healthcare, transportation, and financial activities, government payrolls showed their weakest growth in nearly a year, with federal employment declining significantly.

Other concerning indicators include a record 8.9 million Americans holding multiple jobs, more people working part-time for economic reasons, and a participation rate that fell to a two-year low.

Economists warn that federal job cuts could lead to over 500,000 job losses by year-end when considering broader economic spillover effects.

Despite growing uncertainty in the labor market, Federal Reserve policymakers have indicated that they would like to see more progress that inflation is sustainably easing before they continue cutting interest rates.

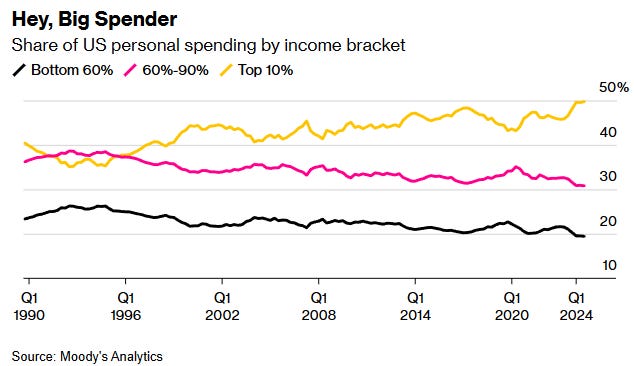

US Economy Depends More Than Ever on Rich People

A recent report from Moody's Analytics found a dramatic shift in the American consumer economy, with the wealthiest 10% of households (those earning over $250,000 annually) now responsible for half of all U.S. consumer spending and at least a third of the country's GDP.

This represents a significant concentration of economic power compared to the 1990s, when this same group accounted for only about a third of consumer spending.

This spending disparity helps explain seemingly contradictory economic indicators: lavish discretionary spending on luxury goods, sold-out concerts and sporting events, and booming first-class travel occurring simultaneously with rising consumer debt, credit card defaults at Great Recession levels, and ongoing inflation challenges for most Americans.

This concentration of spending power creates several concerning economic distortions. First, it introduces systemic fragility, as a small group now has outsized influence over the broader economy's health.

Their wealth, largely derived from homeownership and stock market investments, could quickly evaporate during market corrections.

Second, this concentration could also reshape entire industries as companies shift toward higher-end products to maintain profit margins, making basic goods less accessible—such as automakers focusing on expensive SUVs over affordable vehicles, driving the average new car price to nearly $50,000.

Does Dollar-Cost Averaging Actually Work?

Research revealed some fascinating insights about dollar-cost averaging, the tried-and-true strategy where you invest more when the market declines regardless of market conditions.

Professor Horstymeyer at George Mason University conducted a comprehensive study using one million market simulations found that DCA generally outperforms a fixed-share approach (buying the same amount each year) by 0.4 percentage points annually over a 20-year period.

This edge comes primarily from DCA's stellar performance during bull markets, where it delivered an impressive 7.53 percentage point advantage annually—essentially supercharging your returns when markets are climbing.

However, the study uncovered an important nuance for investors to consider: during extended market downturns, the fixed-share strategy actually outperformed DCA by 1.64 percentage points annually.

While dollar-cost averaging remains an excellent default strategy for most long-term investors (particularly during periods of high volatility), you might consider shifting toward a fixed-share approach when you believe we're entering a prolonged bear market.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like-minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like-minded investors.

Thank you, Mr. Yang. Still enjoying your content.

Great content. I particularly liked what you shared about dca, it’s what I use but the extra information was insightful. Thank you for sharing.