💸🐌 Markets React to Slower Inflation & New Job Data

Happy Wednesday all,

Inflation cooled in February, offering some relief after months of stubborn price increases. Meanwhile, the job market showed unexpected strength, with job openings and quit rates rising—though underlying signs of a slowdown remain. In the airline industry, Southwest is making a historic shift, scrapping its free checked bag policy after 50 years.

With markets reacting to these shifts, what’s next for inflation, employment, and consumer spending? Let’s break it all down.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Ukraine agrees to US-led ceasefire plan if Russia accepts (CNBC)

Ray Dalio warns that mounting US debt problems could lead to ‘shocking developments’ (CNBC)

Trump’s 25% tariffs on steel and aluminum imports take effect, Europe retaliates (CNBC)

TSMC pitched Intel foundry JV to Nvidia, AMD and Broadcom, sources say (CNBC)

Education Department Cuts Nearly Half Its Workforce as Effort to Shut the Agency Looms (WSJ)

Consumers Keep Bailing Out the Economy. Now They Might Be Maxed Out (WSJ)

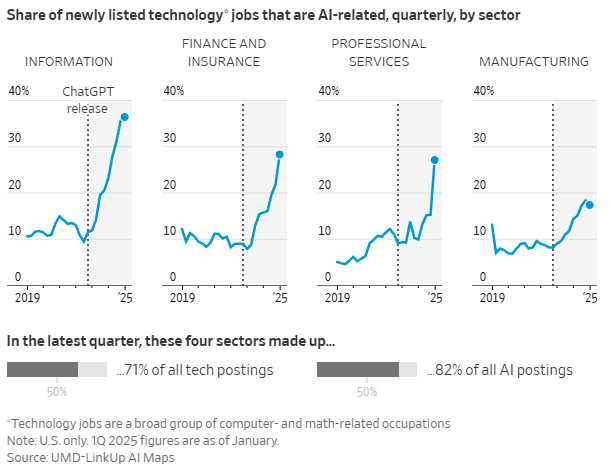

How the AI Talent Race Is Reshaping the Tech Job Market (WSJ)

The Weekly Brief

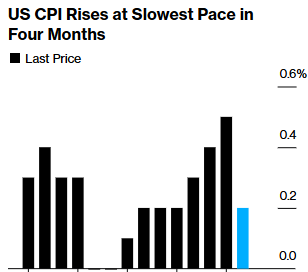

Inflation Rises at Slower Pace in January

The latest CPI data from the Bureau of Labor Statistics showed US consumer prices rising at a slower pace in February, providing some relief after months of stagnant inflation progress.

Overall CPI increased by 0.2% in February, down from a 0.5% increase in January, while the core CPI (excluding food and energy) also rose by 0.2%. Both figures came in slightly below economists' estimates.

The year-over-year inflation rate stood at 2.8% for overall CPI and 3.1% for core CPI, also lower than expected.

Several key components contributed to the moderation in inflation. Shelter costs, while still accounting for nearly half of the overall increase, decelerated from the previous month. Airfares saw a significant drop of 4%, the largest decline since June, amid warnings of weaker demand from carriers. Prices for new cars and gasoline also decreased, while grocery prices remained relatively stable after a substantial increase in January. Car and health insurance costs experienced more moderate price increases.

Despite the encouraging February report, concerns about inflation persist. Some measures suggest that inflation may be picking up again, and the introduction of tariffs by President Trump is expected to lead to price increases on various goods, from food to clothing.

US Job Openings and Quits Rise in Sign of Resilient Labor Market

The US job market showed some surprising resilience in January, with job openings rising to 7.74 million, driven by increases in financial activities, retail trade, and construction.

The quits rate, which measures people voluntarily leaving their jobs, also ticked up to 2.1%, the highest since July.

This suggests workers are feeling more confident about finding new opportunities. Meanwhile, layoffs fell to their lowest level since June, indicating employers are holding onto staff.

However, it's important to note that this data is from January, and more recent reports have shown signs of a slowdown in the labor market. The unemployment rate climbed to 4.1% in February, and continuing unemployment benefit applications have risen to a nearly three-year high.

As a result, investors are now expecting the Federal Reserve to make more interest rate cuts this year than previously anticipated, with the first cut expected by June.

Southwest Ditches Free Checked Bag Policy in End of Era for Airline

Southwest Airlines announced a significant shift in its long-standing policy by introducing charges for checked luggage, effective for flights booked after May 28.

This move ends the airline's 50-year-old "bags fly free" perk, which has been a key differentiator for the carrier. The new policy will charge customers for their first and second checked bags, with exceptions for top-tier loyalty members and business fare travelers.

In addition to the new baggage fees, Southwest plans to introduce a premium class section, offer red-eye flights, and implement a new "basic" fare for budget-conscious travelers. These changes come alongside other cost-cutting measures, including a 15% reduction in corporate positions and a revised financial outlook reflecting weaker booking trends.

The decision to charge for bags has been met with mixed reactions. While Southwest's stock rallied on the news, rival airlines see it as an opportunity to attract disgruntled Southwest customers.

The airline's CEO, Bob Jordan, emphasized that these changes are designed to boost profits and attract new customer segments.